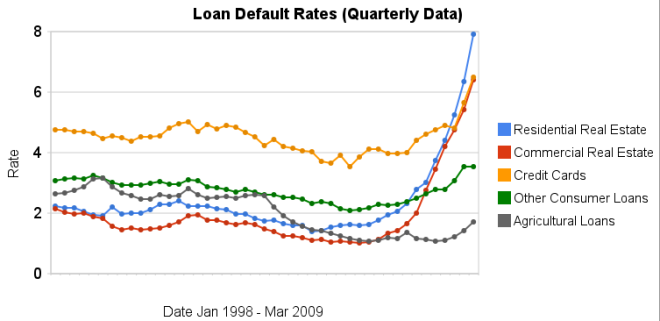

Chart showing loan default rates for real estate, consumer and agricultural loans for 1998 to 2009 by the Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing loan default rates for real estate, consumer and agricultural loans for 1998 to 2009 by the Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.As you can see real estate default rates exploded in 2008. In the 4th quarter of 2007 residential default rates were 3.02% by the 4th quarter of 2008 they were 6.34% and in the 1st quarter of this year they were 7.91% (471 basis points above the 4th quarter of 2007). Commercial real estate default rates were at 2.74 in the 4th quarter of 2007, 5.43% in the fourth quarter of 2008 and 6.5% in the 1st quarter of 2009 (a 366 basis point increase).

Credit card default rates were much higher for the last 10 years (the 4-5% range while real estate hovered above or below 2%). In the last 2 quarters it has increased sharply. From 4.8% in the 3rd quarter 2008 to 5.66% in the 4th and 6.5% in the 1st quarter of 2009. The default rate on other consumer loans are up but nowhere near the amounts of real estate or credit cards.

Agricultural loan default rates are actually about as low now as they have every been 1.71%. That is up a bit from the 1.06% low the default rate hit in the 1st quarter of 2009 but actually lower than it was for half of the last decade (the last 5 years it has been lower but prior to that it was higher – in fact with higher default rates than either real estate loan category).

Related: Mortgage Rates: 6 Month and 5 Year Charts – Jumbo Loan Defaults Rise at Fast Pace – Continued Large Spreads Between Corporate and Government Bond Yields – Nearly 10% of Mortgages Delinquent or in Foreclosure

The Formula That Killed Wall Street

His method was adopted by everybody from bond investors and Wall Street banks to ratings agencies and regulators. And it became so deeply entrenched—and was making people so much money—that warnings about its limitations were largely ignored.

Then the model fell apart. Cracks started appearing early on, when financial markets began behaving in ways that users of Li’s formula hadn’t expected. The cracks became full-fledged canyons in 2008—when ruptures in the financial system’s foundation swallowed up trillions of dollars and put the survival of the global banking system in serious peril.

Very nice article on the dangers of financial markets to those that believe that math can provide all the answers. Math can help find opportunities. However markets have physical, psychological and regulatory limitations. And markets frequently experience huge panics or manias. People continue to fail to model that properly.

Related: All Models Are Wrong But Some Are Useful – Leverage, Complex Deals and Mania – Financial Markets with Robert Shiller – Financial Market Meltdown – Failure to Regulate Financial Markets Leads to Predictable Consequences

Economists are raising projections for the USA economy in the second half of 2009. The predictions are still for an anemic economy growing at just 1.5% and with unemployment reaching 10.1%. Still I think if we achieve that we should feel lucky. Economists Raise U.S. Outlook as Recession Fades

…

The economy probably shrank at a 1.8 percent rate from April to June, the latest survey showed, less than economists forecast last month. The U.S. will return to growth in the current quarter and expand 2.1 percent next year.

…

A separate report from the Commerce Department today showed the trade deficit unexpectedly narrowed in May as exports jumped while imports of crude oil and auto parts slid. The gap between imports and exports decreased 9.8 percent to $26 billion, the smallest since November 1999, from $28.8 billion in April.

Unemployment will rise to 10.1 percent in the first quarter of 2010 from 9.5 percent last month, already the highest since August 1983, the survey of economists showed.

