European government debt has been sold at negative interest rates recently. The United States Treasury has now come as close to that as possible with 0% 3 month T-bills in the latest auction.

The incredible policies that have created such loose credit has the world so flooded with money searching for somewhere to go that 0% is seen as attractive. This excess cash is dangerous. It is a condition that makes bubbles inflate.

Low interest rates are good for businesses seeking capital to invest. These super low rates for so long are almost certainly creating much more debt for no good purpose. And likely even very bad purposes since cash is so cheap.

One thing I didn’t realize until last month was that while the USA Federal Reserve stopped pouring additional capital into the markets by buying billions of dollars in government every month they are not taking the interest and maturing securities and reducing the massive balance sheet they have. They are actually reinvesting the interest (so in fact increasing the debt load they carry) and buying more debt anytime debt instruments they hold come due.

The Fed should stop buying even more debt than they already hold. They should not reinvest income they receive. They should reduce their balance sheet by at least $1,500,000,000,000 before they consider buying new debt.

Unless the failure to address too-big-to-fail actions (and systems that allow such action) results in another great depression threat. And if that happens again they should not take action until people responsible are sitting in jail without the possibly of bail. The last bailout just resulted in transferring billions of dollars from retires and other savers to the pockets of those creating the crisis. Doing that again when we knew that was fairly likely without changing the practices of the too-big-to-fail banks. But I would guess we will just bail them out while they sit in one of the many castles their actions at the too-big-to-fail banks bought them and big showered with more cash in the bailout from the next crisis.

How to invest in these difficult times is not an easy question to answer. I would put more money in stocks for yield (real estate investment trusts, drug companies, dividend aristocrats), I would also keep cash even if it yields 0% and actually a new category for me – peer to peer lending (which I will write about soon). Recently many dividend stocks have been sold off quite a bit (and then on top of that drug stocks sold off) so they are a much better buy today than 4 months ago. Still nothing is easy in what I see as a market with much more risk than normal.

I am almost never a fan of long term debt. I would avoid it nearly completely today (if not completely). For people that are retired and living off their dividends and interest I may have some long term debt but I would have much more in cash and short term assets (even with the very low yields). Peer to peer lending has risks but given what the fed has done to savers I would take that risk to get the larger yields. The main risk I worry about is the underwriting risk – the economic risks are fairly well known, but it is very hard to tell if the lender starts doing a poor job of underwriting.

Related: The Fed Should Raise the Fed Funds Rate – Too-Big-to-Fail Bank Created Great Recession Cost Average USA Households $50,000 to $120,000 – Buffett Calls on Bank CEOs and Boards to be Held Responsible – Historical Stock Returns

For job growth, 33,000 — not 150,000 — is the new normal

…

the Census Bureau predicts the working-age population will grow just 50,000 per month over the next 15 years.

The amount of time I spend focusing on economic data is fairly limited (compared to people doing so for a living or as a large part of their job). I stick with general rules of thumb that I can tweak a bit to let me keep up with economic conditions without a huge amount of time devoted to such efforts.

Due to my temperament; to my belief that markets often overreact in the short term; and partially to my less detailed understanding of economic data (that professionals focused on it all day) leads me to get less excited about individual data points. This is helpful for my overall investing performance, I believe.

Occasionally changing conditions require changing those rules of thumb. The 150,000 figure is one I have used for a long time; though I also adjust that for major medium term influences (such as the great recession dumped so many people out of jobs that I bumped up my “we need to add” monthly job figure to 175,000 to 200,000 to bring those people on board.

My 175,000 to 200,000 included a slight adjustment down from the 150,000 that I had made. In addition to using simple ideas like 150,000 monthly job baseline I incorporate the idea of not overreacting to variation in short term data as well as tweaking those numbers for medium term economic conditions (things like recovering from the great recession – though that is about the largest “tweaking” factor that I remember).

This article made me realize how much I should adjust my expectations for a neutral job growth reading in the USA going forward. I also gather data and opinions as I think about making major adjustments to my thinking. I’ll adjust from what I had been using of a base of 125,000 plus 50,000+ for great recession recovery to 75,000 + 50,000 for great recession recovery now (and adjust more later if other sources indicate it makes sense). The great recession recovery factor will likely go down to 25,000 for me by the end of this year.

