The delinquency rate for mortgage loans rose to 9.94% of all loans outstanding at the end of the third quarter, up 108 basis points from the second quarter of 2009, and up 265 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The delinquency rate breaks the record set last quarter (since 1972).

The delinquency rate includes loans that are at least one payment past due but does not include loans somewhere in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 4.47%, an increase of 17 basis points from the second quarter of 2009 and 150 basis points from one year ago. The combined percentage of loans in foreclosure or at least one payment past due was 14.4% on a non-seasonally adjusted basis, the highest ever recorded in the MBA delinquency survey.

The percentages of loans 90 days or more past due, loans in foreclosure, and foreclosures started all set new record highs. The percentage of loans 30 days past due is still below the record set in the second quarter of 1985.

“Despite the recession ending in mid-summer, the decline in mortgage performance continues. Job losses continue to increase and drive up delinquencies… Over the last year, we have seen the ranks of the unemployed increase by about 5.5 million people, increasing the number of seriously delinquent loans by almost 2 million loans,” said Jay Brinkmann, MBA’s Chief Economist.

“The performance of prime adjustable rate loans, which include pay-option ARMs in the MBA survey, continue to deteriorate with the foreclosure rate on those loans for the first time exceeding the rate for subprime fixed-rate loans. In contrast, both subprime fixed-rate and subprime adjustable rate loans saw decreases in foreclosures.”

This continues the bad news on housing. Though home sales have been picking up, the underlying strength of the housing market remains questionable. Without jobs increasing it is very difficult for the real estate market to recover.

Related: Nearly 10% of Mortgages Delinquent or in Foreclosure (Dec 2008) – Loan Default Rates Increased Dramatically in the 2nd Quarter – Another Wave of Foreclosures Loom (July 2009) – Homes Entering Foreclosure at Record (Sep 2007)

Read more

The credit card delinquency rate (borrowers 90 days or more delinquent on one or more of their credit cards) dropped to 1.10% percent in the third quarter of 2009, down 6 basis points from the previous quarter. Year over year, credit card delinquencies remained essentially flat from 1.09% in the third quarter of 2008.

Credit card delinquency was highest in Nevada (1.98%), Florida (1.47%) and Arizona (1.35%). Credit card delinquency rates were lowest in North Dakota (0.66%), South Dakota (0.70%) and Alaska (0.73%).

Average credit card borrower debt decreased to $5,612 from the previous quarter’s $5,719, and $5,710 for the third quarter of 2008.

“At end of the 2001 recession, the national bankcard delinquency rate had increased to a high of 1.69% as that recession came to a close (in November of 2001),” said Ezra Becker, with Transunion.

The slight declines in credit card debt are an encouraging sign that more people are taking the right action to eliminate their credit card debt.

Related: USA Consumers Paying Down Debt – Consumer Debt Down Over $100 Billion So Far in 2009 – Families Should not Finance Everyday Purchases on Credit – Some Movement on Regulating Credit Cards Companies

Peter Schiff does a good job of explaining The Truth Behind China’s Currency Peg

…

In fact, for the U.S., de-pegging would cause the economic equivalent of cardiac arrest. Our economy is currently on life support provided by an endless flow of debt financing from China. These purchases are the means by which China maintains the relative value of its currency against the dollar. As the dollar comes under even more downward pressure, China’s purchases must increase to keep the renminbi from rising. By maintaining the peg, China enables our politicians and citizens to continue spending more than they have and avoiding the hard choices necessary to restore our long-term economic health.

…

As demand falls for both dollars and Treasuries, prices and interest rates in the United States will rise. Rising rates will restrict the flow of credit that is currently financing government and consumer spending. This change will finally force a long overdue decline in borrowing.

…

De-pegging will force the hand of U.S. politicians toward pursuing realistic policies. The Chinese will come to their senses eventually because it is in their interest to do so. Meanwhile, the longer the peg is maintained, the more indebted we become, the more out of balance our economy grows, and the more our industrial base shrivels. In short, the longer they wait, the steeper our fall.

I agree the largest impact of the currency peg on the USA is supporting our economy in the short run. If we didn’t go into huge debt it would actually be good for the USA for the long run too. Essentially China subsidies our purchases and borrowing. The problem is that we have taken a good thing too far and become used to living beyond our means. That is not sustainable – even with a subsidy from China.

I disagree that the USA manufacturing base is hollowed out. It is strong in comparison to the rest of the world, except China. China’s manufacturing growth has been phenomenal, compared to that everyone looks weak. Manufacturing jobs are disappearing everywhere, not just in the USA.

Related: Top 10 Manufacturing Countries in 2008 – China and the Sugar Industry Tax Consumers – Why the Dollar is Falling – Who Will Buy All the USA’s Debt? – Peter Schiff Answers Redditers Questions

Over the last few years Elizabeth Warren has become one of my favorite leaders. She is a leader in economic thought, ethical society and the law (she is a law professor at Harvard Law School). Far too many on Wall Street, Washington and in C-suites are leading us down a very bad path. She is a voice we need to heed.