The trade deficit is still far to large. And the to move the economy in the right direction we need to continue reducing personal debt (and start reducing government debt).

Related: First Quarter GDP 2009 down 6.1% – When Will the Recession Be Over? – Warren Buffett Webcast on the Credit Crisis

U.S. Job Report Suggests that Green Shoots are Mostly Yellow Weeds by Nouriel Roubini

It’s clear that even if the recession were to be over anytime soon – and it’s not going to be over before the end of the year – job losses are going to continue for at least another year and a half. Historically, during the last two recessions, job losses continued for at least a year and a half after the recession was over.

…

The latest figures – published this week – on mortgage delinquencies and foreclosures suggest a spike not only in subprime and near-prime delinquencies, but now also on prime mortgages. So the problems of the economy are significantly affecting the banking system.

…

So the outlook for the US and global economy remains extremely weak ahead. The recent rally in global equities, commodities and credit may soon fizzle out as an onslaught of worse- than-expected macro, earnings and financial news take a toll on this rally, which has gotten way ahead of improvement in actual macro data.

Certainly this is not a forecast that will make people happy. I agree that the expectations for a nice quick recovery have become too optimistic. I am far from certain what lies ahead but the second half of 2009 does not look to be very strong. It is still a time to be cautious.

Related: Jim Rogers on the Financial Market Mess (Oct 2008) – Beware of the Sucker’s Rally – USA Consumers Paying Down Debt – Investing quotations

Another wave of foreclosures is poised to strike

…

Mark Zandi of Moody’s Economy.com estimates that 15.4 million homeowners — or about 1 in 5 of those with first mortgages — owe more on their homes than they are worth.

…

Government and company reports show that the number of completed foreclosures nationwide slowed sharply late last year and into early this year, largely because of various moratoriums in effect during much of the first quarter.

But anecdotal reports indicate that foreclosure sales have started to climb again in the second quarter. And the pipeline is clearly getting fuller. In the first quarter, some 1.8 million homeowners nationwide fell behind on their loans by 60 to 90 days, a 15% increase from the prior quarter, according to Moody’s Economy.com. The research firm said that loan defaults rose sharply as well, to 844,000 in the first three months of this year.

…

Even as defaults among subprime borrowers have trended lower this year, newly initiated foreclosures involving prime mortgage loans saw a significant increase in the first quarter, jumping 21.5% from the fourth quarter, according to a government report of loan data from national banks and federally regulated thrifts.

This is more bad news for the economy. As I have been saying the economy is still in serious trouble. Cleaning up the damage caused by living beyond our means for decades does not get cleaned up quickly. This are actually going as well as could be hoped for, I think. We need to hope the remainder of this year sees the economy stabilize and then hope 2010 brings some good news.

Related: Nearly 10% of Mortgages Delinquent or in Foreclosure – Over Half of 2008 Foreclosures From Just 35 Counties – How Much Worse Can the Mortgage Crisis Get? (March 2008) – Mortgage Rates Falling on Fed Housing Focus

Peter Schiff answers economic questions from Reddit users (see part 2). See our Economics and Investing Reddit. He made the point that inflation will be a serious problem. He also recommended several books, including: Economics in One Simple Lesson by Henry Hazlit and The Biggest Con: How the Government is Fleecing You by his father. He is an opinionated economist. I certainly do not agree with everything he says but I think he is worth listening to. As an investor I believe it is important to seek out unconventional opinions and find worthwhile unconventional opinions that can help you beat the market.

Related: Skeptics Think Big Banks Should Not be Bailed Out – Inflation is a Real Threat – Let the Good Times Roll (using Credit) – Dell, Reddit and Customer Focus

Nonfarm payroll employment continued to decline in June (by 467,000), and the unemployment rate increased to changed at 9.5% (with a total of 14.7 million unemployed), the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Job losses were widespread across the major industry sectors, with large declines occurring in manufacturing, professional and business services, and construction.

Since the start of the recession in December 2007, the number of unemployed persons has increased by 7.2 million, and the unemployment rate has risen by 460 basis points (from 4.9% to 9.5%). The number of long-term unemployed (those jobless for 27 weeks or more) increased by 433,000 over the month to 4.4 million. In June, 30% of unemployed persons were jobless for 27 weeks or more.