Related: There is No Such Thing as “True Unemployment Rate†– Long Term View of Manufacturing Employment in the USA (2012) – USA Individual Earnings Levels for 2011: Top 1% $343,000, 5% $154,000, 10% $112,000, 25% $66,000 – GDP Growth Per Capita for Selected Countries from 1970 to 2010 (Korea, China, Singapore, Indonesia, Brazil

When you sell your primary residence in the USA you are able to exclude $250,000 in capital gains (or $500,000 if you file jointly). The primary test of whether it is your primary residence is if you lived there 2 of the last 5 years (see more details from the IRS). You can’t repeat this exemption for 2 years (I believe).

It doesn’t matter if you buy another house or not, that exclusion of up to $250,000 is all that can be excluded (you must pay tax on anything above that amount – taxed at capital gains rates for long term gains).

For investment property you can do 1031 exchanges which defers capital gains taxes. Otherwise capital gains will be taxed as you would expect (as capital gains).

When you inherit a house the tax basis will be “stepped up” to the current market rate. So if you then sell your basis isn’t what the owner paid for it, but what it was worth when it was given to you.

Related: Looking for Yields in Stocks and Real Estate – Your Home as an Investment – Home Values and Rental Rates

The 10 publicly traded companies with the largest market capitalizations. Since October of last year the top 20 list has seen quite a bit of profit for stockholders (mainly in Apple and Chinese companies).

| Company | Country | Market Capitalization | |

|---|---|---|---|

| 1 | Apple | USA | $741 billion |

| 2 | Microsoft | USA | $374 billion |

| 3 | USA | $370 billion | |

| 4 | Exxon Mobil | USA | $352 billion |

| 5 | Berkshire Hathaway | USA | $346 billion |

| 6 | China Mobile | China | $340 billion* |

| 7 | Industrial & Commercial Bank of China | China | $306 billion** |

| 8 | Wells Fargo | USA | $292 billion |

| 9 | GE | USA | $275 billion |

| 10 | Johnson & Johnson | USA | $273 billion |

Apple’s market cap is up $115 billion since the last list was created in October of 2014. That increase is more than 50% of the value of the 14th most valuable company in the world (in October 2014).

China Mobile increased $100 billion and moved into 6th place. Industrial and Commercial Bank of China (ICBC) increased $78 billion to move into 7th place.

Exxon Mobil lost over $50 billion (oil prices collapsed as OPEC decided to stop attempting to hold back supply in order to maximize the price of oil). Alibaba (the only non-USA company in the last list) and Walmart dropped out of the top 10.

The total value of the top 20 increased from $5.722 trillion to $6.046 trillion, an increase of $324 billion. Several companies have been replaced in the new top 20 list.

The next ten most valuable companies:

| Company | Country | Market Capitalization | |

|---|---|---|---|

| 11 | JPMorgan Chase | USA | $250 billion |

| 12 | China Construction Bank | China | $250 billion** |

| 13 | Novartis (NVS) | Switzerland | $246 billion |

| 14 | Petro China | China | $237 billion |

| 15 | Wal-Mart | USA | $236 billion |

| 16 | Tencent | China | $235 billion** |

| 17 | Nestle | Switzerland | $235 billion*** |

| 18 | USA | $231 billion | |

| 19 | Hoffmann-La Roche (ROG.VX) | Switzerland | $231 billion |

| 20 | Alibaba | China | $226 billion |

Market capitalization shown are of the close of business last Friday, as shown on Yahoo Finance.

The current top 10 includes 8 USA companies and 2 Chinese companies. The 11th to 20th most valuable companies includes 4 Chinese companies, 3 Swiss companies and 3 USA companies. Facebook (after increasing $21 billion), China Construction Bank (increasing $68 billion – it is hard for me to be sure what the value is, I am not sure I am reading the statements correctly but this is my best guess) and Tencent moved into the top 20; which dropped Procter & Gamble, Royal Dutch Shell and Chevron from the top 20.

Related: Historical Stock Returns – Global Stock Market Capitalization from 2000 to 2012 – Stock Market Capitalization by Country from 1990 to 2010 – Solar Energy Capacity by Country (2009-2013)

A few other companies of interest (based on their market capitalization):

A new study, Secure Retirement, New Expectations, New Rewards: Work in Retirement for Middle Income Boomers, explores how Boomers are blurring the lines between working for pay and retirement (as I have discussed in posts previously, phased retirement).

From their report:

The define middle income as income between $25,000 and $100,000 with less than $1 million in investable assets and boomers as those born between 1946 and 1964.

Nearly 70% of retirees retired earlier than they planned to. Many did so due to health issues. Only 3% retired so they could travel more.

48% of middle income boomer retirees wish they could work. For those wishing to, but unable to work: 73% cannot due to health, 17% can’t find a job and 10% must care for a loved one.

