Federal Reserve Beige Book highlights for April 15th. The Beige Book documents comments received from business and other contacts outside the Federal Reserve and is not a commentary on the views of Federal Reserve officials. The book is published eight times a year.

…

Manufacturers’ assessments of future factory activity improved marginally over the survey period as well.

…

Consumer spending remained generally weak. However, several Districts said sales rose slightly or declines moderated compared with the previous survey period.

…

Home prices continued to decline in most Districts, although a few reports noted that prices were unchanged or that the pace of decline had eased. Low mortgage rates were fueling refinancing activity. Outlooks for the housing sector were generally more optimistic than in earlier surveys, with respondents hopeful that increased buyer interest would lead to better sales.

…

Commercial real estate investment activity weakened further.

…

Labor market conditions were weak and reports of layoffs, reductions in work hours, temporary factory shutdowns, branch closures and hiring freezes remained widespread across Districts.

Related: Central Bank Intervention Unprecedented in scale and Scope – Why do we Have a Federal Reserve Board? – Manufacturing Employment Data – 1979 to 2007 – Oil Consumption by Country

Life Insurers Profit as Retirees Fear Outliving Cash by Alexis Leondis

…

Payouts among insurers vary significantly, said Weatherford of NAVA. Monthly payments range from $629 to $745 for a $100,000 investment by a 65-year-old male, according to a survey of six issuers by Hueler Companies, a Minneapolis-based data research firm and provider of an independent annuity platform.

An annuity is a comforting in that you cannot outlive your annuity payment. However, there are drawbacks also. Having a portion of retirement financing based on annuity payments does help planning. Social security payments are effectively an annuity (that also increases each year, to counter inflation). While living off social security payments alone is not an enticing prospect, as a portion of a retirement plan those payments can be valuable. If you have a pension that can also serve as an annuity.

It can make sense to put a portion of retirement assets into an annuity however I would limit the amount, myself. And the annuity payout is partially determined by current interest rates, which are very low, and those now the payout rates are low. If interest rates stay low, then you lose nothing but if interest rates increase substantially in the next several year (which is certainly possible) the payout for annuities would likely increase.

Choosing to purchase an annuity is something that should be done after careful study and only once you understand the investment options available to you. Also you need to have saved up substantial retirement saving to take advantage of the option to buy enough monthly income to contribute substantially to your retirement (so don’t forget to do that while you are working).

Related: Many Retirees Face Prospect of Outliving Savings – Spending Guidelines in Retirement – Retirement Tips from TIAA CREF – Social Security Trust Fund

It is no surprise that paying politicians lot of money gets you favors: Politicians Change rules for Big Donors – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals (2007) – Congress Eases Bank Laws to Aid Big Donors (1999) – More Government Waste – Monopolies and Oligopolies do not a Free Market Make

Investments Can Yield More on K Street, Study Indicates by Dan Eggen

…

The paper by three Kansas professors examined the impact of a one-time tax break approved by Congress in 2004 that allowed multinational corporations to “repatriate” profits earned overseas, effectively reducing their tax rate on the money from 35 percent to 5.25 percent. More than 800 companies took advantage of the legislation, saving an estimated $100 billion in the process, according to the study.

The largest recipients of tax breaks were concentrated in the pharmaceutical and technology fields, including Pfizer, Merck, Hewlett Packard, Johnson & Johnson and IBM. Pfizer alone repatriated $37 billion, representing 70 percent of its revenue in 2004

…

Mazza added that the results are “troubling” because they show how large companies can distort tax policy to benefit their bottom line.

It’s Now a Renter’s Market by Prashant Gopal

…

Oklahoma City, where people spent just 12% of their income on rent, was the most affordable. Other cheap markets included Indianapolis, Denver, Fort Worth, and Cleveland. The least affordable market was New York, where people spent 57% of their income on rent.

