The unemployment rate grew to 9.8% in November, and nonfarm payroll employment increased by 39,000 (less than the expected 150,000), the U.S. Bureau of Labor Statistics reported today. Temporary help services and health care continued to add jobs over the month, while employment fell in retail trade. The change in total nonfarm payroll employment for September was revised from -41,000 to -24,000, and the change for October was revised from +151,000 to +172,000.

The unemployment rate has now remained above 9% for more consecutive months since data has been gathered since 1940.

There are now 15.1 million unemployed in the USA. Among the major worker groups, the unemployment rates for adult men (10.0 %), adult women (8.4%), and teenagers (24.6%).

The number of long-term unemployed (those jobless for 27 weeks and over) was little changed at 6.3 million and accounted for 41.9%. The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed over the month at 9.0 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.

Among the marginally attached, there were 1.3 million discouraged workers in November, an increase of 421,000 from a year earlier. (The data are not seasonally adjusted.) Discouraged workers are persons not currently looking for work because they believe no jobs are available for them. The remaining 1.2 million persons marginally attached to the labor force had not searched for work in the 4 weeks preceding the survey for reasons such as school attendance or family responsibilities.

Total nonfarm payroll employment changed little in November (+39,000). Job gains continued in temporary help services and in health care, while employment fell in retail trade. Since December 2009, total payroll employment has increased by an average of 86,000 per month.

Within professional and business services, employment in temporary help services continued to increase in November (+40,000) and has risen by 494,000 since September 2009.

Related: USA Economy Adds 151,000 Jobs in October and Revisions Add 110,000 More – Over 500,000 Jobs Disappeared in November, 2008 – Manufacturing Employment Data – 1979 to 2007

Read more

Record U.S. Exports Reflect Midwest Boom With 3.7% Unemployment

…

The U.S. dollar has declined 7.3 percent in the second half of the year as food prices surged after cold in China, drought in Russia and parts of Europe, and flooding in Canada damaged harvests. The spot price of corn has gained 46 percent since July 1, wheat is up 28 percent and soybeans have risen 25 percent, according to the USDA. The S&P GSCI Agriculture Index added 41 percent, compared with the 17 percent advance in the broader S&P GSCI Index of 24 commodities.

Farmland values also are rising. Land prices in some areas of the Federal Reserve Bank of Kansas City’s district — which includes Kansas, Nebraska, Wyoming and parts of Missouri — increased as much as 12 percent in the third quarter from a year earlier, the biggest jump since the fourth quarter of 2008, the Fed bank said Nov. 12.

…

While “the agricultural side of the Midwest is doing well,” the plains states “are very, very different than the industrial Midwest,” she said.

Unemployment in Michigan is 13 percent, the second highest after Nevada at 14.4 percent. The jobless rate in the Detroit metro area has stalled above 13 percent for 21 months.

There are reasons to believe this strength in commodities will continue. Though the global population is growing fairly slowly the increase in the global middle class is greatly increasing the demand for food and meat. To provide meat huge amounts of grains are used. When you add to it, crazy policies to promote ethanol the cost of food crops like corn have more pressure to increase. It is good to remember that the economy has many facets and parts of the economy are doing well (energy is also doing very well), thankfully. They help stabilize what could be an even worse overall economy.

Related: USA Economy Adds 151,000 Jobs in October and Revisions Add 110,000 More – 3rd Quarter USA GDP Up 3% from 2009 – Real Estate, Consumer and Agricultural Loan Delinquency Rates 2000-2010 – Auto Manufacturing in 2009: USA 5.7 million, Japan 7.9 million, China 13.8 million

Consumers debt decreasing very slowly. In the 3rd quarter it decreased at an annual rate of 1.5%, after decreasing at a 3.25% rate in the second quarter. Revolving credit (credit card debt) decreased at an annual rate of 8.5% (compared to 9.5% in the second quarter), and nonrevolving credit (car loans…, not including mortgages) was up 2.5% (versus essentially unchanged).

Revolving consumer debt now stands at $814 billion down $52 billion this year. That is on top of a $92 decline in 2009. Hopefully we can increase the size of the decrease going forward. As individuals we should aim to have no consumer debt and build up cash reserves instead (the way the debt figures are calculated though, even if you don’t really have any debt, say you pay off your credit card bill each month, I believe your balance is still seen as “debt”, it is credit extended to you).

