Often your non-monetary contributions to help can provide more benefit than just giving some money.

There are many ways to help without writing a check. You can volunteer to help someone learn how to read or how to speak English. You can take on a little brother or sister and give them a positive role model. You can provide extra food from your garden to neighbors in need using Ampleharvest.org. You can volunteer at Hospice. Help build housing for those in need. Volunteer Match can help you find opportunities like these in your area.

12 ways of giving — without reaching into your wallet

…

Baby a baby with A New Way of Life Reentry Project. Are your babies all grown up? Your lightly used car seats, strollers, baby clothes and toys can help a mom keep babies bouncing this holiday.

…

Step into a sisterhood with Birthing Project USA. Help a new life enter the world by becoming a “sister friend” to a mother-to-be. Kathryn Hall-Trujillo, a 2010 CNN Hero, started Birthing Project USA to battle high infant-mortality rates. The initiative pairs soon-to-be moms with volunteer “sister friends.” These mentors, who provide one-on-one sisterly guidance and support through the pregnancy and first year of the baby’s life, have welcomed more than 12,000 babies into 94 communities so far.

Sometimes it is far more convenient to give money to support a worthy charity. But if your financial situation makes that difficult there are many other options. And truthfully volunteering your time is often more rewarding to those you help and those who are doing the helping.

Related: You Can Help Reduce Extreme Poverty – More Kiva Entrepreneur Loans: Kenya, Honduras, Armenia… – Financial Thanksgiving

Municipal bonds seem safe. But the incredible long period of irresponsible spending and taking on long term liabilities (pensions, health care costs, infrastructure to maintain) and low taxes and selling off future income streams (to consume today) leaves those bonds with questionable financial backing in many locations. Municipal bond investments should be examined more closely today in light of the problems in the market.

Video shows the State Budgets: The Day of Reckoning by 60 minutes.

Wave of Muni Defaults to Spur Layoffs, Social Unrest: Whitney

Muni experts, including an analyst from Standard & Poor’s, dismissed her predictions, saying the numbers don’t add up.

…

“States clearly have been funding municipal governments—for now up to 40 percent of their total expenditures,” she explained. “As the states become more compromised from a fiscal standpoint, that funding is going to end.”

…

Whitney added that it’s way too soon to see muni bonds as a buying opportunity. But she said that can change quickly.

“When you start to see the first major defaults in this area [the states and cities], when you see more defaults and indiscriminate selling—if you do your research now and figure out who’s protected where and which revenues are protected, there will be great buying opportunities,” Whitney said.

“People are complacent about these defaults. The news about all this isn’t out there yet,” Whitney went on to say. “And only when it is out there, then there will be a buying opportunity [for munis].”

Related: USA State Governments Have $1,000,000,000,000 in Unfunded Retirement Obligations – NY State Raises Pension Age to Save $48 Billion – What the Bailout and Stimulus Are and Are Not – posts on bonds

Unfortunately large banks have a very strong tendency to try to take as much of your money as they can get away with. Rather than having to stay ultra-vigilante (as though I am in business with a thief that I have to watch ever minute or expect my money to be stolen) I would rather pick those I going into business with to avoid those seeking to rip me off. Credit unions are usually the best bet. Some credit unions join nationwide ATM networks, so if ATMs are important to you check this out before selecting a credit union.

Hate ATM fees? Try these fee-friendly banks

If you’re looking to avoid those fees, Ally, Charles Schwab (SCHW, Fortune 500) and USAA not only let all of their customers use out of network ATMs free of charge, but they also refund the fees that their customers are charged by other banks. State Farm Bank doesn’t charge you for going out of network and reimburses fees of up to $10 charged by other banks.

In general, the best advice is to avoid large banks like you would someone with a dangerous communicable disease.

BankSimple is a very promising new offering from Alex Payne, one of Twitter’s first employees and CTO of BankSimple, that promises “to simply put people first. Real customer service, no surprise fees, and a deep desire to help people is what makes BankSimple different.” Now the large banks are perfectly comfortable saying they try to help while trying to find any way possible to trick customers out of money. So Banksimple’s words don’t mean much. but I think there is a real chance they will be different. It is a great market to be in, huge amounts of money to be made and your competitors all treat customers egregiously poorly. That should give you a great opportunity to gain a huge market share.

They are not yet open for business but it might open in early 2011. They are not actually going to be a bank, but instead provide the customer value and partner with existing banks (so we can deal with someone that isn’t trying to rip us off and they can let some bank deal with the administration of managing the money.

Related: Worst Business Practices: Fees to Pay Your Bills – Credit Card Regulation Has Reduced Abuse By Banks – FDIC Study of Bank Overdraft Fees – Sneaky Fees

Consumers debt decreasing very slowly. In the 3rd quarter it decreased at an annual rate of 1.5%, after decreasing at a 3.25% rate in the second quarter. Revolving credit (credit card debt) decreased at an annual rate of 8.5% (compared to 9.5% in the second quarter), and nonrevolving credit (car loans…, not including mortgages) was up 2.5% (versus essentially unchanged).

Revolving consumer debt now stands at $814 billion down $52 billion this year. That is on top of a $92 decline in 2009. Hopefully we can increase the size of the decrease going forward. As individuals we should aim to have no consumer debt and build up cash reserves instead (the way the debt figures are calculated though, even if you don’t really have any debt, say you pay off your credit card bill each month, I believe your balance is still seen as “debt”, it is credit extended to you).

On September 30, 2010 total outstanding consumer debt was $2,411 billion (a decline of just $8 billion in the 3rd quarter, after a decline of $21 billion in the 2nd quarter). This still leaves over $8,000 in consumer debt for every person in the USA and $20,000 per family.

Consumer debt grew by about $100 billion each year from 2004 through 2007. In 2009 consumer debt declined over $100 billion: from $2,561 billion to $2,449 billion. For the first 3 quarters of 2010 it has declined just $38 billion.

The huge amount of outstanding consumer and government debt remains a burden for the economy. At least some progress is being made to decrease consumer debt. Credit card delinquency rates have actually been decreasing the last couple of year (from a high of 6.75% in the 2nd quarter of 2009 to 5% in the 2nd quarter of 2010 (I would guesstimate the average for the decade was 4.5%).

Those living in USA have consumed far more than they have produced for decades. That is not sustainable. You don’t fix this problem by encouraging more spending and borrowing: either by the government or by consumers. The long term problem for the USA economy is that people have consuming more than they have been producing.

We can’t afford to seek even more short term spending powered by more debt. Government debt has been exploding so unfortunately that problem has continued to get worse.

Data from the federal reserve.

Related: Consumers Continue to Slowly Reduce Their Debt Level – The USA Economy Needs to Reduce Personal and Government Debt – Consumer debt needs to decline much more.

In the USA we fail to save nearly enough for retirement by and large. And fail to save emergency funds or prepare for economically difficult times. We by and large chose to spend today and hope tomorrow will be good rather than first establishing a good financial safety net before expanding spending.

When people are debating withdrawing from their retirement account it is actually not the important decision it seems to be (normally). Normally the important decision was years before when they chose to take on consumer debt and not to build up an emergency fund. And when they failed to just build up saving beyond that which could be used for nice vacations, a new car, or to live on in economically challenging times.

If someone had been saving 15% of their salary in retirement since they started working if they took an amount that left them at 10% that is hardly a horrible result. While someone that was already behind by say adding just 3% to retirement savings and they took out all of it that would be much worse.

And we should remember even having a retirement account to withdraw from might put you ahead of nearly 50% of the population (and our state and federal governments, by the way). If you have to resort to withdrawing from your retirement account don’t think of that as the failure. The failure was most likely the lack of savings for years prior to that. And as soon as possible, re-fund your retirement account and build up a strong emergency fund, even if that means passing spending on things you want.

Related: Retirement Savings Allocation for 2010 – 401(k)s are a Great Way to Save for Retirement – Save Some of Each Raise

Google finance has a nice new feature to let you chart your entire portfolio. You can then compare it to the S&P 500 or other stocks. This is a very nice feature. Yahoo Finance is about the only part of Yahoo I still use. I do use Google Finance some but they still fall short and I use Yahoo Finance much more. This feature will at least encourage me to put my portfolio in Google and start tracking it.

It would be great if this could give you portfolio annual rates of return (including factoring in cash additions and withdraws and keeping track of sales over time to show a true view of the portfolio). It does look like it will factor in stock purchases and sales which is very nice. You can import csv files with transaction history – another nice feature.

It also strikes me as a very smart move (as a Google stockholder that is nice to see) as advertising rates around investing are high. The more time Google can provide financial advertisers the more income they can make.

Related: Lazy Portfolios Seven-year Winning Streak – Google Posts Good Earning But Not Good Enough for Many (April 2010) – Dollar Cost Averaging – Curious Cat Investing Books

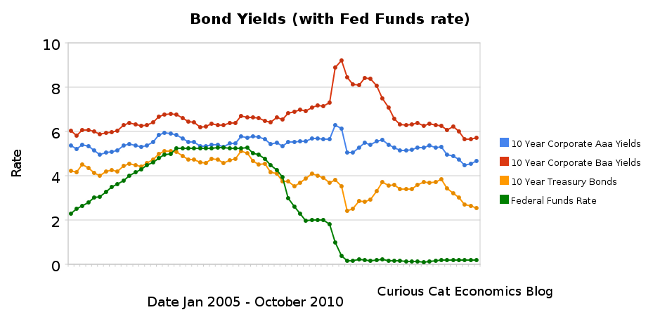

Chart showing corporate and government bond yields from 2005-2010 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields from 2005-2010 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.Bond yields have dropped even lower over the last 6 months, dramatically so for treasury bonds. 10 year Aaa corporate bonds yields have decreased 61 basis points to 4.68%. 10 year Baa yields have decreased 53 basis points to 5.72%. 10 year USA treasury bonds have decreased an amazing 169 basis points to a incredibly low yield of %2.54. The federal funds rate remains under .25%.

The Fed continues to try and discourage saving and encourage spending by punishing savers with policies to drive interest rates far below what the market alone would set. Partially this is a continuation of their subsidy to the large banks that caused the credit crisis. And partially it is an attempt to find a way to encourage spending to try and build job creation in the economy. The Fed announced they are taking huge steps to purchase $600 billion more bonds in an attempt to lower rates even further (much of the impact has been priced into the market as they have been saying they will take this action – but the size is larger than the consensus expectation). I do not think this is a sensible move.

Savers do not have many good options for safely investing retirement assets for a reasonable income. The best options are probably to hold short term bonds and money markets and hope that the Fed finally stops making things so difficult for them. But that will take awhile. I think investing in medium or long term bonds (over 4 years) is crazy at these rates (especially government bonds – unless you are a large bank that can get essentially free money from the Fed to then loan the government and make a profit). Dividends stocks may be a good alternative for some more yield (but this needs to be done carefully to not take unwise risks). And I think you to look at investing overseas because these fiscal policies are just too damaging to savers to continue to just wait for a decent rate of return in bonds in the USA. But there are not many good options. TIPS, inflation protected bonds, are another option to consider (mainly as a less bad, of bad choices).

It is a great time to take on debt however (as often is the case, there are benefits and costs to economic conditions). If you have a mortgage, and can qualify, or are looking to buy a home, mortgage rates are amazingly low.

Related: Bond Rates Remain Low, Little Change in Last 6 Months (April 2010) – Bond Yields Change Little Over Previous Months (December 2009) – Chart Shows Wild Swings in Bond Yields in Late 2008 – Government Debt as Percentage of GDP 1990-2009 in USA, Japan, Germany, China…

Options strike most as exotic investment transactions. And some option strategies can be risky. But stock options can also be used in ways that are not risky. Call options give you the right to buy a stock at a certain price (the strike price) on, or before, a certain date (the expiration date). So if you want to speculate that a stock will go up in a short period of time you can buy call options. This is a risky investment strategy – though it can pay off well if you speculate correctly.

Someone has to sell the call option. The seller gives the buyer the right to buy a stock at a certain price by a certain date. A speculator can do this and take the risk that the price will not rise to the level where a person chooses to exerciser their option. The also carries a significant risk, as if the stock price rises the speculator that sold the option has to either buy the option back (at a significant cost) or provide the stock (which they would have to purchase on the market). In order to trade in options you must be approved by the broker (at least in the USA) as an investor with the knowledge, finances and goals for which options trading is appropriate.

An investor can also sell an option to buy a stock they own – this is called selling a covered call option. This means you get the price the speculator is willing to pay to buy the option and may have to sell the stock you own if the person holding the option chooses to exercise it.

Lets look at an example. Lets say you own some Amazon stock. Read more

Welcome to the Curious Cat Investing and Economics Carnival: find useful recent personal finance, investing and economics blog posts.

- Global Aging – “Over time, low birth rates lead not only to fewer children, but also to fewer working-age people just as the percentage of dependent elders explodes. This means that as population aging runs its course, it might well go from stimulating the economy to depressing it. Fewer young adults means fewer people needing to purchase new homes, new furniture, and the like, as well as fewer people likely to take entrepreneurial risks. ” (The economic consequences of demographic changes are enormous. Investors often fail to appreciate how important they are – John)

- Google: A Free Cash Flow Analysis by Peter Mycroft Psaras – “I learned this trick by analyzing Warren Buffett’s purchase of International Dairy Queen and noticed that many of the investments he was making then were low capital expenditure/ high free cash flow machines.”