Rental markets are driven largely by 2 factors, vacancy rates and jobs. If jobs in a metropolitan area are increasing rents usually increase. If more new apartments are added to the market than jobs (which then increases vacancy rates) this will push down rates. Other factors influence vacancy rates (such as people moving back in with parent, people sharing apartments…). Those factors often are largely influenced by losing jobs in an area.

D.C. apartment market remains strong

…

Rent increases over the past 12 months for all investment grade apartments kept under the long-term average of 4.2 percent per annum, at 0.5 percent since March 2008.

Related: Housing Rents Falling in the USA – Home Values and Rental Rates – Real estate investing articles – Urban Planning – Longer Commutes Translate to Larger Housing Price Declines

Read more

This Time, Old Hands Are Keeping Their Jobs

That’s a big change from the last serious recession, in 1990-91, when older workers, especially in manufacturing, were hard-hit. Today’s pattern is closer to that of the mild 2001 recession, when older workers did reasonably well.

…

Boeing’s buyouts in the 1990s encouraged workers near retirement to jump ship. “We’ve learned from that,” says Hartnett. While Boeing says it doesn’t look at age in making cuts, it and others want to save the most productive workers—often employees whom companies have invested in most and who have “demonstrated track records,” says Chicago lawyer Gerald L. Maatman Jr., who recently advised 10 companies on downsizing. Such workers “tend to be more experienced and are often older.”

Related: Keeping Older Workers – Our Only Hope: Retiring Later – Focus on Customers and Employees – People are Our Most Important Asset

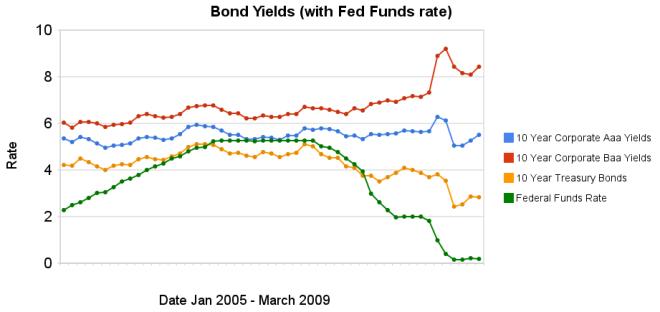

Chart showing corporate and government bond yields by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.The federal funds rate remains under .25%. The large spread between government bonds and corporate bonds remains very large. In the last 3 months the yields on Aaa corporate bonds have increased 45 basis points, Baa corporate bond yields have decreased 1 basis points, while treasury bond yields have increased 40 basis points.

The spread between 10 year Aaa corporate bond yields and 10 year government bond yields is now 268 basis points. In January, 2008 the spread was 159 points. The larger the spread the more people demand in interest, to compensate for the increased risk. The spread between government bonds and Baa corporate bonds decreased to a still very large 566 basis points, the spread was 280 basis point in January 2008, and 362 basis points in September 2008.

Data from the federal reserve: corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Chart Shows Wild Swings in Bond Yields – Fed to Start Buying Treasury Bonds Today – Corporate and Government Bond Rates Graph (Oct 2008) – investing and economic charts

William Black wrote The Best Way to Rob a Bank Is to Own One: How Corporate Executives and Politicians Looted the S&L. I think he a bit off on the “owning one,” being the best way to loot. The looters are not owners, they are executives that loot from owners, taxpayers, customers… And those looters pay politicians a great deal of money to help them. He appeared on Bill Moneys Journal discussing the huge mess we know are in and how little is being done to hold those responsible for the enormous crisis created by them.

…

The FBI publicly warned, in September 2004 that there was an epidemic of mortgage fraud, that if it was allowed to continue it would produce a crisis at least as large as the Savings and Loan debacle. And that they were going to make sure that they didn’t let that happen. So what goes wrong? After 9/11, the attacks, the Justice Department transfers 500 white-collar specialists in the FBI to national terrorism. Well, we can all understand that. But then, the Bush administration refused to replace the missing 500 agents. So even today, again, as you say, this crisis is 1000 times worse, perhaps, certainly 100 times worse, than the Savings and Loan crisis. There are one-fifth as many FBI agents as worked the Savings and Loan crisis.

…

Well, certainly in the financial sphere, I am. I think, first, the policies are substantively bad. Second, I think they completely lack integrity. Third, they violate the rule of law. This is being done just like Secretary Paulson did it. In violation of the law. We adopted a law after the Savings and Loan crisis, called the Prompt Corrective Action Law. And it requires them to close these institutions. And they’re refusing to obey the law.

…

In the Savings and Loan debacle, we developed excellent ways for dealing with the frauds, and for dealing with the failed institutions. And for 15 years after the Savings and Loan crisis, didn’t matter which party was in power, the U.S. Treasury Secretary would fly over to Tokyo and tell the Japanese, “You ought to do things the way we did in the Savings and Loan crisis, because it worked really well. Instead you’re covering up the bank losses, because you know, you say you need confidence. And so, we have to lie to the people to create confidence. And it doesn’t work. You will cause your recession to continue and continue.”

…

And their ideologies, which swept away regulation. So, in the example, regulation means that cheaters don’t prosper. So, instead of being bad for capitalism, it’s what saves capitalism. “Honest purveyors prosper” is what we want. And you need regulation and law enforcement to be able to do this. The tragedy of this crisis is it didn’t need to happen at all.

Related: Fed Continues Wall Street Welfare – Credit Crisis the Result of Planned Looting of the World Economy – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals – Poll: 60% say Depression Likely – Canadian Banks Avoid Failures Common Elsewhere – Too Big to Fail – Why Pay Taxes or be Honest

One problem with investing in mutual funds is potential tax bills. If the fund has invested well and say bought Google at $150 and then Google was at $700 (a few years ago) there is the potential tax liability of the $550 gain per share. So if funds have been successful (which is one reason you may want to invest in them) they often have had a large potential tax liability.

With an open end mutual fund the price is calculated each day based on the net asset value, which is fair but really the true value if there is a large potential tax liability is less than if there was none. So in reality you had to believe the management would outperform enough to make up for the extra taxes that would be owed.

Well, the drastic stock market decline over the last few years has turned this upside down and many mutual funds actual have tax losses that they have realized (which can be used to offset future capital gains). Say the fund had realized capital losses of $30,000,000 last year. Then if they have capital gains of $20,000,000 next year they can use the losses from last year and will not report any taxable capital gains. And the next year the first $10,000,000 in capital gains would be not table either. Business Week, had an article on this recently – Big Losers Can Be Big Tax Shelters

…

Yet it is Miller’s newer charge, Legg Mason Opportunity, which holds stocks of all sizes and can take short positions, that will prove to be the real tax haven. Morningstar pegs its losses at 285% of its $1.2 billion in assets.

…

There are other funds with returns so ugly and losses so large that it may not matter what their trading style is for many years: Fidelity Select Electronics (FSELX), -539%; MFS Core Equity A, -369%; Janus Worldwide (JAWWX), -304%; Vanguard U.S. Growth (VWUSX), -227%.

How does a fund have over 100% tax losses? The way I can think of is if they have a great deal of redemptions. If the fund shrinks in size from a $3 billion fund to a $300 million fund they could have a 50% realized capital loss (down to $750 million) but then another $450 million in redemptions). Now the $300 million has a $750 million capital loss or 250%.

Related: Shorting Using Inverse Funds – Lazy Portfolio Results – Does a Declining Stock Market Worry You? – Asset Allocations Make A Big Difference

I have been running the Curious Cat Management Management Improvement Carnival for several years and decided to start one on the investing and economics theme. I hope you enjoy the inaugural edition. If you like these posts you may also be interested in the Invest Reddit where a community of those interested in investing submit and rate articles and blog posts.

- Case-Shiller: Is it Really THAT Bad? by Stan Humphries – “Unfortunately, in combining both foreclosures and non-foreclosures into a single metric, you’re not really getting a good insight into either market. In the current climate, you’re underestimating the decline in value of foreclosed homes and overestimating the decline in value of non-foreclosure homes.”