If you can’t explain it, you can’t sell it

…

The 1966 high school debate champion of Oklahoma may get what she wants. The House of Representatives will vote in December on her idea. She suggested a Financial Product Safety Commission in a 2007 article in the magazine Democracy [Unsafe at Any Rate]. President Barack Obama proposed it to Congress in June as the Consumer Financial Protection Agency.

Warren won’t discuss whether she may be a candidate to lead the authority, which would have the power to regulate $13.7 trillion of debt products. A Warren nomination would tell banks that Obama is determined to force reduced checking-account fees and limit lender claims in mortgage advertising, among other measures the industry opposes, said Thomas Cooley, dean of New York University’s Stern School of Business.

…

In her role overseeing the TARP, Warren has been critical of the administration, accusing the Treasury Department of undervaluing the stock warrants that were supposed to compensate taxpayers when banks repay their bailouts. A lack of transparency about how TARP functions “erodes the very confidence” it was to restore, her committee said in a report.

I hope she can take her attempts to reduce political favors being granted huge financial institutions and those institution be forced to follow sensible rules to protect individuals and our economy. With a few more people like there we will have a much better chance of a positive economic future.

Related: Bogle on the Retirement Crisis – Bankruptcies Among Seniors Soaring – Don’t Let the Credit Card Companies Play You for a Fool – http://investing.curiouscatblog.net/2009/04/08/the-best-way-to-rob-a-bank-is-as-an-executive-at-one/

Scientist Monkeys Around With The Economy

Dr. NOE: So what then did, is we got a second low-ranking female, trained her to open a second container with apples in it, and then we saw that the value of the first provider dropped, more or less, to the half of what she had before. So now we had a competition between two animals. Both of them could provide this good, these apples, and so the value of the first one dropped down again. And of the second one who was very low at the beginning of the experiment, she went up. And they ended up both in the middle, so to speak.

BLUMBERG: So when there was a monkey monopoly on the skill, the monkeys paid one price. But when it became a duopoly, the price fell to an equilibrium point, about half of what it had been. And this all happened despite the fact that we’re talking about monkeys here. Monkeys can’t do math…

Very cool.

Related: Eric Schmidt on Google, Education and Economics – Too Big to Fail – Expectations

The Worst is yet to Come: Unemployed Americans Should Hunker Down for More Job Losses by Nouriel Roubini

While losing 200,000 jobs per month is better than the 700,000 jobs lost in January, current job losses still average more than the per month rate of 150,000 during the last recession.

Also, remember: The last recession ended in November 2001, but job losses continued for more than a year and half until June of 2003; ditto for the 1990-91 recession.

So we can expect that job losses will continue until the end of 2010 at the earliest.

…

There’s really just one hope for our leaders to turn things around: a bold prescription that increases the fiscal stimulus with another round of labor-intensive, shovel-ready infrastructure projects, helps fiscally strapped state and local governments and provides a temporary tax credit to the private sector to hire more workers.

…

Based on my best judgment, it is most likely that the unemployment rate will peak close to 11% and will remain at a very high level for two years or more.

Roubini has predicted negative economic results and been right for the last few years. I am uncertain about with the short term economic outlook. I can certainly imagine the slow job recovery he predicts will happen. I am hopeful we will see jobs increasing before that but the news in the last few months has not made that prospect seem more likely. And the long term outlook is getting worse with the huge government debt being added as a burden for the future economy.

Related: Nouriel Roubini Believes Stock Market has Risen too Far, too Fast – Unemployment Rate Reached 10.2% – Why the Dollar is Falling

The Federal Weatherization Assistance Program has been around for decades and funding has been increased as part of the stimulus bills. This type of spending is better than much of what government does. It actually invests in something with positive externalities. It targets spending to those that need help (instead of say those that pay politicians to give their companies huge payoffs and then pay themselves tens of millions in bonuses).

The Depart of Energy provides funding, but the states run their own programs and set rules for issues such as eligibility. They also select service providers, which are usually nonprofit agencies that serve families in their communities, and review their performance for quality. In many states the stimulus funds have increased the maximum funds have increased to $6,500 per household, from $3,000.

The weatherization program targets low-income families: those who make $44,000 per year for a family of four (except for $55,140 for Alaska and $50,720 for Hawaii).

The program provides funds for those with low-income for the like of: insulation, air sealing and at times furnace repair and replacement. Taking advantage of this program can help you reduce your energy bills and reduce the amount of energy we use and pollution created. And it employs people to carry out these activities.

The Weatherization Assistance Program invests in making homes more energy efficient, reducing heating bills by an average of 32% and overall energy bills by hundreds of dollars per year.

Weatherization is also often a very good idea without any government support. If you are eligible for some help, definitely take a look at whether it makes sense for you. And even if you are not, it is a good idea to look into saving on your energy costs.

