Inflation is a real threat. I guess it is good the Federal Reserve finally seems to be taking the risk somewhat seriously. They can’t be taking it very seriously with the fed funds rate at 2%. Inflation can create havoc in the economy once it gets started and it may already be too late to try and address it. There could be some real problems ahead. An economy can’t exist forever by printing money (the government’s huge debts) and consumers financing extravagant living by borrowing from foreigners. Pretty much the textbook on what will happen if this is done is bad inflation.

For more than a decade other countries have continued to finance the excess spending by the USA which delayed the inflation (they were more concerned with growing trade than anything else). That has changed as they are now interested in consuming themselves and sensibly growing concerned about the inflation risk of investing in dollar assets (especially bonds). There are now numerous risks to the economy (high gas prices, credit crisis, housing crisis, huge federal debt, huge consumer debt…). Still it is amazing how well the economy is doing. Hopefully that can continue but the risks are serious.

Assessing how much further house prices are likely to fall gets even trickier. One route is to look at market expectations: investors expect a further 20% drop, judging by the prices of futures contracts linked to the Case-Shiller 10 city index. But the futures market is small and illiquid and may overstate the possible declines.

…

Using a model that ties house prices to disposable incomes and long-term interest rates, analysts at Goldman Sachs reckon that the correction in national house prices is only halfway through. They expect an 18-20% correction overall, or another 11-13% decline from today’s levels. But their models suggest that six states – Arizona, Florida, Virginia, Maryland, California and New Jersey, could see further price declines of 25% or more.

Optimists dispute this gloomy assessment, pointing out that some measures of housing affordability have dramatically improved. According to NAR figures, monthly payments on a typical house with a 30-year mortgage and 20% downpayment were 18.5% of the median family’s income in February, down from almost 26% at the peak – and close to the historical average. But this measure of affordability is misleading, not least because credit standards have tightened so much.

…

Given the typical pace of rental growth, Mr Feroli reckons house prices (as measured by the Case-Shiller index) need to fall by 10-15% over the next year and a half for the rent/price yield to return to its historical average.

Actually predicting the where the declines will stop is very difficult. But this articles provides some very good thoughts on what the future holds. While things may not go as those quoted guess their guesses seem pretty reasonable and the explanations make sense.

Related: Home Values and Rental Rates – Housing Prices Post Record Declines – Housing Inventory Glut – mortgage terms

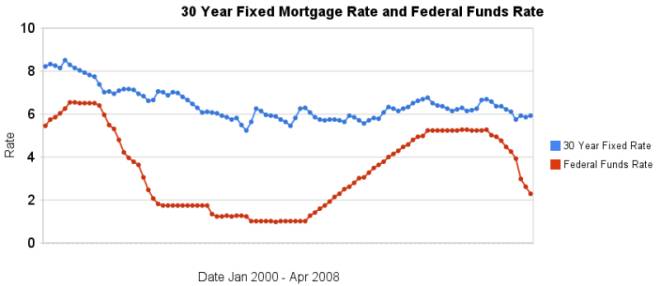

The recent drastic reductions again emphasize (once again) that changes in the federal funds rate are not correlated with changes in the 30 year fixed mortgage rate. In the last 4 months the discount rate has been reduced nearly 200 basis points, while 30 year fixed mortgage rates have fallen 18 basis points.

I have update my article showing the historical comparison of 30 year fixed mortgage rates and the federal funds rate. The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through April 2008 (for more details see the article).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates that can be used for those looking to determine short term (over a few days, weeks or months) moves in the 30 year fixed mortgage rates. For example if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do. No matter how often those that should know better repeat the belief that there is such a correlation you can look at the actual data in the graph above to see that it is not the case.

