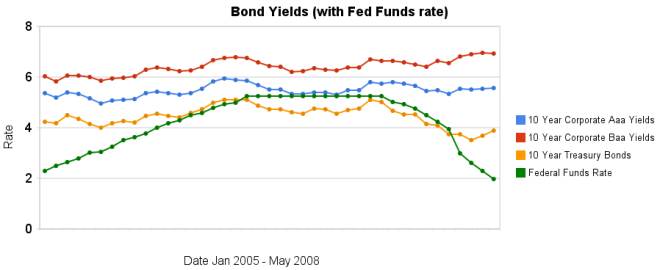

Over the last 2 months the yields on bonds have increased the discount rate has continued to decline.

The spread between corporate bond yields and government bonds has decreased a bit as treasury yields have increased 37 basis points compared to just 4 and 6 basis point increased in corporate bond yields.

Data from the federal reserve – corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Bond Yields 2005-2008 – 30 Year Fixed Mortgage Rates versus the Fed Funds Rate – Initial Retirement Account Allocations

Pretty much everyone (certainly the vast majority of regulators and politicians) have no clue about capitalism. The concept that a “free market” should be allowed to operate is theoretical, based on “perfect competition” (which essentially means zero barriers to entry). Obviously the politicians support, not capitalism (which would require regulation of imperfect markets (and certainly not support consolidation past the point of many competing companies), but the idea that those with the gold make the rules. Natural monopolies (like gas distribution, electricity, likely internet infrastructure…) should be fully regulated companies which then have the infrastructure accessed by multiple competitors (none of which own the natural monopoly – of course).

With some market that is even remotely in the area where a capitalist free market was in place, it is very simple to not have to deal with companies that treat customers horribly (like Verizon, Comcast, Time Warner Cable…) you just chose another company to deal with.

But these companies want to have the government allow them to create a monopoly (or something extremely close) and then claim to be in favor of capitalism (and further make ludicrous claims about what capitalism would suggest about regulation in oligopolistic markets). These ideas is so laughable that if politicians had even a sense of economic understanding they would adopt the appropriate capitalist response (for government).

Obviously, regulation is required as the market moves away from the area of “perfect competition.” When some huge company wants to buy some other huge company (say creating greater than 10% of the market combined) this would be rejected. If the market is a natural monopoly where the free market is not the proper capitalist market (such as one where the government would allow the proper capitalist response to players in the market attempting to break the free market by gaining to much control), then, of course a regulated natural monopoly would take on that economic task. This is not really complicated stuff.

Read more

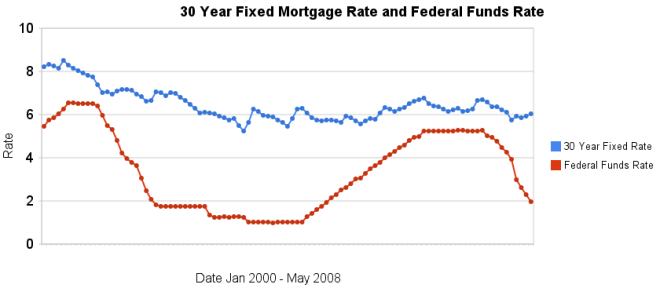

This year, the average discount rate has fallen every month while the average 30 year mortgage rate has climbed all but 1 month (a 5 basis point drop). In January, 2008 the discount rate averaged 3.94% and 30 year conventional fixed rate mortgages averaged 5.76%. In May, 2008 the discount rate had fallen to 1.98% (for a 196 basis point drop) and 30 year conventional fixed rates had risen to 6.04% (for a 28 basis point increase).

The chart shows the federal funds rate and the 30 year conventional fixed rate mortgage rate from January 2000 through May 2008 (for more details see: historical comparison of 30 year fixed mortgage rates and the federal funds rate).

Related: Affect of Fed Funds Rates Changes on Mortgage Rates – real estate articles – Bond Yields 2005-2008 – Jumbo and Regular Mortgage Rates By Credit Score

Read more

What’s the real federal deficit? by Dennis Cauchon, 2006

…

The audited financial statement – prepared by the Treasury Department – reveals a federal government in far worse financial shape than official budget reports indicate, a USA Today analysis found. The government has run a deficit of $2.9 trillion since 1997, according to the audited number. The official deficit since then is just $729 billion.

…

The new Medicare prescription-drug benefit alone would have added $8 trillion to the government’s audited deficit. That’s the amount the government would need today, set aside and earning interest, to pay for the tens of trillions of dollars the benefit will cost in future years.

