The best method to avoid problems with debt collectors is to avoid debt problems (Create Your Cash Reserve – use your credit card responsibly – Buy less stuff). But if you do run into problems and get stuck dealing with debt collectors in addition to the financial trouble you may find yourself very frustrated and stressed. The Fair Debt Collection resource of the Federal Trade Commission provides useful information:

Debt collectors may not harass, oppress, or abuse you or any third parties they contact. For example, debt collectors may not:

- use threats of violence or harm

- publish a list of consumers who refuse to pay their debts (except to a credit bureau)

- use obscene or profane language; or repeatedly use the telephone to annoy someone

Debt collectors may not use any false or misleading statements when collecting a debt. For example, debt collectors may not:

- falsely imply that they are attorneys or government representatives

- falsely imply that you have committed a crime

- falsely represent that they operate or work for a credit bureau

- misrepresent the amount of your debt

- indicate that papers being sent to you are legal forms when they are not

- indicate that papers being sent to you are not legal forms when they are

Why is such a resource needed? Because many debt collectors have behaved unethically and illegally. To file a complaint use that link or call toll-free, 1-877-382-4357.

FTC 2008 Report on Fair Debt Collection Practices Act

Read more

As the credit card companies continue to prove they are not interested in providing value to the customer and making a fair profit from the value they provide. Instead they attempt to do whatever they can to get money from customers. I would guess because they can get more from careless customers that don’t block each attempt to take their money than the companies have to pay back or pay in fines.

J.P. Morgan Chase — What Every Person With A Credit Card Should Know

Canceling cards from companies that repeatedly treat customers as a source of ill gotten gains is wise. Unfortunately most options seem to be led by the same unethical tactics. Some credit unions seem to actually believe in providing a fair service and treating customers with honesty and integrity (though many just outsource credit card service to a company that has no interest in the mission of the credit union to serve members). During the era of the robber barrons it was accepted that business was amoral. Since then it is understood morality applies in the business world – some people just case less about morality than cash.

Read more

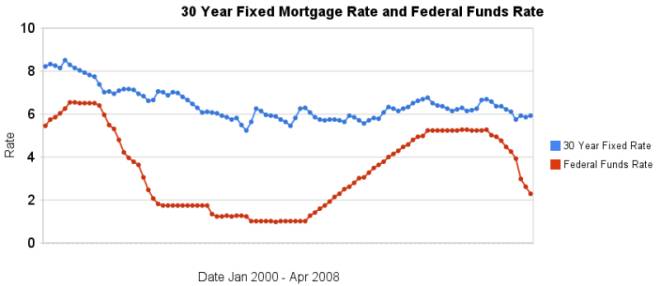

The recent drastic reductions again emphasize (once again) that changes in the federal funds rate are not correlated with changes in the 30 year fixed mortgage rate. In the last 4 months the discount rate has been reduced nearly 200 basis points, while 30 year fixed mortgage rates have fallen 18 basis points.

I have update my article showing the historical comparison of 30 year fixed mortgage rates and the federal funds rate. The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through April 2008 (for more details see the article).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates that can be used for those looking to determine short term (over a few days, weeks or months) moves in the 30 year fixed mortgage rates. For example if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do. No matter how often those that should know better repeat the belief that there is such a correlation you can look at the actual data in the graph above to see that it is not the case.

Related: real estate articles – Affect of Fed Funds Rates Changes on Mortgage Rates – How Not to Convert Equity – more posts on financial literacy

Read more

Regulators zero in on credit card reform

The plan would allow consumers more time to pay their monthly bill. It would prevent companies from applying interest-rate increases retroactively to pre-existing balances. And it would ban “double cycle billing,” a practice that computes finance charges based on previous billing cycles.

…

U.S. consumers were saddled with $850 billion in credit card debt as of the end of last year, according to the Consumer Federation of America.

…

“It’s a good first step in addressing a number of abusive practices,” said Travis Plunkett, legislative director at the consumer federation. “However, it will still be necessary for Congress to step in because the proposal only deals with a few of the problems that have been identified.”

At the same time, legislators could have quite a fight on their hands. Previous efforts trying to reform the industry have largely failed, while recent legislative proposals have found little support among GOP lawmakers.

The credit card companies pay politicians a great deal of money. That is the reason sensible regulation has failed. Now those fighting for sensible regulation have to have such an obvious case that even those taking huge amounts of money from the credit card companies can’t stymie sensible rules. Remember to follow our credit card tips to avoid the pitfalls that catch so many – that don’t read our blog ![]()

Related: Legislation to Address the Worst Credit Card Fee Abuse, Maybe – Sneaky Fees – Incredibly Bad Customer Service from Discover Card – Hidden Credit Card Fees

At work people have been talking about the increasing prices of food and the price increases sure are noticeable to me. With the exception of gas, I have not heard discussion of inflation outside of a classroom, maybe ever, I can’t recall hearing it anyway. Egg prices are up 35 percent, with milk and bread not far behind

…

The crunch for American shoppers pales compared with the challenges faced by those in the developing world. Americans spend just 9.9 percent of household income on food, according to the Agriculture Department. Compare that with poor countries such as Ethiopia and Bangladesh, where it’s not uncommon for families to spend 70 percent.

Consumer Price Index Summary – March 2008:

Related: what is inflation risk? – Manufacturing Productivity – What Do Unemployment Stats Mean?

Much of personal finance is not amazingly complex once you take some time to lay out the basics. We have covered some important topics previously: tips on using credit cards, retirement saving, creating an emergency fund… One of the most critical factors is to insure yourself against possible catastrophic events.