- This is unquestionably the worst global economic crisis since the 1930s by Brad Setser – “Both the IMF and World Bank are now forecasting an outright fall in global output in 2009… Anything below 2% [growth] is generally considered a global recession.”

- Value Added Tax (VAT): The Pros and Cons by Eric Stinson – “The VAT is also a consumption tax, so there is incentive for you to limit your spending. Like the Fair Tax, if you spend less than you make, you’ll pay less in taxes (all else equal).”

- Face To Face With The Deficit by Scott Bittle – “The public simply will not permit Washington to raise their taxes, change their health insurance, or cut programs without their consent. Nor should they. But the public should understand the rules, too. It’s not enough to complain about red ink and then reject any possible solution.”

- Confusing price discrimination – “Any way I think about it, the discount should either be to all consumers or to students for the entire day. Why would it be only to students in the afternoon?”

- Leave Your Money in Your Retirement Accounts by Patrick – “At this point, the best thing you can do is stick to your retirement savings and investment plans. Continue contributing to your retirement accounts, make sure your asset allocation is set at your desired level, and don’t withdraw your retirement savings.”

- Invisible Hands Explain Nothing: a response to a critic by Gavin Kennedy – “Indeed, Smith gives over 60 instances in Books I and II of Wealth Of Nations where the actions of individuals for their own ‘gain’ have less than beneficial consequences on those around them”

A couple of my posts have appeared in other carnivals recently: California Unemployment Rate Climbs to 10.5 Percent in the Money Hacks Carnival and Add to Your 401(k) and IRA in the Carnival of Personal Finance.

Related: Money Hacks Carnival #50 – Curious Cat Investing and Economics Search

Then came a shocker: Amid one of the most reckless lending sprees in history, regulators focused on the one bank that refused to play along. Beal’s moves confused and worried them, and so they began to probe him with questions. “What are you doing?” he recalls them asking. “You’re shrinking yet you’re raising capital?”

Says Beal about the scrutiny, “I just didn’t fit into any box.” One regulator, the former head of the Texas Savings & Loan Department, Charles Danny Payne, says, “I was skeptical at first, but I’ve gained a lot of confidence over the years,” adding that Beal has an “uncanny ability to sniff out deals.”

Next, the credit rating agencies started pestering him about his dwindling loan portfolio. They never downgraded him but scolded him for seeming not to have a “sustainable” business model. This while their colleagues were signing off on $32 billion of bum collateralized debt obligations issued by Merrill Lynch.

…

He thinks the government is going to be “disappointed” by its various programs to revive lending. He says Treasury Secretary Timothy Geithner’s new plan to guarantee loans to buyers of toxic assets won’t lead to many sales because the problem isn’t liquidity but price. They are not low enough. Half the country’s banks–4,000 in all–would be bust, he says, if they marked their loans to what the loans would fetch in an auction. He says banks are fooling themselves by refusing to mark busted assets down.

“Banks are on a prayer mission that somehow prices will come back and they won’t have to face reality,” Beal says. And that reality, according to Beal, is going to get a lot worse. “Unemployment is going over 10%, commercial real estate hasn’t even begun collapsing and corporate credit defaults are just getting started,” he says. His prediction: depression, without bread lines this time, thanks to the government safety net, but with equal cost to society.

There are some (very few) who succeeded in not acting like lemmings. I wish someone would explain to me why people are worthy of millions in bonuses when they just do what every single other person in their position did that was also getting millions in bonuses. Obviously they were just practicing bankruptcy for profit (which worked out incredibly well for them) and still we seem to think the only solution is to support these moral bankrupt (and now commercially bankrupt) organizations and individuals.

Related: What the Bailout and Stimulus Are and Are Not – Sound Canadian Banking System – More on Failed Executives – Jim Rogers on the Financial Market Mess