Employment in manufacturing fell by 136,000 over the month and has declined by 1.9 million during the recession. Health care employment increased by 21,000 in June. Job gains in health care have averaged 21,000 per month thus far in 2009, down from an average of 30,000 per month during 2008.

The number of persons working part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in June at 9.0 million. Since the start of the recession, the

number of such workers has increased by 4.4 million.

About 2.2 million persons (not seasonally adjusted) were marginally attached to the labor force in June, 618,000 more than a year earlier. These individuals wanted and were available for work and had looked for a job sometime in the past 12 months. They were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey.

Related: posts on employment – Unemployment Rate Increased to 8.9% – Can unemployment claims predict the end of the American recession? – The Economy is in Serious Trouble – Over 500,000 Jobs Disappeared in November 2008

China Manufacturing Expands a Fourth Month

…

China’s economy may keep improving in the third and fourth quarters, enabling the nation to meet its 8 percent economic growth target for this year, central bank Governor Zhou Xiaochuan said this week.

Given the still quite uncertain global economy this is a pretty strong performance. And it is one of the positive indications that we may be recovering from the credit crisis. There continues to be fairly good news in many areas. However we are far from certain to make a decently global recovery even in 2010.

Related: Manufacturing Contracting Globally – Rodgers on the US and Chinese Economies – Manufacturing Cars in the USA – Leading Manufacturing Countries in 2007 – USA Unemployment Rate Jumps to 9.4% – The Economy is in Serious Trouble

Surging U.S. Savings Rate Reduces Dependence on China

…

Nouriel Roubini, an economics professor at New York University and chairman of RGE Monitor, forecasts that the savings rate will ultimately reach 10 percent to 11 percent. What’s critical, he said in a Bloomberg Television interview on June 24, is how quickly it increases.

A rapid rise in the next year because of a collapse in consumption would push the economy, already in its deepest contraction in 50 years, further into recession, he said. If it occurs over a few years, the economy may grow.

…

From 1960 until 1990, households socked away an average of about 9 percent of their after-tax income, government figures show. Americans got out of the habit in the 1990s as they saw their wealth build up in other ways, first through surging stock prices and then soaring home values, Gramley said.

That process has now gone into reverse. U.S. household wealth fell by $1.3 trillion in the first quarter of this year, with net worth for households and nonprofit groups reaching the lowest level since 2004, according to a Fed report. Wealth plunged by a record $4.9 trillion in the last quarter of 2008.

Edmund Phelps, winner of the Nobel Prize in economics in 2006 and a professor at Columbia University in New York, said it may take as long as 15 years for households to rebuild what they lost in the recession.

As I have been saying the living beyond our means must stop. Those that think health of an economy is only the GDP forget that if the GDP is high due to spending tomorrows earnings today that is not healthy. Roubini correctly indicates the speed at which savings increases could easily determine the time we crawl out of the recession. I hope the savings rate does increase to over 10 percent.

If we do that over 3 years that would be wonderful. But it is more important we save more. If that means a longer recession to pay off the excessive spending over the last few decades so be it. And it is going to take a lot longer than a few years to pay off those debts. It is just how quickly we really start to make a dent in paying them off that is in question now (or whether we continue to live beyond our means, which I think it still very possible – and unhealthy).

Related: Will Americans Actually Save and Worsen the Recession? – Can I Afford That? – $2,540,000,000,000 in USA Consumer Debt (April 2008) – Paying for Over-spending

Kiva is one of my favorite charities, as I have mentioned several times. They provide a platform that connects those with funds to lend to entrepreneurs. This week they added the ability to lend money to entrepreneurs in the USA. And they also added short webcasts to some of the entrepreneur profiles.

One of my goals for this blog is to increase the number of readers participating in Kiva – see current Curious Cat Kivans. I have also created a curious cat lending team on Kiva. If you lend through Kiva, add a comment with a link to your Kiva page and I will add you to our list of Curious Cat Kivans.

Related: My 100th Entrepreneur Loan Through Kiva – Using Capitalism to Make a Better World