Some personal finance mistakes can set you behind, say falling to save for retirement when you are 28 or cashing in your 401(k) when you switch jobs at 27. Those mistakes however are most often manageable. You just need to save more later. For health insurance the critical need is to protect yourself from huge costs.

Bankruptcies are a huge problem due to health costs. If you have done everything else right and have saved up say $150,000 in mutual funds (in addition to retirement savings and a house) at age 40 but have no health insurance there is little I can think of more likely to result in your losing that saving than a health crisis when you are without coverage (disability insurance is another critical personal finance need that I will discuss in another post and the another such risk – as is an uninsured home). The costs of health care are just too large for any but the richest to survive a major cost without either ruining an entire lifetime of smart financial moves or coming close.

There are certain things that cannot be compromised in your personal financial situation. Health coverage for significant costs is one of those. If you can afford a $5,000 (or higher) deductible that is fine. The critical need for health insurance is not the first $2,000 or $20,000 but the 2nd, 3rd, 4th… $100,000 bill. A bill for $2,000 you can’t afford is a challenge but a bill for $100,000 you can’t afford can ruin decades of smart and diligent financial moves.

Read more

Half of Gen X Doesn’t Expect to Retire

…

“They are earning money and paying into Social Security and yet they fear they may never see the payback,” said Moloney. “They feel they deserve it, but it looks like a financial black hole to them right now.”

The government certainly is failing to pay for future obligations today instead choosing to raise taxes on the future. But Social Security itself is actually in better shape than most think. We really do need to move out the benefit payment date (when it began projected life expectancy was almost the same as the date payments would start – which would mean moving the retirement date more than 15 years later, I believe). Going that far is not needed but it should be moved back. But really social security is in good shape for 30 years or more. First, it isn’t going to go from good shape to failed in a day. And second, they will make adjustments as they have in the past to make it work (the adjustment they made in the last 15 years helped a great deal so now they can just add some additional delays in when it starts paying out… and extend the good condition of Social Security without too much trouble).

Medicare is the huge problem. The country either needs to stop paying an extra 50-80% for health care than other countries do (and thus reduce the cost of Medicare liabilities) or massively cut benefits or massively increase taxes. Likely a combination of all 3.

Read more

Lazy Portfolios update by Paul Farrell provides some examples of how to use index funds to manage your investments:

I think the article is a bit misleading in showing the out-performance of the S&P 500 index (during periods where the S&P 500 index does very well these portfolios will under-perform it). The out-performance shown in the article is largely due to the great performance of international markets recently. Still the strategy is well worth reading about. The strategy is based on using index funds from Vanguard (very well run mutual funds with very low fees). But don’t get tied into Vanguard, if they start to focus on lining their pockets by increasing your fees look for alternatives.

Overall, I give this concept high marks. Dollar cost average appropriate levels of money into such a strategy and you will give yourself a good chance at positive results.

My preference would be to include significant levels of international and developing stocks. For aggressive long term investing I like something like:

40% USA total stock market

15% Real Estate

25% international developed stock market index

20% developing stock market index

When aiming for more security and preserving capital (over growth) I favor something like:

30% USA total stock market

10% Real Estate

25% international developed stock market index

10% developing stock market index

10% short term bond index

15% money market

Of course all sorts of personal financial factors need to be considered for any specific person’s allocations.

Related: Allocating Retirement Account Assets – Why Investing is Safer Overseas – Saving for Retirement – 12 stocks for 10 years – what is a mutual fund?

What Should You Do With a Check Out of the Blue?

The USA government is sending out checks to taxpayers in an effort to encourage spending which in turn will provide stimulus to the economy in the very short term. First, this is bad policy in my opinion. Second, if you support this policy the precondition is you run surpluses in order to pay for it when you want to carry out such a policy. They have not, instead they have run huge deficits. What they have chosen to do is spend huge amounts and have the taxes paid by the children and grandchildren of those the politicians are spending the money on today. I would support Keynesian government spending in a serious recession or depression – just not for a country already with enormous debts and in a very mild recession.

But ok, so the government chooses to spend your children’s taxes foolishly, what should you do now? This is very easy. Whatever is the wisest move for your personal financial situation for any windfall you receive, regardless of the source of that windfall. If all your savings needs are met there is nothing wrong with buying some toy. But most people need to pay off debt, build an emergency fund, save for retirement or something similar not get another toy. Of course would be nothing wrong with donating it Kiva, Trickle Up, the Concord Coalition or your favorite charity.

The politicians are acting like a 5 year old that wants a new toy. I can too get the new toy now :-O, Mommy you can use your credit card. So what if you already bought me so many toys you couldn’t afford by using your other credit cards and they won’t lend you any more money. Just get another one. Similar to how congress recently yet again increased the allowable federal debt limit to over $9,000,000,000,000.

The stimulus effect of spending is that if you actually purchase a new toy (say a TV), then the store needs to replace that TV so the factory makes another TV… The store, shipper, factory, supplier to the factory all pay staff to carry this out, those staff can buy new books, dishwasher… and the business may buy a new forklift or computer to keep up…

Read more

U.S. Consumer Borrowing Rose $5.2 Billion in February

$2.54 Trillion seems like a great deal to me. Based on a population of 300 million people that would mean $8,467 for every person in just personal debt. USA GDP = $13 trillion. USA federal debt = $9.4 trillion (based on the USA government accounting – so way understating the true debt). USA federal budget $3 trillion.

Related: Americans are Drowning in Debt – Too Much Personal Debt (UK, £1.3 trillion in 2006 – even more than the USA) – Incredibly Bad Customer Service from Discover Card