Peet’s Coffee: In Africa, Brewing Good Works by Steve Hamm

…

Because of bad roads and delays at border crossings, it took 12 days for a truck with a container full of green coffee beans to travel 1,000 miles to the Kenyan port of Mombasa. The sea journey from Mombasa took nearly two months. Worse, when the shipment arrived in Oakland, Calif., in late February, a portion of the coffee was slightly damaged.

Moayyad traveled to Rwanda to cement relationships with farmer groups and gather stories about the farmers for use in marketing. With a videographer tagging along, she navigated molar-crunching roads in a four-wheel-drive pickup to remote villages and farms perched on hillsides high above Rwanda’s Lake Kivu. On the roadsides, children greeted the passing truck with an excited cry of “Abazungu [white people]!” Moayyad plans to post a journal of her travels on Peet’s Web site, aimed at the company’s most loyal customers, called Peetniks.

A good effort. Real world issues confront you when you take steps to build the capacity for capitalism to help people live better lives. We need more such efforts to help capitalists make better lives for themselves around the world.

Related: Bill Gates: Capitalism in the 21st Century – International Development Fair, The Human Factor – Helping Capitalism Create a Better World – Frontline Explores Kiva in Uganda

It seems to me the situation that lead to the current economic problems are due to the overthrown of the Glass-Steagal and other long time sensible regulation put in place to restrict economy wide destruction caused by a few large financial firms (well, that plus incredibly poor management by people that paid themselves many times more than anyone else and other factors – huge consumer debt…). But the most significant systemic problem was failure to regulate even close to sensibly. I have several posts on this topic on previously: Congress Eases Bank Laws, 1999 – Treasury Now (1987) Favors Creation of Huge Banks – Canadian Banks Avoid Failures Common Elsewhere and Greenspan Says He Was Wrong On Regulation.

Capitalism requires sensible regulation. Regulation is not a friction on capitalism it is a necessary component. Poor regulation is a friction that is waste that should be excised. Unfortunately that is a very challenging task and when you allow those with the most gold to set the rules it is no surprise you have them saying they should not be regulated but should be protected. The failure of financial regulations do show the very obvious problem we have currently of those that donate huge amounts to politicians are granted favors that are paid for by the economy overall.

The widespread failure to regulate financial markets recently is almost certain to lead to this exact type of situation every time. Companies will over-leverage, take huge risks, take huge pay while times are good and just go bankrupt when times are bad. Think about how a bank makes money. They charge fees for things like: writing a loan, overdraft charges on your account, arranging financing (loan or stock sale)… They charge more for in interest than they pay. Some money there but really they are doing nothing special so they should not be able to charge too much. Even the ridicules fees companies pay (often those in the companies have arrangements to get personal special deals – allocations of IPO’s, jobs later…) for arranging stock sales do not have a systemic risk. Those risks should be very easy to manage sensible.

They speculate in currency markets, commodities markets, futures, derivatives… If you want a stable economy if you allow huge speculative investments to be assumed to such an extent they risk the economy you are in trouble. If you refused those risks to limited liability companies perhaps your limited regulation model might work. Where those profiting on products with negative economic externalities would personally go bankrupt prior to the losses becoming economically crippling. But I doubt even that would work. And we don’t have that now. We allow people to setup limited liability corporations, drain them of capital on speculation of potential value and then walk about with hundreds of millions of dollars if the company fails. And the negative externalities (due to huge leverage) are huge.

Regulation seems the obvious solution. And it works when applied. It wasn’t until the USA decided to abandon the financial system regulation and enforcement that the problems became systemic. And see the current Canadian banking system for what happens, even while the world economy is collapsing if you required banks to remain banks instead of massively leveraged speculators paying huge bonus to the executives based on their claims of profitability.

I agree trying to control risk is dangerous. There are however, very sensible measures to take. Do not allow huge financial companies to exist (we have laws on anti-trust, anti-competitive behavior…). Do not allow banks to speculate (more than a careful controlled regulated amount). Do not allow massive leverage of massive amounts of money. Do require audited financial records. Do require companies that want to speculate to be much smaller than regulated bank, and bank-like companies. Do elect politicians that will appose allowing companies to undertake systemic risks to the economy for short term financial gains.