Standard accounting concepts say that $8 trillion should be reported as an expense. Combined with other new liabilities and operating losses, the government would have reported an $11 trillion deficit in 2004 – about the size of the nation’s entire economy.

The federal government also would have had a $12.7 trillion deficit in 2000 because that was the first year that Social Security and Medicare reported broader measures of the programs’ unfunded liabilities. That created a one-time expense.

The continued attempts by politicians to distract from the huge taxes they are voting to place on our children and grandchildren is disheartening. And the continued actions that are the equivilent of getting another credit card when they spend so much that even the “official” books that they have exceeded the allowable total federal debt that is damaging the economy. They need to learn how to live within the current taxes they collect just as people need to learn to live within their earning. Either that fails to do so mortgages their future.

Related: Politicians Again Raising Taxes On Your Children – USA Federal Debt Now $516,348 Per Household – Washington’s Funny Accounting – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren – Failed Leadership: Estate Tax Repeal

I would guess a majority of people that read this blog are in the top 2% of earnings in the world. Many might not think they expect to live with more economic wealth than 98% of the world but their expectations seem to indicate that they do.

Generalizations about age groups I find to be mainly useless (providing no actual valuable information, either because it is plain wrong or the truth is so limited as to provide little value). There are often differences among age groups, but rather than the binary way it is presented it is more like those in their 20’s have x trait to say 45% and those in their 30’s have it 35% – hardly the distinct separation many claim. I do, however, think many in the USA today seem to think that it is their right to be rich. This can lead to behavior that is detrimental in the long term – since they are entitled no need to work hard, since they are entitled no need to worry about spending more than they have, since they are entitled there is no need to invest so the future will be prosperous, since they are entitle no need to worry about their own future (savings, career planning…)…

I don’t think this is very defined by age: though to some extent I feel this has grown over the decades. Those that lived through the depression, World War II, without air conditioning, without central heating, had parents that worked in factories when the parents were 14, only the richest in the USA lived in mansions (Mc or otherwise)… are not as likely to think that they just have a natural right to be rich.

Other countries are making the sacrifices today to invest in a prosperous future. It seems to me the USA is mainly counting on the huge economic wealth that has been built up to continue to provide it a prosperous future. That wealth does provide a huge advantage. But if too much is consumed today the future will not be as bright. And for the last few decades it seems to me we have been spending down the huge advantage more than building it up.

It is nice to be rich. But a society believing it is owed a life of luxury has not worked out well over the course of human history.

Related: The Ever Expanding House – Creating a World Without Poverty – Charge It to My Kids – Engineering the Future Economy – USA Federal Debt Now $516,348 Per Household – China’s Economic Science Experiment – Trying to Keep up with the Jones – It’s Not Money

Economist challenges government data

An update e-mailed to ShadowStats subscribers at the beginning of the month warned darkly that “GDP (gross domestic product) and Jobs Data Appear Rigged” and “Despite Manipulated Data, the Recession Deepens.”

By his reckoning, the economy shrank 2.5 percent in the year that ended in March, unemployment is really 13 percent and year-over-year inflation is 7.5 percent.

If I was to believe one of those I would pick 7.5% inflation (or at least something a bit closer to that than to and the government figure). If I had to pick one I think is way off, I would pick the unemployment rate. One thing people need to remember is that numbers can be questioned. Often people see a number and just believe it must be true because it is a number (they usually don’t consciously think this but do so sub-consciously). I am losing confidence in the inflation figures quoted by the government (they just seem to far from what seems to be happening). The GDP is never exact, so being off by a couple percent depending on what assumptions you make is not impossible to understand (yet the news media, politicians, business press… act as though the figure is exactly accurate).

John Williams’ web site, Shadow Government Statistics, has the feel of someone that is a gadfly. And I don’t accept his statements, but I believe the government figures are indeed deserving of more scrutiny. It makes perfect sense for inflation to more accurately take into account the substitution effects people can make but that also allows the figures to be more influenced by judgments of what is a fair substitution (and also what is increased quality worth…). And those questions on inflation can directly effect whether the economy (GDP) grew by 1% of shrunk by 2%.

Related: What Do Unemployment Statistics Really Mean? – the Proxy Nature of Data – Washington’s Funny Accounting

Payday lenders likely doomed in Ohio. Good.

The Senate was unable to find a compromise that both satisfied payday lenders and eliminated the debt trap that bill supporters said forced too many borrowers to take out new loans to pay for old ones. So it did what the House did last month: dropped the hammer.