On September 30, 2010 total outstanding consumer debt was $2,411 billion (a decline of just $8 billion in the 3rd quarter, after a decline of $21 billion in the 2nd quarter). This still leaves over $8,000 in consumer debt for every person in the USA and $20,000 per family.

Consumer debt grew by about $100 billion each year from 2004 through 2007. In 2009 consumer debt declined over $100 billion: from $2,561 billion to $2,449 billion. For the first 3 quarters of 2010 it has declined just $38 billion.

The huge amount of outstanding consumer and government debt remains a burden for the economy. At least some progress is being made to decrease consumer debt. Credit card delinquency rates have actually been decreasing the last couple of year (from a high of 6.75% in the 2nd quarter of 2009 to 5% in the 2nd quarter of 2010 (I would guesstimate the average for the decade was 4.5%).

Those living in USA have consumed far more than they have produced for decades. That is not sustainable. You don’t fix this problem by encouraging more spending and borrowing: either by the government or by consumers. The long term problem for the USA economy is that people have consuming more than they have been producing.

We can’t afford to seek even more short term spending powered by more debt. Government debt has been exploding so unfortunately that problem has continued to get worse.

Data from the federal reserve.

Related: Consumers Continue to Slowly Reduce Their Debt Level – The USA Economy Needs to Reduce Personal and Government Debt – Consumer debt needs to decline much more.

In the USA we fail to save nearly enough for retirement by and large. And fail to save emergency funds or prepare for economically difficult times. We by and large chose to spend today and hope tomorrow will be good rather than first establishing a good financial safety net before expanding spending.

When people are debating withdrawing from their retirement account it is actually not the important decision it seems to be (normally). Normally the important decision was years before when they chose to take on consumer debt and not to build up an emergency fund. And when they failed to just build up saving beyond that which could be used for nice vacations, a new car, or to live on in economically challenging times.

If someone had been saving 15% of their salary in retirement since they started working if they took an amount that left them at 10% that is hardly a horrible result. While someone that was already behind by say adding just 3% to retirement savings and they took out all of it that would be much worse.

And we should remember even having a retirement account to withdraw from might put you ahead of nearly 50% of the population (and our state and federal governments, by the way). If you have to resort to withdrawing from your retirement account don’t think of that as the failure. The failure was most likely the lack of savings for years prior to that. And as soon as possible, re-fund your retirement account and build up a strong emergency fund, even if that means passing spending on things you want.

Related: Retirement Savings Allocation for 2010 – 401(k)s are a Great Way to Save for Retirement – Save Some of Each Raise

Nonfarm payroll employment increased by 151,000 in October, and the unemployment rate was unchanged at 9.6%, the U.S. Bureau of Labor Statistics reported today. Since December 2009, nonfarm payroll employment has risen by 874,000.

The BLS also increased previous estimates by 110,000 jobs in adjustments to August and September. The change in total nonfarm payroll employment for August was revised from -57,000 to -1,000, and the change for September was revised from -95,000 to -41,000.

Adding 151,000 jobs last month (especially with a revision that adds 110,000to our previous estimates) is good news but not great news. We really need to be adding at least 250,000 and hopefully 400,000 for many months in a row. Both to keep up with population growth and restore some of the 8 million job losses from the credit crisis recession. The fears of a depression that some had a few years ago though are decreasing as we provide slow but real growth. However those gains are far from certain to continue, but overall things look much better than than did 2 years ago.

In November of 2008 the economy lost over 500,000 Jobs and in October 2009 the unemployment Rate Reached 10.2%.

The number of unemployed persons, at 14.8 million, was little changed in October. Among the major worker groups, the unemployment rate for adult men (9.7%), adult women (8.1%), teenagers (27.1%). The number of long-term unemployed (those jobless for 27 weeks and over) was about unchanged over the month at 6.2 million.

Both the civilian labor force participation rate, at 64.5 percent, and the employment-population ratio, at 58.3 percent, edged down over the month.

About 2.6 million persons were marginally attached to the labor force in October, up from 2.4 million a year earlier. (The data are not seasonally adjusted.) These individuals were not in the labor force, wanted and were available for work, and had looked for a job sometime in the prior 12 months. They were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey.