We continue to elect politicians that provide large favors to those giving them money at the expense and risk to the rest of us. Therefore we are bringing this upon ourselves. When we chose to stop supporting politicians that behave in that way then we will get different behavior. Until that point it will continue. We don’t seems to be in any mood to change what we have been doing.

Comments on Note to Regulators: Beware the Montana Paradox

Related: More on Failed Banking Executives – more posts on regulation in capitalist economies – Credit Crisis the Result of Planned Looting of the World Economy – Bad Behavior

Let big banks fail, bailout skeptics say

I must say this is the is how I feel, but I don’t have the time to research all the details – to know all the existing limitations for realistic solutions. But I can’t believe allowing huge, incredibly poorly run financial organizations to remain in place with the same bozos that have looted the treasuries of their companies and then taken huge handouts from the federal government, is good policy. It was a very bad idea to allow such anti-competitive large financial institutions to exist in the first place. Then the extremely bad behavior of thousands of people taking millions from those banks treasuries and imposing huge risks on the financial system certainly should result in government finally doing their job to prevent harm to the economic system.

This sounds like a much more sensible strategy to me. It is certainly much much better than increasing consolidation with moves like having huge financial firms buy other huge firms. Obviously I would not support the selling of pieces of the old broken institution to remaining large organizations. The anti-competitive market power must be sharply reduced.

Related: Treasury Now (1987) Favors Creation of Huge Banks – posts on the credit crisis – Leverage, Complex Deals and Mania – Canadian Banks Avoided Failures Common Elsewhere – There is No Invisible Hand

Home Ownership Shelter, or Burden?

The other area of concentrated distress is subprime mortgages, which increased their share of the American mortgage market from 7% in 2001 to over 20% in 2006. According to the Mortgage Bankers Association, the delinquency rate was 22% in the fourth quarter of 2008, compared with only 5% for prime loans.

…

“Perhaps the most compelling argument for housing as a means of wealth accumulation”, argues Richard Green of the University of Southern California, “is that it gives households a default mechanism for savings.” Because people have to pay off a mortgage, they increase their home equity and save more than they otherwise would. This is indeed a strong argument: social-science research finds that people save more if they do so automatically rather than having to choose to set something aside every month.

Yet there are other ways to create “default savings”, such as companies offering automatic deductions to retirement plans. In any case, some of the financial snake oil peddled at the height of the housing bubble was bad for saving.

The debate over whether home ownership is a wise investment or not, is contentious (more so in the last year than it was several years ago). I believe in most cases it probably is wise, but there are certainly cases where it is not. If you put yourself in too much debt that is often a big problem. I also think you should save a down payment first. If you are going to move (or have good odds you may want to) then renting is often the better option.

The “default saving” feature is one of the large benefits of home ownership. That benefit is destroyed when you take out loans against the rising value of the house. And in fact this can not just remove the benefit but turn into a negative. If you spend money you should have (increasing your debt) that can not only remove you default saving benefit but actual make your debt situation worse than if you never bought.

Related: Your Home as an Investment – Nearly 10% of Mortgages Delinquent or in Foreclosure – Housing Rents Falling in the USA – Ignorance of Many Mortgage Holders

William Black wrote The Best Way to Rob a Bank Is to Own One: How Corporate Executives and Politicians Looted the S&L. I think he a bit off on the “owning one,” being the best way to loot. The looters are not owners, they are executives that loot from owners, taxpayers, customers… And those looters pay politicians a great deal of money to help them. He appeared on Bill Moneys Journal discussing the huge mess we know are in and how little is being done to hold those responsible for the enormous crisis created by them.

…

The FBI publicly warned, in September 2004 that there was an epidemic of mortgage fraud, that if it was allowed to continue it would produce a crisis at least as large as the Savings and Loan debacle. And that they were going to make sure that they didn’t let that happen. So what goes wrong? After 9/11, the attacks, the Justice Department transfers 500 white-collar specialists in the FBI to national terrorism. Well, we can all understand that. But then, the Bush administration refused to replace the missing 500 agents. So even today, again, as you say, this crisis is 1000 times worse, perhaps, certainly 100 times worse, than the Savings and Loan crisis. There are one-fifth as many FBI agents as worked the Savings and Loan crisis.