- Oil Consumption by Country 1990-2009 by John Hunter – “The USA consumed 18.7 million barrels a day in 2009. Only China was also over 5 million barrels, they reached 8.2 million in 2009. Japan is next at 4.4 million.”

- 9 lazy portfolios for UK investors – “You don’t need to pay for black box analytics that spit out your fully personalized, mean variance optimised, risk calibrated portfolio. You can just keep things simple and do it yourself.”

- Where corn prices go (and that’s UP), meat prices will follow by Jim Jubak – “But it is good news for farm incomes as higher prices for corn and other commodities push up revenues. That’s good news for the stocks of Mosaic (MOS) and Agrium (AGU) in the fertilizer group, seed companies Monsanto (MON) and Syngenta (SYT), and farm equipment makers Deere (DE) and AGCO (AGCO).”

- Three Small Financial Tweaks You Should Make Before Winter by Mark Riddix – “At a minimum, try to increase your [retirement] contribution 1% every year. Although you shouldn’t miss 1% every time you add it, over time those small increases become 5% and 10%, which means a big long-term boost to your investments.”

- How to Avoid Lifestyle Inflation by Ryan Guina – “Live beneath your means. An increase in income does not change the fact that living beneath your means is the single most important step in financial independence.”

- How to keep yourself from retiring broke – ” According to the Center for Retirement Research, Americans, who are between 32 and 64 years old now, will be short about $90,000 on average to retire comfortably and ‘on time’.”

- Yield Curve by Robert Wasilewski – “You’ll find today’s spread is historically steep… The spread is the compensation that investors get for taking on price risk for buying longer maturities. Bond investors constantly assess whether the additional yield, i.e. spread, compensates for the incremental risk.”

- Asset Allocation In A Rising Interest Rate Environment by Gaétan Ruest – “Typically, a shorter term bond will be less impacted in a rising interest rate environment than a long term bond. But this is only true if the increase in the short term interest rates is the same as at the long term.”

Related: investing books – articles on investing – Curious Cat Investing and Economics Search

I made several more Kiva loans to entrepreneur in Kenya, Lebanon, Nicaragua, Kenya, Honduras and Armenia (brining my total loans to 251). It really is great to see real people using capitalism to improve their lives. And being able to help by lending some money is wonderful. When looking for loans I give preference to loans that improve productivity and increasing capacity of the entrepreneur. If they use the proceeds of the loan to increase their capacity to produce they can pay off the loan and find themselves much better off.

Douglas Osusu, Kisii, Kenya, in front of his posho mill (used for grinding maize into flour).

Douglas Osusu, Kisii, Kenya, in front of his posho mill (used for grinding maize into flour).A nice example of this is the loan to Douglas Osusu (pictured). He has requested this loan of 80,000 KES to purchase a dairy cow and a posho mill. This loan also has a portfolio yield (Kiva’s equivalent of an annual percentage rate) of 19%. 19% is very loan for loans on Kiva (remember there are significant costs to servicing micro-loans) – I like the rate to be under 30% but sometimes accept rates up to 40% (or even higher occasionally). I also give great preference to low rates, as the lower the rate the better for the entrepreneur. The 3rd factor I consider is the history of the field partner bank (default rate, delinquency rate and currency exchange loss rate). In this case the field partner is new and carries risk because of that. Still in this case I really like the loan and I like that this lender is charging low rates so I want to take the risk and see how they can do. The amount I lend is based on the combination of these factors – I lend more when I have several reasons to really like the loan.

Join other readers by making loans and joining the Curious Cats Lending Team: 8 members, 213 loans totaling $8,775. Comment with the link to your Kiva page and I will add a link on Curious Cat Kivans.

My current default rate is 1.39% and the delinquency rate is 8.49% (see chart of USA general delinquency rates). The delinquency rate is exaggerated due to technical details (some difficulties in reporting in various countries and such things). Agricultural loans often become delinquent on Kiva but still are paid in full (in my experience). While the defaulted loan rate is 1.39% if you look at the percent of dollars lost I have a rate of 1.2% (this is nearly all due to a bank that failed over a year ago to which I had 2 loans where I lost $87.50 of $100 – there are also 2 other losses for under $5). I add to my total loan amount a couple times a year but also I get to keep relending as money is paid back.

Some of my favorite ways to help reduce extreme poverty are Trickle Up, Kiva and using Global Giving to find small organizations.

Related: 100th Entrepreneur Loan – More Kiva Entrepreneur Loans: Kenya, El Salvador (June 2010) – Kiva Opens to USA Entrepreneur Loans – MicroFinance Currency Risk – Kiva Fellows Blog: Nepalese Entrepreneur Success