Related: real estate articles – Affect of Fed Funds Rates Changes on Mortgage Rates – How Not to Convert Equity – more posts on financial literacy

Read more

Every year at the Berkshire Hathaway Warren Buffett and Charlie Munger provide great insights on investing and the economy. Here are some thought from today – Buffett to investors: Think small

…

“Overall I think that the U.S. continues to follow policies that will make the dollar weaken against other major currencies

…

Asked what’s in store for the economy, Buffett said he doesn’t have a clue and doesn’t care. “I haven’t the faintest idea,” he said. “We never talk about it, it never comes up in our board meetings or other discussions. We’re not in that business [of economic forecasting], we don’t know how to be in that business. If we knew where the economy was going, we’d do nothing but play the S&P futures market.”

…

In terms of the [chief] investment officer, the board has four names, any one or all of whom would be good at my job. They all are happy where they are now [working outside of Berkshire], but any would be here tomorrow if I died tonight, they all are reasonably young, and compensation would not be a big factor…. There will be no gap after my death in terms of having someone manage the money.

Related: Live From Omaha 2007 – Buffett’s 2008 Letter to Shareholders – 2005 annual meeting with Buffett and Munger – Why Investing is Safer Overseas

Read more

Housing prices posted large declines over the last year. One important thing to keep in mind when looking at the recent results is how rare significant declines in housing prices have been. In general housing prices decline very little (less than 10% drops and normally less than 5%). Normally the turnover just decreases dramatically as people refuse to sell at lower prices and just stay in their house until prices recover. Housing Prices Post Record Declines:

Of those 20 metro areas, 17 posted their largest year-over-year declines ever. Ten of the 20 cities posted double-digit dips. The 10-city Case/Shiller index is down 13.6% year-over-year, the biggest drop since its launch in 1987

…

Prices in the Las Vegas metro area have plunged more than any other city, down 22.8% over the 12 months through February. Miami prices plummeted 21.7%. In Phoenix, they’ve fallen 20.8%. Of the 20 cities Case/Shiller tracks, only Charlotte, N.C. showed higher prices, up 1.5% over the 12-month period.

Other metro areas recorded only modest price declines, including Portland, Ore., down 2.0%, Seattle, off 2.7% and Dallas, 4.1%. In the nation’s largest city, New York, metro area prices dropped a modest 6.6%.

Related: Home Price Declines Exceeding 10% Seen for 20% of Housing Markets (Sep 2007) – How Not to Convert Equity – Housing Inventory Glut (Aug 2007) – Mortgage Defaults: Latest Woe for Housing (Feb 2007)

Home Prices Drop Most in Areas with Long Commute by Kathleen Schalch

The Washington, D.C., metropolitan area has been hit hard. Prices tumbled an average of 11 percent in the past year. That’s the big picture. But a look at Ashburn, Va., about 40 miles from the center of town, finds a steeper fall.

…

Jonathan Hill, vice president of Metropolitan Regional Information Systems, which tracks home sales, sat in his office recently, clicking through page after page of price data sorted by ZIP code. There were a lot of negative numbers, but not in places that are close in or near public transit.

…

David Stiff, chief economist for the company that produces the Case-Shiller Home Price Index, saw the trend in other cities, as well – including Los Angeles, San Francisco, New York, San Diego, Miami and Boston. Stiff recently matched home resale values against commute times and found that in most of these major metropolitan areas, the trend is the same. The longer the commute, the steeper the drop in prices.

Related: Urban Planning – How Walkable is Your Prospective Neighborhood – Exurbs Hardest Hit in Recent Housing Slump (Feb 2007)

Half of Gen X Doesn’t Expect to Retire

…

“They are earning money and paying into Social Security and yet they fear they may never see the payback,” said Moloney. “They feel they deserve it, but it looks like a financial black hole to them right now.”

The government certainly is failing to pay for future obligations today instead choosing to raise taxes on the future. But Social Security itself is actually in better shape than most think. We really do need to move out the benefit payment date (when it began projected life expectancy was almost the same as the date payments would start – which would mean moving the retirement date more than 15 years later, I believe). Going that far is not needed but it should be moved back. But really social security is in good shape for 30 years or more. First, it isn’t going to go from good shape to failed in a day. And second, they will make adjustments as they have in the past to make it work (the adjustment they made in the last 15 years helped a great deal so now they can just add some additional delays in when it starts paying out… and extend the good condition of Social Security without too much trouble).