…

Well, certainly in the financial sphere, I am. I think, first, the policies are substantively bad. Second, I think they completely lack integrity. Third, they violate the rule of law. This is being done just like Secretary Paulson did it. In violation of the law. We adopted a law after the Savings and Loan crisis, called the Prompt Corrective Action Law. And it requires them to close these institutions. And they’re refusing to obey the law.

…

In the Savings and Loan debacle, we developed excellent ways for dealing with the frauds, and for dealing with the failed institutions. And for 15 years after the Savings and Loan crisis, didn’t matter which party was in power, the U.S. Treasury Secretary would fly over to Tokyo and tell the Japanese, “You ought to do things the way we did in the Savings and Loan crisis, because it worked really well. Instead you’re covering up the bank losses, because you know, you say you need confidence. And so, we have to lie to the people to create confidence. And it doesn’t work. You will cause your recession to continue and continue.”

…

And their ideologies, which swept away regulation. So, in the example, regulation means that cheaters don’t prosper. So, instead of being bad for capitalism, it’s what saves capitalism. “Honest purveyors prosper” is what we want. And you need regulation and law enforcement to be able to do this. The tragedy of this crisis is it didn’t need to happen at all.

Related: Fed Continues Wall Street Welfare – Credit Crisis the Result of Planned Looting of the World Economy – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals – Poll: 60% say Depression Likely – Canadian Banks Avoid Failures Common Elsewhere – Too Big to Fail – Why Pay Taxes or be Honest

I have been running the Curious Cat Management Management Improvement Carnival for several years and decided to start one on the investing and economics theme. I hope you enjoy the inaugural edition. If you like these posts you may also be interested in the Invest Reddit where a community of those interested in investing submit and rate articles and blog posts.

- Case-Shiller: Is it Really THAT Bad? by Stan Humphries – “Unfortunately, in combining both foreclosures and non-foreclosures into a single metric, you’re not really getting a good insight into either market. In the current climate, you’re underestimating the decline in value of foreclosed homes and overestimating the decline in value of non-foreclosure homes.”

- This is unquestionably the worst global economic crisis since the 1930s by Brad Setser – “Both the IMF and World Bank are now forecasting an outright fall in global output in 2009… Anything below 2% [growth] is generally considered a global recession.”

- Value Added Tax (VAT): The Pros and Cons by Eric Stinson – “The VAT is also a consumption tax, so there is incentive for you to limit your spending. Like the Fair Tax, if you spend less than you make, you’ll pay less in taxes (all else equal).”

- Face To Face With The Deficit by Scott Bittle – “The public simply will not permit Washington to raise their taxes, change their health insurance, or cut programs without their consent. Nor should they. But the public should understand the rules, too. It’s not enough to complain about red ink and then reject any possible solution.”

- Confusing price discrimination – “Any way I think about it, the discount should either be to all consumers or to students for the entire day. Why would it be only to students in the afternoon?”

- Leave Your Money in Your Retirement Accounts by Patrick – “At this point, the best thing you can do is stick to your retirement savings and investment plans. Continue contributing to your retirement accounts, make sure your asset allocation is set at your desired level, and don’t withdraw your retirement savings.”

- Invisible Hands Explain Nothing: a response to a critic by Gavin Kennedy – “Indeed, Smith gives over 60 instances in Books I and II of Wealth Of Nations where the actions of individuals for their own ‘gain’ have less than beneficial consequences on those around them”

A couple of my posts have appeared in other carnivals recently: California Unemployment Rate Climbs to 10.5 Percent in the Money Hacks Carnival and Add to Your 401(k) and IRA in the Carnival of Personal Finance.

Related: Money Hacks Carnival #50 – Curious Cat Investing and Economics Search

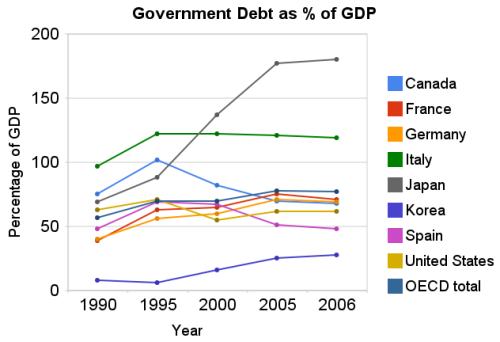

Chart showing government debt as a percentage of GDP by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from OECD, March 2009.