Read more

Google finance has a nice new feature to let you chart your entire portfolio. You can then compare it to the S&P 500 or other stocks. This is a very nice feature. Yahoo Finance is about the only part of Yahoo I still use. I do use Google Finance some but they still fall short and I use Yahoo Finance much more. This feature will at least encourage me to put my portfolio in Google and start tracking it.

It would be great if this could give you portfolio annual rates of return (including factoring in cash additions and withdraws and keeping track of sales over time to show a true view of the portfolio). It does look like it will factor in stock purchases and sales which is very nice. You can import csv files with transaction history – another nice feature.

It also strikes me as a very smart move (as a Google stockholder that is nice to see) as advertising rates around investing are high. The more time Google can provide financial advertisers the more income they can make.

Related: Lazy Portfolios Seven-year Winning Streak – Google Posts Good Earning But Not Good Enough for Many (April 2010) – Dollar Cost Averaging – Curious Cat Investing Books

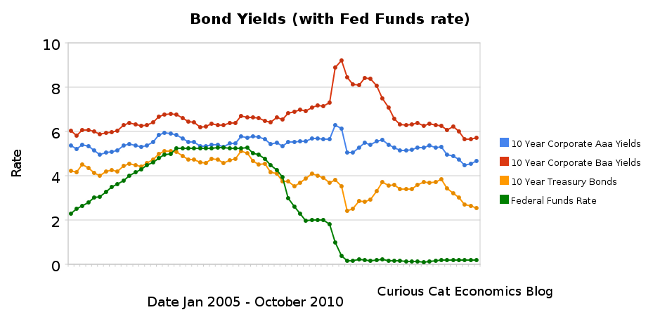

Chart showing corporate and government bond yields from 2005-2010 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields from 2005-2010 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.Bond yields have dropped even lower over the last 6 months, dramatically so for treasury bonds. 10 year Aaa corporate bonds yields have decreased 61 basis points to 4.68%. 10 year Baa yields have decreased 53 basis points to 5.72%. 10 year USA treasury bonds have decreased an amazing 169 basis points to a incredibly low yield of %2.54. The federal funds rate remains under .25%.

The Fed continues to try and discourage saving and encourage spending by punishing savers with policies to drive interest rates far below what the market alone would set. Partially this is a continuation of their subsidy to the large banks that caused the credit crisis. And partially it is an attempt to find a way to encourage spending to try and build job creation in the economy. The Fed announced they are taking huge steps to purchase $600 billion more bonds in an attempt to lower rates even further (much of the impact has been priced into the market as they have been saying they will take this action – but the size is larger than the consensus expectation). I do not think this is a sensible move.

Savers do not have many good options for safely investing retirement assets for a reasonable income. The best options are probably to hold short term bonds and money markets and hope that the Fed finally stops making things so difficult for them. But that will take awhile. I think investing in medium or long term bonds (over 4 years) is crazy at these rates (especially government bonds – unless you are a large bank that can get essentially free money from the Fed to then loan the government and make a profit). Dividends stocks may be a good alternative for some more yield (but this needs to be done carefully to not take unwise risks). And I think you to look at investing overseas because these fiscal policies are just too damaging to savers to continue to just wait for a decent rate of return in bonds in the USA. But there are not many good options. TIPS, inflation protected bonds, are another option to consider (mainly as a less bad, of bad choices).

It is a great time to take on debt however (as often is the case, there are benefits and costs to economic conditions). If you have a mortgage, and can qualify, or are looking to buy a home, mortgage rates are amazingly low.

Related: Bond Rates Remain Low, Little Change in Last 6 Months (April 2010) – Bond Yields Change Little Over Previous Months (December 2009) – Chart Shows Wild Swings in Bond Yields in Late 2008 – Government Debt as Percentage of GDP 1990-2009 in USA, Japan, Germany, China…

Real gross domestic product increased at an annual rate of 2.0% in the third quarter, reaching a annual rate of $14,730 billion (that is, from the second quarter to the third quarter), according to the “advance” estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 1.7%. The 3rd quarter real USA GDP was up 3.1% compared to the 3rd quarter of 2009. Just scanning the headlines gives a hint why investors are moving money into emerging markets: China up 9.6%, India 8.8%, Brazil 8.8%.

The third-quarter advance estimate released today is based on source data that are incomplete or subject to further revision (the “second” estimate for the third quarter, based on more complete data, will be released on November 23, 2010).

