Farmer in Chief by Michael Pollan

…

Spending on health care has risen from 5 percent of national income in 1960 to 16 percent today, putting a significant drag on the economy. The goal of ensuring the health of all Americans depends on getting those costs under control. There are several reasons health care has gotten so expensive, but one of the biggest, and perhaps most tractable, is the cost to the system of preventable chronic diseases. Four of the top 10 killers in America today are chronic diseases linked to diet: heart disease, stroke, Type 2 diabetes and cancer.

…

You cannot expect to reform the health care system, much less expand coverage, without confronting the public-health catastrophe that is the modern American diet.

…

It must be recognized that the current food system — characterized by monocultures of corn and soy in the field and cheap calories of fat, sugar and feedlot meat on the table — is not simply the product of the free market. Rather, it is the product of a specific set of government policies that sponsored a shift from solar (and human) energy on the farm to fossil-fuel energy.

Read the full, long, interesting article. I have discussed both the failed special interest focused federal spending on farmers and the failed health care system.

Related: Farming Without Subsidies in New Zealand – Eat food. Not too much. Mostly plants. – International Health Care System Performance – USA Paying More for Health Care –

Greenspan Says He Was Wrong On Regulation

…

Even Greenspan seemed genuinely perplexed yesterday by all that had happened, hard-pressed to explain how formerly fundamental truths about how markets work could have proved so wrong.

…

“When bubbles cause huge problems is when they cause the financial sector to seize up,” said Frederic S. Mishkin, a Columbia University economist and, until recently, Fed governor. “The right way to deal with that kind of bubble is not with monetary policy,” but with bank supervision and other regulatory powers.

…

While endorsing some expanded regulation yesterday, such as requiring the companies that combine large numbers of loans into securities to hold on to significant numbers of those securities, he also repeatedly retreated to his libertarian-leaning roots, and warned of the dangers of overreacting.

…

“I made a mistake,” Greenspan said, “in presuming that the self-interests of organizations, specifically banks and others, were such as that they were best capable of protecting their own shareholders and their equity in the firms.”

The key is to strive for properly functioning markets. Unfortunately that does not mean allowing those that give large payments to politicians to foist huge risks on the economy by exempting themselves from sensible regulation. I guess some people get confused that the benefits of “free markets” are not the same as standing back and allowing powerful interests to manipulate markets and risk economies. The benefits of a free market are provided to the economy when the market is free not when large, powerful organizations are allowed to exert undue influence on markets.

I don’t really understand how people could think “free markets” are about letting special interests be free to manipulate markets. It is not really something that should be confusing to people that have thought enough to have an opinion on the benefits of free markets. The dangers of monopolies and business people conspiring to extract benefit (for those in the cartel, trust, conspiracy…) by manipulating the market was well know from the initial minds putting together capitalist theory. And the obvious method to allow the benefits of the free market to be maintained was regulation to prevent those that sought to manipulate the market for their benefit.

And the dangers of overly leveraged financial institutions should be obvious to anyone with a modicum of understanding of financial history. Then make those overly leveraged financial institutions large (too be to fail) types and you really are asking for disaster. Add in a extremely large use of debt by the public and private sectors (living beyond your means). Then throw in encouraging reckless short term thinking by providing enormous cash bonuses for paper potential profits and you really have to wonder how anyone could think this was not a perfect design to assure a financial meltdown.

Related: Too Big to Fail, Too Big to Exist – Fed to Loan AIG $85 Billion in Rescue – 2nd Largest Bank Failure in USA History

Treasury Now Favors Creation of Huge Banks, New York Times, 1987:

The Treasury plan, which would permit the acquisition of banks by large industrial companies, was also endorsed by Alan Greenspan, in an interview before President Reagan nominated him this week to be chairman of the Federal Reserve Board.

…

Mr. Gould acknowledged that any policy promoting the creation of very large financial institutions encounters deep-seated sentiments that date from the founding of the Republic. But he thinks the nomination of Mr. Greenspan could provide an important stimulus for change. Mr. Greenspan contends that many of the laws restricting commercial banks severely limit their ability to adapt to a changing marketplace.

The Reagan Administration has met frustration in its efforts to lessen regulation of banking, largely because Paul A. Volcker, the current Federal Reserve chairman, has firmly opposed any move that would begin to break down the barriers that prohibit large nonbanking companies from owning banks. Mr. Volcker has also been rather grudging in his support of changes that would allow interstate banking and the underwriting of securities by banks.

…

”We have been the beneficiaries of living in a relatively insulated big economy, and only recently have we found out that the Japanese can make automobiles better than we do,” said Hans Angermueller, vice chairman of Citicorp. ”We are discovering that the same thing may apply in the financial services area, and to meet that challenge, we need to get leaner, meaner and stronger. We don’t do this by preserving the heartwarming idea that 14,000 banks are wonderful for our country.”