Chart showing government debt as a percentage of GDP by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from OECD, March 2009.The USA federal government debt is far too large, in my opinion. We have been raising taxes on future taxpayers for several decades, to finance our current spending. Within reason deficit spending is fine. What that reasonable level is however, is not easy to know. One big problem with the past few decades is that during very prosperous economic times we spent money that we didn’t have, choosing to raise taxes on the future (instead of either not spending as much or paying for what we were spending by raising taxes to pay for current spending).

By not even paying for what we are spending when times were prosperous we put ourselves in a bad situation when we have poor economic conditions – like today. If we were responsible during good economic times (and at least paid for what we spent) we could have reduced our debt as a percentage of GDP. Even if we did not pay down debt, just by not increasing the outstanding debt while the economy grew the ratio of debt to GDP would decline. Then when times were bad, we could afford to run deficits and perhaps bring the debt level up to some reasonable level (maybe 40% of GDP – though it is hard to know what the target should be, 40% seems within the realm of reason to me, for now).

There is at least one more point to remember, the figures in the chart are based on reported debt. The USA has huge liabilities that are not accounted for. So you must remember that the actually debt is much higher than reported in the official debt calculation.

Now on to the good news. As bad as the USA has been at spending tomorrows increases in taxes today, compared to the OECD countries we are actually better than average. The OECD is made up of countries in Europe, the USA, Japan, Korea, Australia, New Zealand and Canada. The chart shows the percentage of GDP that government debt represents for various countries. The USA ended 2006 at 62% while the overall OECD total is 77%. In 1990 the USA was at 63% and the OECD was at 57%. Japan is the line way at the top with a 2006 total of 180% (that is a big problem for them). Korea is in the best shape at just a 28% total in 2006 but that is an increase from just 8% in 1990.

Related: Federal Deficit To Double This Year – Politicians Again Raising Taxes On Your Children – True Level of USA Federal Deficit – Who Will Buy All the USA’s Debt? – Top 12 Manufacturing Countries in 2007 – Oil Consumption by Country

Read more

The health care system in the USA is broken, and has been for decades. The economic consequences of failing to implement effectively solutions has been immense. Finally, the momentum demanding change is growing. I still think the entrenched interests are going to delay needed reform, but hopefully I am wrong. An interesting proposal for ending medical status pricing is in the news – Health Insurers Propose End to Medical-Status Pricing

…

Health insurers oppose a Democratic push to create a government-run health plan to compete with private insurers for customers. Supporters of a public plan, including President Barack Obama, say it would guarantee affordable coverage, especially among those denied insurance or charged higher rates because of pre-existing medical conditions.

…

Insurers still would adjust variations in the price of premiums to an applicant’s age, family size and place of residence, according to Zirkelbach’s group. The organization speaks for 1,300 companies that provide public or privately funded benefits, led by UnitedHealth Group Inc. of Minnetonka, Minnesota, and Indianapolis-based WellPoint Inc.

This federal employees health benefit plan provides any federal employee the option to buy the insurance with no cost difference depending on health status. Some option, building off that is one that seems to have some possibility of success. I think some such system would be an improvement. However, it is far from the solution. Many problems are not solved by that at all. The huge amount of waste generated by insures and all the forms, needless bureaucracy… they generate is hard to justify. What value to they provide for the enormous costs?

Related: Broken Health Care System: Self-Employed Insurance – Traveling for Health Care – Employees Face Soaring Health Insurance Costs – Personal Finance Basics: Health Insurance – USA Spent $2.2 Trillion, 16.2% of GDP, on Health Care in 2007

As I mentioned a few months ago, the New York Times archive is a great tool to see the history that led to the economic crisis we now face. Here is an article from 1999: Congress Passes Wide Ranging Bill Easing Bank Laws

”Today Congress voted to update the rules that have governed financial services since the Great Depression and replace them with a system for the 21st century,” Treasury Secretary Lawrence H. Summers said. ”This historic legislation will better enable American companies to compete in the new economy.”

The decision to repeal the Glass-Steagall Act of 1933 provoked dire warnings from a handful of dissenters that the deregulation of Wall Street would someday wreak havoc on the nation’s financial system. The original idea behind Glass-Steagall was that separation between bankers and brokers would reduce the potential conflicts of interest that were thought to have contributed to the speculative stock frenzy before the Depression.

…

‘The world changes, and we have to change with it,” said Senator Phil Gramm of Texas, who wrote the law that will bear his name along with the two other main Republican sponsors, Representative Jim Leach of Iowa and Representative Thomas J. Bliley Jr. of Virginia. ”We have a new century coming, and we have an opportunity to dominate that century the same way we dominated this century. Glass-Steagall, in the midst of the Great Depression, came at a time when the thinking was that the government was the answer. In this era of economic prosperity, we have decided that freedom is the answer.” In the House debate, Mr. Leach said, ”This is a historic day. The landscape for delivery of financial services will now surely shift.”

But consumer groups and civil rights advocates criticized the legislation for being a sop to the nation’s biggest financial institutions. They say that it fails to protect the privacy interests of consumers and community lending standards for the disadvantaged and that it will create more problems than it solves.

The opponents of the measure gloomily predicted that by unshackling banks and enabling them to move more freely into new kinds of financial activities, the new law could lead to an economic crisis down the road when the marketplace is no longer growing briskly.

”I think we will look back in 10 years’ time and say we should not have done this but we did because we forgot the lessons of the past, and that that which is true in the 1930’s is true in 2010,” said Senator Byron L. Dorgan, Democrat of North Dakota. ”I wasn’t around during the 1930’s or the debate over Glass-Steagall. But I was here in the early 1980’s when it was decided to allow the expansion of savings and loans. We have now decided in the name of modernization to forget the lessons of the past, of safety and of soundness.”

Senator Paul Wellstone, Democrat of Minnesota, said that Congress had ‘’seemed determined to unlearn the lessons from our past mistakes.”

This is a great view into how both parties foolishly risked the economy to provide favors to their big donors and golfing buddies. It is sad that we chose to elect such people that play such an important role in our economy. But it is not as though we make these choice without easy access to the information on how they govern. And today listening to the people that took the money and voted for these, and similar changes to favor financial friends, they try and make it sound like they are not responsible. And sadly my guess is most people will accept their excuses. Until we do a better job of electing people we are going to continue to suffer the results of bad policy and to pay for the favors politicians give to those giving them money.

Related: Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren – Copywrong – Pork Sugar – Monopolies and Oligopolies do not a Free Market Make – Ignorance of Capitalism – Ethanol: Science Based Solution or Special Interest Welfare – Legislation to Address the Worst Credit Card Fee Abuse – Maybe

Fed to start buying T-bonds today, hoping to move rates

The yield on the 10-year T-note plunged to 2.53% on March 18 from 3% the previous day, the biggest one-day drop in decades. But since then, Treasury bond yields have been creeping higher. The 10-year T-note ended Tuesday at 2.65%. Conventional mortgage rates have flattened or inched up, although they remain historically low, in the range of 4.75% to 5%.

…

On Tuesday the Treasury sold $40 billion of new two-year T-notes at a yield of 0.95%, which was lower than expected, indicating healthy investor demand. The government will auction $34 billion in five-year notes today and $24 billion in seven-year notes on Thursday. Against numbers like those in just one week, the Fed’s commitment to buy $300 billion of Treasuries over six months doesn’t look like much.

…

there’s nothing to stop the Fed from suddenly announcing that its $300-billion commitment will get substantially bigger: The central bank can, in effect, print as much money as it wants to buy bonds — at least, until the day that global investors stop wanting dollars.

The original announcement caused a dramatic move but since then yields have been drifting up, every day, including today. Rates are already very low. And the huge amount of increased federal borrowing is a potential serious problem for lowering rates. And potentially an even more serious problem is foreign investors deciding the yield does not provide a good investment given the risks of inflation (I know that is how I feel). It will be interesting to see what happens with rates.

Related: Who Will Buy All the USA’s Debt? – Lowest 30 Year Fixed Mortgage Rates in 37 Years – mortgage terms