Medicare is the huge problem. The country either needs to stop paying an extra 50-80% for health care than other countries do (and thus reduce the cost of Medicare liabilities) or massively cut benefits or massively increase taxes. Likely a combination of all 3.

Read more

Lazy Portfolios update by Paul Farrell provides some examples of how to use index funds to manage your investments:

I think the article is a bit misleading in showing the out-performance of the S&P 500 index (during periods where the S&P 500 index does very well these portfolios will under-perform it). The out-performance shown in the article is largely due to the great performance of international markets recently. Still the strategy is well worth reading about. The strategy is based on using index funds from Vanguard (very well run mutual funds with very low fees). But don’t get tied into Vanguard, if they start to focus on lining their pockets by increasing your fees look for alternatives.

Overall, I give this concept high marks. Dollar cost average appropriate levels of money into such a strategy and you will give yourself a good chance at positive results.

My preference would be to include significant levels of international and developing stocks. For aggressive long term investing I like something like:

40% USA total stock market

15% Real Estate

25% international developed stock market index

20% developing stock market index

When aiming for more security and preserving capital (over growth) I favor something like:

30% USA total stock market

10% Real Estate

25% international developed stock market index

10% developing stock market index

10% short term bond index

15% money market

Of course all sorts of personal financial factors need to be considered for any specific person’s allocations.

Related: Allocating Retirement Account Assets – Why Investing is Safer Overseas – Saving for Retirement – 12 stocks for 10 years – what is a mutual fund?

What Should You Do With a Check Out of the Blue?

The USA government is sending out checks to taxpayers in an effort to encourage spending which in turn will provide stimulus to the economy in the very short term. First, this is bad policy in my opinion. Second, if you support this policy the precondition is you run surpluses in order to pay for it when you want to carry out such a policy. They have not, instead they have run huge deficits. What they have chosen to do is spend huge amounts and have the taxes paid by the children and grandchildren of those the politicians are spending the money on today. I would support Keynesian government spending in a serious recession or depression – just not for a country already with enormous debts and in a very mild recession.

But ok, so the government chooses to spend your children’s taxes foolishly, what should you do now? This is very easy. Whatever is the wisest move for your personal financial situation for any windfall you receive, regardless of the source of that windfall. If all your savings needs are met there is nothing wrong with buying some toy. But most people need to pay off debt, build an emergency fund, save for retirement or something similar not get another toy. Of course would be nothing wrong with donating it Kiva, Trickle Up, the Concord Coalition or your favorite charity.

The politicians are acting like a 5 year old that wants a new toy. I can too get the new toy now :-O, Mommy you can use your credit card. So what if you already bought me so many toys you couldn’t afford by using your other credit cards and they won’t lend you any more money. Just get another one. Similar to how congress recently yet again increased the allowable federal debt limit to over $9,000,000,000,000.

The stimulus effect of spending is that if you actually purchase a new toy (say a TV), then the store needs to replace that TV so the factory makes another TV… The store, shipper, factory, supplier to the factory all pay staff to carry this out, those staff can buy new books, dishwasher… and the business may buy a new forklift or computer to keep up…

Read more

It has long been the case that home owners refuse to accept falling prices and choose to demand higher prices than the market demands in a falling market. Therefore when prices should fall (to find buyers) instead the sales decrease as buyers don’t decrease prices to a level buyers are willing to pay. Be It Ever So Illogical: Homeowners Who Won’t Cut the Price

Three years ago, when the real estate bubble was still inflating, this sort of standoff was the exception. It’s the norm today. Overall home sales have fallen a remarkable 33 percent since the summer of 2005. Home prices, on the other hand, continued to rise until 2006 and are now only 5 to 10 percent below where they were in mid-2005, according to various measures.