Related: Oil Consumption by Country in 2007 – Japan to Add Personal Solar Subsidies – personal finance tips – Kodak Debuts Printers With Inexpensive Cartridges – Personal Finance Basics: Dollar Cost Averaging

Read more

Is it cynical to think that politicians want to provide payments from the treasury to those that paid the politicians? More cynical to think the politicians that created huge Wall Street Welfare payments won’t actually do anything except talk about how they think it is bad that those they paid billions to are buying new mansions and yachts? More cynical to think they will continue to provide huge amounts of nearly free cash for those that paid them to speculate with? More cynical to think if any of those speculators lose money they will give them more welfare? More cynical to think those bought and paid for politicians won’t actually take any steps to tax or curtail speculation? I think maybe I am cynical about Washington doing anything other than talk about how they don’t want to provide huge amounts of cash to Wall Street all the while giving their Wall Street friends huge amounts of cash that will be paid back by our grandchildren.

Wouldn’t it be nice if the politicians actually took actions to fund a partial payback of the hundreds of billions (or maybe trillions) of bailout dollars by taxing financial speculation? I doubt it will happen. But maybe I am too cynical. Maybe politicians will not just do what they have been paid to do. But it seems the best predictor of what congress will do is based on what they are paid to do, based on their past and current behavior. Now what congress will say is very different. those paying Congressmen might not love it if the congressmen call them names but through a few billion more and they are happy to be called names while given the cash to buy new jets and sports teams and parties for their daughters.

Making Wall Street pay by Dean Baker

The logic of a financial transactions tax is simple. It would impose a modest fee on trades of stocks, futures, credit default swaps and other financial instruments. For example, the UK puts a 0.25% tax on the sale or purchase of shares of stock. This has very little impact on people who buy stock with the intent of holding it for a long period of time.

…

We can raise more than $140bn a year taxing financial transactions, an amount equal to 1% of GDP.

…

Since the financial sector is the source of the country’s current economic and budget problems it also makes sense to have this sector bear the brunt of any new taxes that may be needed. The economic collapse caused by Wall Street’s irrational exuberance has led to a huge increase in the country debt burden. It seems only fair that Wall Street bear the brunt of the clean-up costs. A financial transactions tax is the way to make sure that this happens.

One challenge of understanding the state of the economy is we don’t have clear measures. We attempt to gather accurate data but there is quite a bit of inaccuracy in the data (both from preliminary estimates – before all the data is in, which can take months, or longer – and just plain items we have to estimate no matter how long we have).

Related: Manufacturing Data – Accuracy Questions – Why China’s Economic Data is Questionable – What Do Unemployment Statistics Mean? – Manufacturing Jobs Data: USA and China – The Long-Term USA Federal Budget Outlook – Is China’s Recovery for Real?

Economists Seek to Fix a Defect in Data That Overstates the Nation’s Vigor

The problem is particularly acute in manufacturing. Imported components constitute an ever greater share of the computers, autos, appliances and other finished merchandise that roll off assembly lines in the United States – and an ever greater share of all of the nation’s imports.

…

The stated goal, among those at the conference, is to repair the statistics, but that requires several years, lots of money (from Congress) to gather more information about what companies are doing, and whole new procedures for measuring imports. Much of the conference was devoted to an analysis of the gap between existing data and reality, and ways to close that gap.

The Measurement Issues Arising from the Growth of Globalization conference has thankfully provided open access to papers from the conference including:

Offshoring Bias: The Effect of Import Price Mismeasurement on Manufacturing Productivity Read more

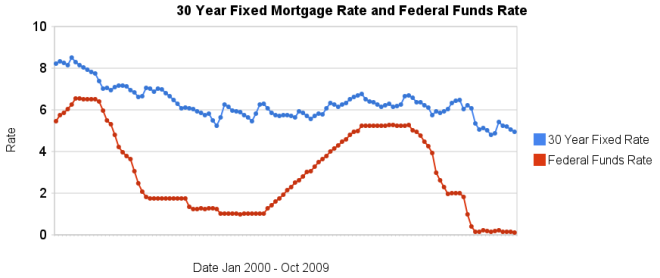

30 year fixed mortgage rates have declined a bit over the last few months and remain at very low levels.

The poor economy, Unemployment Rate Reached 10.2%, has the Fed continuing massive intervention into the economy. The Fed is keeping the fed funds rate at close to 0% (.12% in October). They also continue to hold massive amounts of long term government and mortgage debt (in order to suppress interest rates on long term bonds – by reducing the supply of such bonds in the market).

I can’t see how lending US dollars, over the long term, at 5%, makes any sense. I would much rather borrow at those rates than lend. If you have not refinanced yet, doing so now may well make sense. And if you are looking at a new real estate purchase, financing a 30 year mortgage sure is attractive at rates close to 5%.

Related: historical comparison of 30 year fixed mortgage rates and the federal funds rate – Lowest 30 Year Fixed Mortgage Rates in 37 Years – Jumbo v. Regular Fixed Mortgage Rates: by Credit Score – What are mortgage definitions – Ignorance of Many Mortgage Holders

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates