N.Y. Raises Pension Requirements to Save $48 Billion

…

For new workers, the bill raises the age for retirement without penalty to 62 from 55, imposes a 38 percent penalty on non-uniformed workers who retire before 62 and increases the minimum years of service to draw a pension to 10 from 5, according to Paterson’s office.

Overtime payments included in calculating pension benefits will be capped at $15,000 a year for civilian workers, and 15 percent of wages for police and firefighters.

Raising the retirement age from 55 to 62 (for new workers) is something that should have been done decades ago. 62 is too young for a full retirement age. If a country has the life expectancies we do they either need to have huge retirement savings (which for NY State would mean huge taxes to support that level of retirement savings) or live off the wealth saved in previous generations (or count on taxes of future generations).

Unfortunately for too long all of the USA we have chosen not to save for retirement when we work and then retire when we still have decades to live (on average). That is not sustainable. You can only add so much to the credit card (buy now let someone pay later strategy). Increasing from 55 to 62 is a good move. But it is too little and too late. More should be done.

Saving for retirement is not complicated. It is just that many people would rather speed money now and now save it. That is easy to understand but it is not helped if we make it sound like saving for retirement is hard. It takes some discipline. But certainly adults should be able to show some discipline. We have to stop acting like not saving for retirement is somehow acceptable. It is no more acceptable than those that had to store food for the winter a few hundred years ago deciding they would rather go swimming all summer and worry about the winter later.

And state governments should not provide out-sized retirement benefits which must be paid for by the taxpayers. 80 years ago maybe setting the retirement age at 55 made sense. It certainly did not for new workers in 1980 (or 1990 or 2000 at least now in 2009 they are making a move in the right direction).

Related: Working Longer and Delaying Retirement – Many Retirees Face Prospect of Outliving Savings – Pushing your financial problems into the future – Gen X Retirement

In the webcast interview above Warren Buffett and Bill Gates discuss business, health care, economics, wall street, the Fed and more. Both agree the health care system is far too expensive and needs to be fixed. And both agree the current reforms are far too small and seem to do little to address the core problems with incentives and entrenched interests maintaining system in need of reform.

Both also agree the future is bright for the USA and the world economically. The innovation possible will may well come from more locations in the next century but those innovations will also come from the USA.

Warren Buffett also defends the independent Federal Reserve board system.

Related: Warren Buffet Webcast to MBAs – Advice from Warren Buffett UT at Austin business school – Bill Gates: Capitalism in the 21st Century

The delinquency rate for mortgage loans rose to 9.94% of all loans outstanding at the end of the third quarter, up 108 basis points from the second quarter of 2009, and up 265 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The delinquency rate breaks the record set last quarter (since 1972).

The delinquency rate includes loans that are at least one payment past due but does not include loans somewhere in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 4.47%, an increase of 17 basis points from the second quarter of 2009 and 150 basis points from one year ago. The combined percentage of loans in foreclosure or at least one payment past due was 14.4% on a non-seasonally adjusted basis, the highest ever recorded in the MBA delinquency survey.

The percentages of loans 90 days or more past due, loans in foreclosure, and foreclosures started all set new record highs. The percentage of loans 30 days past due is still below the record set in the second quarter of 1985.

“Despite the recession ending in mid-summer, the decline in mortgage performance continues. Job losses continue to increase and drive up delinquencies… Over the last year, we have seen the ranks of the unemployed increase by about 5.5 million people, increasing the number of seriously delinquent loans by almost 2 million loans,” said Jay Brinkmann, MBA’s Chief Economist.

“The performance of prime adjustable rate loans, which include pay-option ARMs in the MBA survey, continue to deteriorate with the foreclosure rate on those loans for the first time exceeding the rate for subprime fixed-rate loans. In contrast, both subprime fixed-rate and subprime adjustable rate loans saw decreases in foreclosures.”

This continues the bad news on housing. Though home sales have been picking up, the underlying strength of the housing market remains questionable. Without jobs increasing it is very difficult for the real estate market to recover.

Related: Nearly 10% of Mortgages Delinquent or in Foreclosure (Dec 2008) – Loan Default Rates Increased Dramatically in the 2nd Quarter – Another Wave of Foreclosures Loom (July 2009) – Homes Entering Foreclosure at Record (Sep 2007)

Read more

The Federal Weatherization Assistance Program has been around for decades and funding has been increased as part of the stimulus bills. This type of spending is better than much of what government does. It actually invests in something with positive externalities. It targets spending to those that need help (instead of say those that pay politicians to give their companies huge payoffs and then pay themselves tens of millions in bonuses).

The Depart of Energy provides funding, but the states run their own programs and set rules for issues such as eligibility. They also select service providers, which are usually nonprofit agencies that serve families in their communities, and review their performance for quality. In many states the stimulus funds have increased the maximum funds have increased to $6,500 per household, from $3,000.

The weatherization program targets low-income families: those who make $44,000 per year for a family of four (except for $55,140 for Alaska and $50,720 for Hawaii).

The program provides funds for those with low-income for the like of: insulation, air sealing and at times furnace repair and replacement. Taking advantage of this program can help you reduce your energy bills and reduce the amount of energy we use and pollution created. And it employs people to carry out these activities.

The Weatherization Assistance Program invests in making homes more energy efficient, reducing heating bills by an average of 32% and overall energy bills by hundreds of dollars per year.

Weatherization is also often a very good idea without any government support. If you are eligible for some help, definitely take a look at whether it makes sense for you. And even if you are not, it is a good idea to look into saving on your energy costs.

Related: Oil Consumption by Country in 2007 – Japan to Add Personal Solar Subsidies – personal finance tips – Kodak Debuts Printers With Inexpensive Cartridges – Personal Finance Basics: Dollar Cost Averaging

Read more

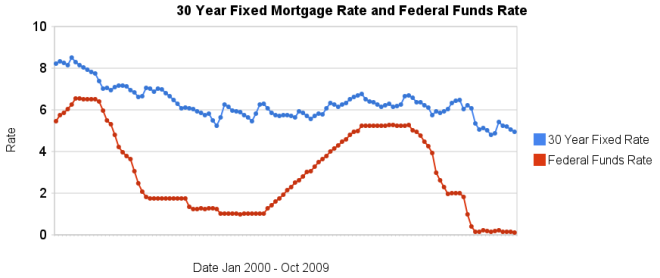

30 year fixed mortgage rates have declined a bit over the last few months and remain at very low levels.

The poor economy, Unemployment Rate Reached 10.2%, has the Fed continuing massive intervention into the economy. The Fed is keeping the fed funds rate at close to 0% (.12% in October). They also continue to hold massive amounts of long term government and mortgage debt (in order to suppress interest rates on long term bonds – by reducing the supply of such bonds in the market).

I can’t see how lending US dollars, over the long term, at 5%, makes any sense. I would much rather borrow at those rates than lend. If you have not refinanced yet, doing so now may well make sense. And if you are looking at a new real estate purchase, financing a 30 year mortgage sure is attractive at rates close to 5%.

Related: historical comparison of 30 year fixed mortgage rates and the federal funds rate – Lowest 30 Year Fixed Mortgage Rates in 37 Years – Jumbo v. Regular Fixed Mortgage Rates: by Credit Score – What are mortgage definitions – Ignorance of Many Mortgage Holders

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates

Landlords Offer Incentives to Stay Put

…

One problem for landlords is that existing tenants can easily check the Web to see what deals new tenants are being offered. And new tenants are getting incentives like a waived pet deposit or two months’ free rent.

…

Apartment landlords say that one benefit of the bad market is that it has practically halted new construction. New completions are expected to be 98,000 next year and 109,000 in 2011, compared with 188,000 last year and 204,000 this year, according to Green Street Advisors Inc.

But when loss rates are taken into account—the removal of units because of obsolescence—the actual addition will be immaterial. That means that when the economy rebounds, the supply will be tight, increasing landlord profits.

Related: Apartment Vacancy at 22-Year High in USA (July 2009) – Articles on Real Estate Investing – It’s Now a Renter’s Market – Housing Rents Falling in the USA

Welcome to the Curious Cat Investing and Economics Carnival: we highlight recent blog posts we found interesting.

- Dividend stocks that beat the market by Jim Jubak – “A hefty dividend isn’t enough to prevent major capital damage when a sector takes that kind of punishment. Another lesson is that a dividend income portfolio needs more frequent care and feeding than I gave this one.”

- Get Real On The Economic Recovery And Stock Market Rally – “Another rapid slump in global economy is far from impossible. Double dip recession could arise from sky-high public debts or another financial crisis sparked by delinquency in prime mortgage loans, risky commercial sector or derivatives.”

- Don’t Miss Out on a Good Investment Today Because You Missed a Better Investment Earlier by John Hunter – Instead of just missing out because I made a mistake and didn’t buy a stock at a lower price earlier, I have learned to accept that buying at the higher price available today can be the best option…

- How much should be in your emergency fund? by Patrick – “Some people recommend at least 3-6 months living expenses, some recommend 6 months to a year, and some recommend a few thousand dollars. In my opinion, this is a very personal decision and should be based on your individual circumstances.”

- Weakon 238: Stock Beta by Philip – ” If the beta comes back 1 or higher then you are relying on the market for your returns and are not protected against a down market. That isn’t a bad thing if you’re tolerant to risk, the beta on my 401(k) is 1.3.”

- Government Debt Around the World as Percentage of GDP 1990-2007 by John Hunter – The overall OECD debt to GDP ratio decreased from 77% in 2005 to 75% in 2007. The USA moved in the opposite direction increasing from 62% to 63%

There are several factors that need to be addressed relating to the broken health care system in the USA.

1) It is bankrupting the government

2) It is severely handicapping business that must pay for the expensive and poorly performing system

3) It is bankrupting individuals (Employees Face Soaring Health Insurance Costs)

4) It is hampering economic freedom due to the model that ties health care to employment. If I want to go start my own small business, I not only have to worry about all the risks of running a business I have to risk my heath coverage (coverage is expensive and if you get sick you can be dropped, or rates increased so dramatically that they are not affordable – hardly insurance when you are dropped when you need it).

5) social inequity – no other rich country denies basic health care to everyone

6) the results are poor to mediocre (at by far the highest cost of any country)

The idea that a system that is far more expensive than any in the world and performs, at best, in the middle of the pack of rich countries while creating huge economic and human hardships should not be reformed is crazy. Unless you believe the USA is just incapable of performing even at a mediocre level in health care, for some reason, you have to believe they current performance needs to be dramatically improved.

Now there may well be disagreement about which failures are most important. Some may not care about the huge competitive disadvantage companies are put in by the current broken system. Others may not care that millions don’t have basic coverage. Others may not care that sick people go bankrupt. Others may not care that the heath results are mediocre at best – that tens of millions have much less healthy lives than they would. Others may like that they make a great deal of money from the current system. Others may like that they personally get good health care. So in what ways the broken system in place now needs to be fixed is open for debate.

The long term result is very simple to see. The current system is very broken and will not work. Different people suffer differently depending on what solution is adopted. My desire would be to reduce spending on hugely expensive miracle cures (especially for terminal ill patients) and increase spending dramatically on preventative and healthy living (versus spending on managing sickness) but I can see that such a solution is not at all popular. So we are not going to adopt that part of what I would like to see.

But I have no doubt the system will be dramatically reformed. Because if not the economic costs will destroy the economic future of the country. I don’t believe tens of millions without health care will drive action – we have seen that we are perfectly willing to allow that to continue. If the economic costs (say reducing the economic benefit to every person in the USA by $5,000 a year) just stayed at that level, it seems those that are benefiting from the current system are able to hold off improvement. But that figure is increasing each and every year. Eventually the costs grow too large and too many people will demand the broken system be improved.

Amazon’s stock price is up 25% to $117 today, after announcing good earnings and increasing sales projections for the 4th quarter. I own stock in Amazon and have it in my 12 stocks for 10 years portfolio. That portfolio is currently beating the S&P 500 by 500 basis points (for annualized return) with a beta of .96 (meaning with a bit less risk than the S&P 500 historically and an alpha of 4.7).

Operating cash flow for Amazon was $2.25 billion for the trailing twelve months, compared with $1.27 billion for prior year. Free cash flow increased 98% to $1.92 billion from $0.97 billion for the trailing twelve months.

Net sales increased 28% to $5.45 billion in the third quarter, compared with $4.26 billion in third quarter 2008. Operating income increased 62% to $251 million in the third quarter, compared with $154 million in third quarter 2008.

Net income increased 68% to $199 million in the third quarter, or $0.45 per diluted share, compared with net income of $118 million, or $0.27 per diluted share, in third quarter 2008.

“Kindle has become the #1 bestselling item by both unit sales and dollars – not just in our electronics store but across all product categories on Amazon.com. It’s also the most wished for and the most gifted. We are grateful for and energized by this customer response,” said Jeff Bezos, founder and CEO of Amazon.com. “Earlier this week we began shipping the latest generation Kindle. Its 3G wireless works in the U.S. and 100 countries, and we’ve just lowered its price to $259.”

North America segment sales, representing the Company’s U.S. and Canadian sites, were $2.84 billion, up 23% from third quarter 2008. International segment sales, representing the Company’s U.K., German, Japanese, French and Chinese sites, were $2.61 billion, up 33% from third quarter 2008. Worldwide Electronics & Other General Merchandise sales grew 44% to $2.36 billion.

For the quarter that ends in December, Amazon forecast sales of $8.1 billion to $9.1 billion (compared with $8.19 billion in previous analyst estimates).

Amazon continues to build a strong company for the long term. I must admit I think the current stock price might be a bit too high. But I believe in the long term success of the company. They continue to make intelligent, customer focused decisions.

Related: 12 Stocks for 10 Years – July 2009 Update – Another Great Quarter for Amazon (July 2007) – Very Good Amazon Earnings (April 2007) – Amazon Innovation – Jeff Bezos and Root Cause Analysis – Jeff Bezos management quotes

This hardly constitutes an outright collapse, nor is it necessarily cause for concern. American exporters, whose goods have become more competitive abroad, are happy with their weaker currency. Similarly domestic producers may be cheered that rival, imported goods are more expensive. And European tourists, who can buy more for their euros during weekend shopping excursions to America, may cheer too. However, the continued decline of the dollar does come against a backdrop of ominous murmurs from the likes of China and Russia, who hold much of their reserves in dollars, about the need to shift their reserves out of the greenback. Brazil’s imposition of a 2% levy on portfolio inflows is also a sign that other countries are getting nervous about seeing their currencies rise against the dollar.

…

But it is hard, also, to think of a parallel in history. A country heavily in debt to foreigners, with a government deficit it is making little headway at controlling, is creating vast amounts of additional currency. Yet it is allowed to get away with very low interest rates. Eventually such an arrangement must surely break down, bringing a new currency system into being, just as Bretton Woods emerged in the 1940s.

The absence of a credible alternative to the dollar means that, despite its declining value, its status as the world’s reserve currency is not seriously under threat. But the system could change in other ways. A world where currencies traded within bands, or where foreign creditors insist on America issuing some debt in other currencies, are all real possibilities as the world adjusts to a declining dollar.

The issuance of USA government debt of any significant size in other currencies would be an amazing event, to me. However, that does not mean it won’t happen. In my opinion it is hard to justify the non-collapse of the dollar, and has been for quite some time.

The huge future tax liability imposed over the last few decades along with the failure to save by those in the country creates a hollow economy. Granted the USA had a huge surplus of wealth built up since the end of World War II. The USA has to a great extent sold off that wealth to finance living beyond the productive capacity of the country the last 20-30 years. But that can only go on so long.

The only thing saving the dollar is that other countries do not want the dollar to decline because they don’t want the competition of American goods (either being sold to their country or for the goods they hope to export). So they intervene to stop the fall of the dollar (and buy USA government debt). That can serve to artificially inflate the dollar for some time. However, eventually I think that will collapse. And when it does it will likely be very quick. The idea of the USA issuing debt in other currencies seems crazy now. It could then go from possibility to necessity within months.

You cannot print money forever to live beyond your means and have people accept it as valuable. The government can runs deficits if the citizen’s finance that debt with savings: and still maintain a sound currency. But the recent period, given the macro-economic conditions, don’t justify the value of the dollar. It should have fallen much further a long time ago. The other saving grace for the dollar is few large economies have untarnished economies. The Euro has strengths but is hardly perfect. The Chinese Renminbi is possibly the strongest contender but the economy is still very controlled, financial data is untrustworthy, political freedom is not sufficient… The Japanese Yen does have some strengths but really their long term macro-economic conditions is far from sound.

Related: The USA Economy Needs to Reduce Personal and Government Debt – Let the Good Times Roll (using Credit) – Federal Reserve to Buy $1.2T in Bonds, Mortgage-Backed Securities – Who Will Buy All the USA’s Debt?