“I think everybody said there is just no way to redeem this product. It’s fundamentally flawed,” Bill Faith, a leader of the Ohio Coalition for Responsible Lending, said of the twoweek loans. The industry “drew a line in the sand, and the legislature kicked the line aside and said we’re done with this toxic product.”

House Bill 545 would slash the annualized interest rate charged by payday lenders from 391 percent to 28 percent, prohibit loan terms of less than 31 days and limit borrowers to four loans per year. It also would ban online payday lending.

Yes in a small number of cases payday loans are helpful. In the vast majority of cases they harm citizens and the economic well being of society. Legislators should act to fix practices that harm the economy.

Assessing how much further house prices are likely to fall gets even trickier. One route is to look at market expectations: investors expect a further 20% drop, judging by the prices of futures contracts linked to the Case-Shiller 10 city index. But the futures market is small and illiquid and may overstate the possible declines.

…

Using a model that ties house prices to disposable incomes and long-term interest rates, analysts at Goldman Sachs reckon that the correction in national house prices is only halfway through. They expect an 18-20% correction overall, or another 11-13% decline from today’s levels. But their models suggest that six states – Arizona, Florida, Virginia, Maryland, California and New Jersey, could see further price declines of 25% or more.

Optimists dispute this gloomy assessment, pointing out that some measures of housing affordability have dramatically improved. According to NAR figures, monthly payments on a typical house with a 30-year mortgage and 20% downpayment were 18.5% of the median family’s income in February, down from almost 26% at the peak – and close to the historical average. But this measure of affordability is misleading, not least because credit standards have tightened so much.

…

Given the typical pace of rental growth, Mr Feroli reckons house prices (as measured by the Case-Shiller index) need to fall by 10-15% over the next year and a half for the rent/price yield to return to its historical average.

Actually predicting the where the declines will stop is very difficult. But this articles provides some very good thoughts on what the future holds. While things may not go as those quoted guess their guesses seem pretty reasonable and the explanations make sense.

Related: Home Values and Rental Rates – Housing Prices Post Record Declines – Housing Inventory Glut – mortgage terms

Who will watch the watchmen? The USA is in desperate need for some people in power that support the ideas of Jefferson et. al. Taking your laptop into the US? by Bruce Schneier (a leading authority on computer security matters).

…

Lastly, don’t forget your phone and PDA. Customs agents can search those too: emails, your phone book, your calendar. Unfortunately, there’s nothing you can do here except delete things.

This is so sad. The continued erosion of liberty is amazing. I think we need to wonder now how much longer we can expect the right to openly criticize bad government policy. It used to be the USA government looked down on “soviet block” spying on those visiting the country. That the leaders of the USA have so abandoned liberty is very sad.

20 years from now when the consequences of such anti-liberty behavior results in the much more rapid emergence of other countries that respect the rights of visitors we can wish we didn’t follow this bad path. People can gnash their teeth and wonder why the USA threw away its central role in international trade, science, engineering… This continued path of stupid behavior is condemning the USA to a poorer future.

So far my worry has been the failure of the USA government to take sensible proactive steps. Increasingly however, my worry is growing from that to include growing concern at very damaging policies that serve to isolate the USA from those leaders of the future that of course will shun those that strip their liberties as a condition of dealing with the USA (some will continue to put up with the ludicrous demands as long as their is money to be made but I bet they will be anxious to find more willing partners as soon as they can).

Read more

Singapore’s Social Entrepreneur Diana Saw makes things Bloom in Cambodia

The decision was swift as it was simple: move to Cambodia to provide jobs for poor women. I first

visited Phnom Penh in April 2006 and was back the next month to look for a house.

…

I approached the job placement arm of an NGO in Phnom Penh (PP). There are many NGOs who train poor Cambodians, but what this country needs is jobs. You can train people all you like, but if no one employs them, you’ll have frustrated skilled people who are unable to use their

skills.

…

Bloom has a savings plan for staff. Every month staff are encouraged to put away a percentage of their income which goes towards buying a sewing machine. Bloom will then subsidize the cost of the machine. With the machine, workers will be able to become small business owners, supplying bags not only to Bloom, but to other sellers, like small shops in the tourist markets.

Related: Bloom Bags Blog – Using Capitalism to Make the World Better – Make the World a Better Place – Kiva – Provide a Helping Hand – Aim for everybody to gain: workers, customers, suppliers, shareholders… – Obscene CEO Pay

- We believe in the right of all people to a decent life, free of poverty, and with access to education

- We believe you can be rich by helping the poor