The increase in real GDP in the third quarter primarily reflected positive contributions from

personal consumption expenditures (PCE), private inventory investment, nonresidential fixed

investment, federal government spending, and exports that were partly offset by a negative contribution from residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.

The small acceleration in real GDP in the third quarter primarily reflected a sharp deceleration in imports and accelerations in private inventory investment and in PCE that were partly offset by a downturn in residential fixed investment and decelerations in nonresidential fixed investment and in exports.

The price index for gross domestic purchases, which measures prices paid by U.S. residents,

increased 0.8% in the third quarter, compared with an increase of 0.1% in the second. Real personal consumption expenditures increased 2.6% in the third quarter, compared

with an increase of 2.2% in the second. Durable goods increased 6.1%, compared with an

increase of 6.8%.

Related: Initial 4th Quarter 2009 Data Show USA GDP Increased at 5.7% Annual Rate – First Quarter 2009 USA GDP Down 6.1% – India Grew GDP 8.6% in First Quarter – China Economy Grows 11.9% in 1st Quarter

Read more

The 12 stock for 10 years portfolio consists of stocks I would be comfortable putting into an IRA for 10 years. My main criteria was companies with a history of large positive cash flow, that seemed likely to continue that trend.

In the original portfolio I created in April of 2005, I included Dell. Apple was one of the stocks I was considering but I chose not to include it. That has turned out to be a very bad mistake (though even with that the annualized return for the portfolio is beating the S&P 6%). As I have said the last few updates, I was considering dropping Dell. Since the last update, Dell has been dropped and replaced with Apple. This is the first decision to drop an original selection (First Data restructured and so it was removed).

The current marketocracy* calculated annualized rate or return (which excludes Tesco) is 6.8% (the S&P 500 annualized return for the period is 2.6%) – marketocracy subtracts the equivalent of 2% of assets annually to simulate management fees – as though the portfolio were a mutual fund – so without that (it is not like this portfolio takes much management), the return beats the S&P 500 annual return by about 6.2% (it would be a bit less with Tesco, but still close to 6%).

The current stocks, in order of return:

| Stock | Current Return | % of sleep well portfolio now | % of the portfolio if I were buying today | |

|---|---|---|---|---|

| Amazon – AMZN | 330% | 11% | 7% | |

| Google – GOOG | 184% | 17% | 15% | |

| PetroChina – PTR | 102% | 7% | 6% | |

| Templeton Dragon Fund – TDF | 100% | 11% | 10% | |

| Templeton Emerging Market Fund – EMF | 76% | 6% | 6% | |

| Danaher – DHR | 22% | 9% | 10% | |

| Cisco – CSCO | 18% | 6% | 7% | |

| Apple – AAPL | 12% | 5% | 6% | |

| Tesco – TSCDY | -2%** | 0%* | 10% | |

| Toyota – TM | -5% | 7% | 10% | |

| Intel – INTC | -8% | 5% | 8% | |

| Pfizer – PFE | -27% | 5% | 7% |

The current marketocracy results can be seen on the Sleep Well marketocracy portfolio page.

Related: 11 Stocks for 10 Years, July 2010 Update – 12 Stocks for 10 Years, July 2009 Update – Retirement Savings Allocation for 2010 – posts on stocks – investing books

Read more

Options strike most as exotic investment transactions. And some option strategies can be risky. But stock options can also be used in ways that are not risky. Call options give you the right to buy a stock at a certain price (the strike price) on, or before, a certain date (the expiration date). So if you want to speculate that a stock will go up in a short period of time you can buy call options. This is a risky investment strategy – though it can pay off well if you speculate correctly.

Someone has to sell the call option. The seller gives the buyer the right to buy a stock at a certain price by a certain date. A speculator can do this and take the risk that the price will not rise to the level where a person chooses to exerciser their option. The also carries a significant risk, as if the stock price rises the speculator that sold the option has to either buy the option back (at a significant cost) or provide the stock (which they would have to purchase on the market). In order to trade in options you must be approved by the broker (at least in the USA) as an investor with the knowledge, finances and goals for which options trading is appropriate.

An investor can also sell an option to buy a stock they own – this is called selling a covered call option. This means you get the price the speculator is willing to pay to buy the option and may have to sell the stock you own if the person holding the option chooses to exercise it.

Lets look at an example. Lets say you own some Amazon stock. Read more