Nearly all (94%) nonretirees who plan to work in retirement would like some kind of special work arrangement, such as flex-time or telecommuting, but only about one third (37%) of currently employed retirees have such an arrangement.

It seems to me, both employees and employers need to be more willing to adapt. Workers seem to be more willing, even though they claim they are not: this is mainly a revealed versus stated preference, they claim they won’t accept lower pay but as all those that do show, they really are willing to do so, they just prefer not to. This report is based on survey data which always has issue; nevertheless there are interesting results to consider.

61% of middle income boomers who ware working say they do so because they want to work, not because they have to work.

Only 12% of working middle income boomer retirees work full time all year. 60% work part-time. 7% are seasonal while 16% are freelance and 4% are other. Of those identifying as non-retired 75% work full time while 17% are part-time.

49% plan to work into their 70’s or until their health fails.

51% are more satisfied with their post-retirement work than their pre-retirement work. 27% are equally satisfied with their jobs.

As I have stated in previous posts I think a phased approach to retirement is the most sensible thing for society and for us as individuals. Employers need to provide workable options with part time work. The continued health care mess in the USA makes this more of a challenge than it should be. With USA health care being closely tied to employment and it costing twice as much as other rich countries (for no better results) it complicates finding workable solutions to employment. The tiny steps taken in the Affordable Care Act are not even 10% of magnitude of changes needed for the USA health care system.

Related: Providing ways for those in their 60’s and 70’s (part time schedules etc.) – Companies Keeping Older Workers as Economy Slows (2009) – Keeping Older Workers Employed (2007) – Retirement, Working Longer to Make Ends Meet

USA health care spending increased at a faster rate than inflation in 2013, yet again; increasing 3.5%. Total health expenditures reached $2.9 trillion, 17.4% of the nation’s Gross Domestic Product (GDP) or $9,255 per person.

While this remains bad news the rate at which heath care is increasingly costing those in the USA has been slower the last 5 years than it has been in past years. Basically the system is getting worse at a slower rate than we used to be, so while that isn’t great, it beats getting worse as quickly as we used to be. For the last 5 years the rate of increase has been between 3.6% and 4.1%.

GDP has increased more than inflation. As the GDP grows the economy has more production for society to split. The split between the extremely wealthy and the rest of society has become much more weighted to the extremely wealthy (they have taken most of the gains to the overall economy in the last 20 years). Health care has a similar track record of devouring the gains made by the economy. This has resulted in health care spending soaring over the decades in an absolute basis and as a percentage of GDP.

The slow down in how badly the health care system has performed in the USA has resulted in the share of GDP taken by the health care system finally stabilizing. Health care spending has remained near 17.4% since 2009. While hardly great news, this is much better news than we have had in the last 30 years from the USA health care system. The percentage of GDP taken by the USA health care system is double what other rich countries spend with no better health results.

It is similar to if a team started as a championship team and then got worse every year and now they have finally stopped getting even worse. Granted they have become the worst team in the league but if, say, their record has now been 5-55 for 3 years in a row, they at least are not winning fewer game in each subsequent year anymore. But you can hardly think you are doing a great job when you are clearly the worst team each and every year.

Obviously there is a need for much much more improvement in the USA health care system. Still stopping the growth in spending, as a percent of GDP, is a positive step toward drastically decreasing it to reach a level more in live with all other rich countries. Even this goal is only to have the USA reach a level of mediocrity. If you actually believe the USA can to better than mediocre that would imply a combination of drastic declines in spending (close to 50%) and drastic gains in outcomes. Decreasing spending by 50% would put the USA at essentially the definition of mediocre – middling result with average spending.

Health Spending by Type of Service or Product

- Hospital Care: Hospital spending increased 4.3% to $936.9 billion in 2013 compared to 5.7% growth in 2012. The lower growth in 2013 was influenced by growth in both prices and non-price factors (which include the use and intensity of services).

- Physician and Clinical Services: Spending on physician and clinical services increased 3.8% in 2013 to $586.7 billion, from 4.5% growth in 2012. Slower price growth in 2013 was the main cause of the slowdown, as prices grew less than 0.1%, due in part to the sequester and a zero-percent payment update.

The 10 publicly traded companies with the largest market capitalizations.

| Company | Country | Market Capitalization | |

|---|---|---|---|

| 1 | Apple | USA | $626 billion |

| 2 | Exxon Mobil | USA | $405 billion |

| 3 | Microsoft | USA | $383 billion |

| 4 | USA | $379 billion | |

| 5 | Berkshire Hathaway | USA | $337 billion |

| 6 | Johnson & Johnson | USA | $295 billion |

| 7 | Wells Fargo | USA | $270 billion |

| 8 | GE | USA | $260 billion |

| 9 | Wal-Mart | USA | $246 billion |

| 10 | Alibaba | China | $246 billion |

Alibaba makes the top ten, just weeks after becoming a publicly traded company. The next ten most valuable companies:

| Company | Country | Market Capitalization | |

|---|---|---|---|

| 11 | China Mobile | China | $240 billion* |

| 12 | Hoffmann-La Roche | Switzerland | $236 billion |

| 13 | Procter & Gamble | USA | $234 billion |

| 14 | Petro China | China | $228 billion |

| 15 | ICBC (bank) | China | $228 billion** |

| 16 | Royal Dutch Shell | Netherlands | $227 billion |

| 17 | Novartis | Switzerland | $224 billion |

| 18 | Nestle | Switzerland | $224 billion*** |

| 19 | JPMorgan Chase | USA | $224 billion |

| 20 | Chevron | USA | $210 billion |

Petro China reached to top spot in 2010. I think NTT (Japan) also made the top spot (in 1999); NTT’s current market cap is $66 billion.

Market capitalization shown are of the close of business today, as shown on Yahoo Finance.

According to this March 2014 report the USA is home to 47 of the top 100 companies by market capitalization. From 2009 to 2014 that total has ranged from 37 to 47.

The range (during 2009 to 2014) of top 100 companies by country: China and Hong Kong (8 to 11), UK (8 to 11), Germany (2 to 6), France (4 to 7), Japan (2 to 6), Switzerland (3 to 5).

Related: Stock Market Capitalization by Country from 1990 to 2010 – Global Stock Market Capitalization from 2000 to 2012 – Investing in Stocks That Have Raised Dividends Consistently – The Economy is Weak and Prospects May be Grim, But Many Companies Have Rosy Prospects (2011)

A few other companies of interest:

Facebook, USA, current market cap is $210 billion.

Pfizer, USA, $184 billion.

Toyota, Japan, $182 billion.

Read more

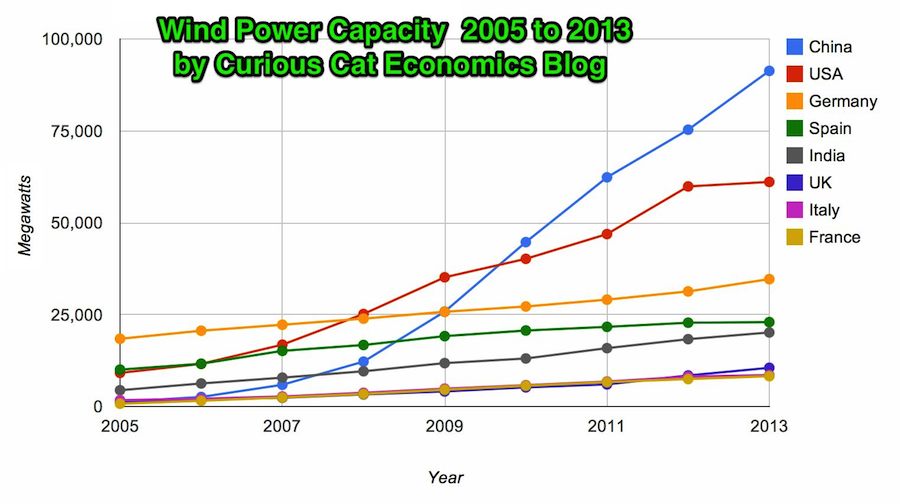

Chart by Curious Cat Economics Blog using data from the Wind Energy Association. Chart may be used with attribution as specified here.

In 2013 the addition to wind power capacity slowed a great deal in most countries. Globally capacity was increased just 13% (the increases in order since 2006: 26%, 27%, 29%, 32%, 25%, 19% and again 19% in 2012). China alone was responsible for adding 16,000 megawatts of the 25,838 total added globally in 2013.

At the end of 2013 China had 29% of global capacity (after being responsible for adding 62% of all the capacity added in 2013). In 2005 China had 2% of global wind energy capacity.

The 8 countries shown on the chart account for 81% of total wind energy capacity globally. From 2005 to 2013 those 8 countries have accounted for between 79 and 82% of total capacity – which is amazingly consistent.

Wind power now accounts for approximately 4% of total electricity used.

Related: Chart of Global Wind Energy Capacity by Country 2005 to 2012 – In 2010 Global Wind Energy Capacity Exceeded 2.5% of Global Electricity Needs – Global Trends in Renewable Energy Investment – Nuclear Power Generation by Country from 1985-2010

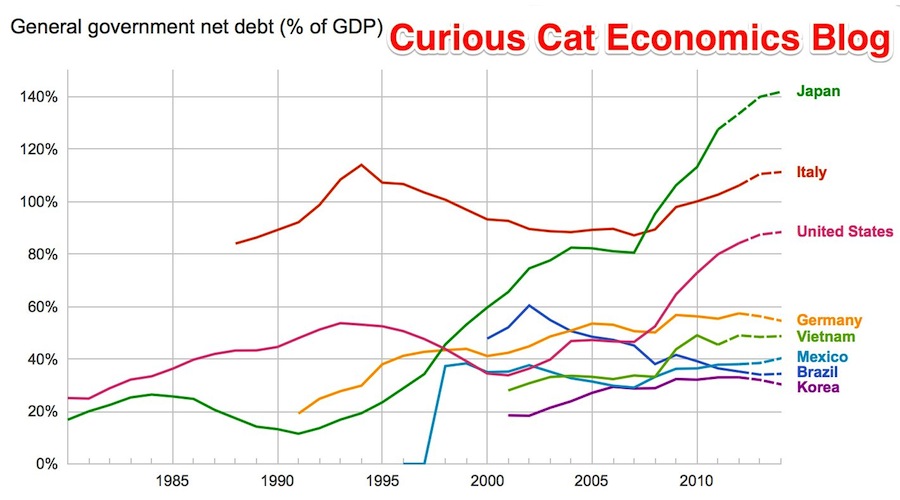

The data, from IMF, does not include China or India.

The chart shows data for net debt (gross debt reduced by certain assets: gold, currency deposits, debt securities etc.).

Bloomberg converted [broken link was removed] the data to look at debt load per person (looking at gross debt – estimated for 2014). Japan has ill-fortune to lead in this statistic with $99,725 in debt per person (242% of GDP), Ireland is in second with $60, 356 (121% of GDP). USA 3rd $58,604 (107%). Singapore 4th $56,980 (106%). Italy 6th $46,757 (133%). UK 9th $38,939 (95%). Greece 12th $38,444 (174%). Germany 14th $35,881 (78%). Malaysia 32nd $6,106 (57%). China 48th $1,489 (21%). India 53rd $946 (68%). Indonesia 54th $919 (27%).

I think the gross debt numbers can be more misleading than net debt figures. I believe Singapore has very large assets so that the “net” debt is very small (or non-existent). Japan is 242% in gross debt to GDP but 142% of net debt (which is still huge but obviously much lower). The USA in contrast has gross debt at 107% with a net debt of 88%.

Related: Government Debt as Percent of GDP 1998-2010 for OECD – Gross Government Debt as Percentage of GDP 1990-2009: USA, Japan, Germany, China – Chart of Largest Petroleum Consuming Countries from 1980 to 2010 – Top Countries For Renewable Energy Capacity

USA health care spending increased at a faster rate than inflation in 2012, yet again; increasing 3.7%. Total health expenditures reached $2.8 trillion, which translates to $8,915 per person or 17.2% of the nation’s Gross Domestic Product (GDP).

The GDP is calculated was adjusted in 2013 and the data series going back in time was adjusted. These changes resulted in increasing historical GDP values and making the portion of GDP for health care to decline (for example in 2011 using the old calculation health care was 17.9% of GDP and now 2011 is shown as health care spending representing 17.3% of GDP).

While health care spending increased faster than inflation yet again, the economy actually grew at a higher rate than health care spending grew. That the spending on health care actually declined as a percentage of GDP is good news; and it may even be that this hasn’t happened for decades (I am not sure but I think that might be the case).

Still health care spending growing above the rate of inflation is bad news and something that has to change. We have to start addressing the massive excessive costs for health care in the USA versus the rest of the world. The broken USA health care system costs twice as much as other rich countries for worse results. And those are just the direct accounting costs – not the costs of millions without preventative health care, sleepness nights worrying about caring for sick children without health coverage, millions of hours spent on completing forms to try and comply with the requirements of the health care system’s endless demand for paperwork, lives crippled by health care bankruptcies…

Health Spending by Type of Service or Product: Personal Health Care

- Hospital Care: Hospital spending increased 4.9% to $882 billion in 2012.

- Physician and Clinical Services: Spending on physician and clinical services increased 4.6% in 2012 to $565 billion.

- Other Professional Services: Spending for other professional services reached $76 billion in 2012, increasing 4.5%. Spending in this category includes establishments of independent health practitioners (except physicians and dentists) that primarily provide services such as physical therapy, optometry, podiatry, and chiropractic medicine.