The New York Times web archive is a great resource for viewing the historical trends to turn away form the capitalist ideas of free market competition and instead move toward large market dominating banks. You get the impression from people talking about “free markets” that they have never actually read Adam Smith, Ricardo, Mills…

Related: Ignorance of What Capitalism Is – Not Understanding Capitalism – Canadian Banks Avoid Failures Common Elsewhere – Monopolies and Oligopolies do not a Free Market Make – Estate Tax Repeal

Read more

Americans need to save much more money. This is true for people’s personal financial health. And it is true for the long term health of the economy. Of course the credit card immediate gratification culture doesn’t put much weight on those factors. And if Americans actually do reduce their consumption to save more that will harm the economy in the short term. But since those reading this are people (the economy can’t read) the smart thing for most readers is to save more to create a stronger financial future for themselves.

Turmoil May Make Americans Savers, Worsening ‘Nasty’ Recession

…

From 1960 until 1990, households socked away an average of about 9 percent of their after-tax income, Commerce Department figures show. But Americans got out of the saving habit starting in the 1990s

…

“Consumers are starting to realize that they’ve been living in a fantasy world,” says Lyle Gramley, a former Fed governor who is now senior economic adviser at Stanford Group Co. in Washington. “They will have to begin salting away money for retirement, their children’s education and other reasons.”

Americans have a way to go to catch up with their counterparts in other countries. The 0.4 percent of disposable income that U.S. households saved last year compares with 10.9 percent for Germany and 3.1 percent for Japan

Related: Americans are Drowning in Debt – Too Much Stuff – Financial Illiteracy Credit Trap

‘Armageddon’ Prices Fail to Lure Buyers Amid Selling

…

The selling is being compounded by hedge funds and mutual funds dumping holdings to meet redemptions, which may push prices even lower, according to analysts at UBS AG.

…

Corporate debt has been pressured by “incessant selling by hedge funds and leveraged institutions as they unwind,” Bill Gross, manager of the world’s biggest bond fund at Newport Beach, California-based Pacific Investment Management Co.

…

Corporate bond prices plunged to 79.9 cents on the dollar on average from 94 cents at the end of August and 99 cents at the end of 2007, according to index data compiled by New York-based Merrill Lynch & Co.

…

“The de-leveraging that we’re witnessing will probably continue,” said Paul Scanlon, team leader for U.S. high yield and bank loans at Boston-based Putnam Investments LLC, which manages $55 billion in fixed income. “My sense is that’s not turning around in the very near term.”

I am not very familiar with the bond market but it does seem like the panic is in full swing but calling the bottom is always hard. I would guess the de-leveraging (and investors pulling money out of bond funds) could well lead things lower over the short term.

Related: Corporate and Government Bond Rates Graph – Municipal Bonds After Tax Return

I have been curious how Kiva deals with currency risk. Kiva is a great resource for providing micro-lending and the opportunity to engage in choosing who you will lend to. But my transactions are all in US$ and the loans in the field are in the local currency. This creates an issue of what happens when currency values fluctuate. I asked a question on the Kiva LinkedIn group (an excerpt is shown here):

A lender takes out a loan of $100 with 10 months to repay. If the loan is in the local currency, what if the value of that currency during the 10 months declines by 20%? Then the bank has received all their money back but they owe Kiva $100 but they only have $80 worth of the local currency (again ignore that the payments are made monthly – since it doesn’t effect the issue at hand – currency rates). Hows does Kiva deal with this currency risk? Do the local partner banks take the risk…?

I was directed to a great slideshow showing Kiva’s lending policies. It turns out Kiva does have the local banks take the currency risk. So they have to pay back $100, if the local currency value is now $80, they would have a loss, of course the local currency value could also have risen, then the local bank has a gain.

They have a chart showing the cost of capital to local Kiva lenders at 0-1% plus currency exchange risk (which they say some banks choose to hedge and others just take the risk), which is about the lowest cost of capital around. Kiva charges no interest on the loans to the local banks. The costs come from the requirements (the cost of adding a profile – the time of staff of the bank to add the information…) of using the Kiva website.

Curious Cat Kiva connections: Curious Cats Kiva lending team – Curious Cat Kivans - Funding Entrepreneurs in Nicaragua, Ghana, Viet Nam, Togo and Tanzania – Kiva Fellows Blog: Nepalese Entrepreneur Success – Kiva related blog posts

Buy American. I Am. by Warren Buffett:

…

A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful. And most certainly, fear is now widespread, gripping even seasoned investors. To be sure, investors are right to be wary of highly leveraged entities or businesses in weak competitive positions. But fears regarding the long-term prosperity of the nation’s many sound companies make no sense.

…

Let me be clear on one point: I can’t predict the short-term movements of the stock market. I haven’t the faintest idea as to whether stocks will be higher or lower a month — or a year — from now. What is likely, however, is that the market will move higher, perhaps substantially so, well before either sentiment or the economy turns up.

…

Today people who hold cash equivalents feel comfortable. They shouldn’t. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value. Indeed, the policies that government will follow in its efforts to alleviate the current crisis will probably prove inflationary and therefore accelerate declines in the real value of cash accounts.

Equities will almost certainly outperform cash over the next decade, probably by a substantial degree.

Yet more great advice from Warren Buffett. I must admit I think buying stocks from the USA and elsewhere is wise, but there isn’t any reason to listen to me instead of him.

Related: Financial Markets Continue Panicky Behavior – Great Advice from Warren Buffett – Stock Market Decline – Warren Buffett’s 2004 Annual Report – Does a Declining Stock Market Worry You?

I want to be free to make my own decisions. I like the security of a corporate job, the health and financial benefits, but it IS a business. They’re in the market to make money. If that means cutting jobs and salary, that’s part of the equation.

…

I want to do something that I’m responsible for; something I’ve poured my heart and soul into. As it happens, I don’t think my current day-job is that “something” which will help build those dreams…

I like this post. For me personal finance is a subset of life. Like health and education, personal finance, can hamper or provide options to your life. You need to keep track of your finances and manage them but that is in order to provide yourself options to live the life you want. Don’t forget to decide what you want out of life. Then see how you can help make that happen based on finances or what steps you need to take to live your dreams in the future.

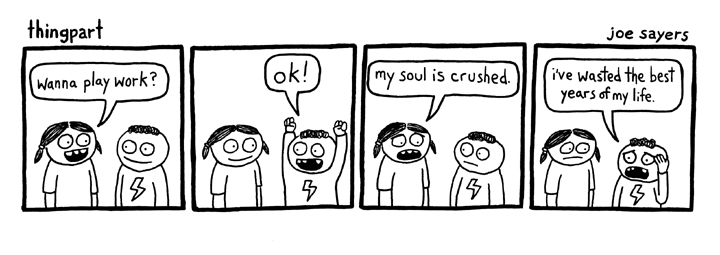

comic: Wanna play work? – also see: Joy in Work

Related: Medieval Peasants had More Vacation Time – Signs You Have a Great Job … or Not – How to Protect Your Financial Health – Credit Card Tips – Provide a Helping Hand – 1,000 True Fans

FDIC to double bank fees in face of $40bn loss

About 90 per cent of US banks will see their basic deposit insurance fees double in the first quarter of 2009, from between 5 cents and 7 cents for each $100 of deposits to between 12 cents and 14 cents, according to a plan laid out yesterday by the FDIC, a government-backed agency that insures consumer deposits up to $250,000. From the second quarter that range would widen to from 10 to 14 cents per $100.

…

Banks with the riskiest profiles could end up paying fees as high as 77.5 cents for every $100 of insured deposits under the plan, compared with a maximum of 43 cents under the current structure.

The FDIC insures bank deposits with fees charged to banks. The recent increase of the FDIC Limit to $250,000 seems to indicate that taxpayers will now pay for any costs for covering above $100,000 per account-holder (which I think is a mistake – the fund should be self supporting). But this increase in fees is to restore the fund to the minimum capital requirements of the insurance fund.

Related: posts on banking – Avoid Getting Squeezed by Credit Card Companies – Where to Keep Your Emergency Funds?

| Jim Rogers webcast: Fannie Mac and Freddie Mac should not have been bailed out. Jim Rogers is one of the most successful investors in the last 50 years. He and George Soros (together with the Quantum Fund) and then separately along with Warren Buffett have made the most as investors (that I know of – I could easily be wrong).

How you want to accept their opinions on the current crisis is up to you. I believe they are worth listening to – more than anyone else. That does not mean I believe they are totally right. To me the long term track record of each is very impressive. Especially Jim Rodgers and George Soros have been making big investment gains largely on macro economic predictions in the last 20 years. |

In The Dollar is Doomed (July 2008) Jim Rogers predicts the United States Federal Reserve is so badly run it will be gone in a decade or two. I disagree with that sentiment. He certainly has much more expertise than I do but in evaluating such a comment you need to look at what really matters to him. He doesn’t need the Federal Reserve to actually cease to exist to make profitable trades based on his prediction that the Federal Reserves policies are dooming the dollar.

Another thing to note with Rogers and Soros is they will make strong statements and take huge positions but will change their mind when conditions change (often quickly). So you can’t assume what they said awhile back is still their belief today.

Related: Jim Rogers: Why would anybody listen to Bernanke? – investment books – Rodgers on the US and Chinese Economies – A Bull on China