Two Professors Argue About the Invisible Hand – And Both Get it Wrong too

…

He used the term not in his discussion and analysis of markets (Book I and II of Wealth Of Nations), but in a discussion of the choice of export/importing versus investing in domestic businesses (Book IV of Wealth Of Nations on his critique of mercantile political economy). It had nothing to do with ‘regulating’.

…

It was a metaphor Smith used only three times and he never said “that when this invisible hand exists, when we all pursue our own interest, we end up promoting the public good, and often more effectively than if we had actually and directly intended to do so.” That is a modern construction placed on the metaphor and has next to nothing to do Adam Smith

…

The invisible hand was never in Adam Smith’s world in the form invented in mid-20th century by some economists who created the Chicago version of Adam Smith, while ignoring the Adam Smith born in Kirkcaldy, Scotland in 1723.

Related: There is No Invisible Hand – Myths About Adam Smith Ideas v. His Ideas – Not Understanding Capitalism

Here is a good blog post showing one great feature of the blogosphere (that term seems to have fallen out of use hasn’t it): interaction. It also shows that you have to think critically. You can’t just accept what you read (you never can, but that is even more true with blogs than it is with newspapers that at least have some standards normally). I tend to agree with this posts look at the data, though I have not examined the issue closely.

Bad Math, Bad Statistics: Trying to get a blogger to admit a mistake

1981: 229465714 * 8476.0 = 1.944 trillion

1992: 255029699 * 14847.0 = 3.786 trillion (94% gain)

2005: 292892127 * 25036.0 = 7.332 trillion (93.6% gain)

Er, doesn’t look like a lag to me. In fact, it looks like it’s doubling every 12-13 years just as much as GDP is. I also looked up total income statistics for the US, and found the following figures (source). (Note these figures are different. More on that later.)

1981: $2,580,600,000 (2.58 / 3.1 = 83% of GDP)

1992: $5,349,384,000 (more than double!) (5.34 / 6.2 = 86% of GDP)

2005: $10,252,973,000 (another double!) (10.25 / 12.4 = 82% of GDP)

Anyway it is a much more interesting argument than I would hear when I listened to TV “pundits” years ago spout meaningless talking points at each other. Granted they argument is not going to be studied as a wonderful example of how we should debate. Still it is much above what passes for debate from our politicians (yes this is more a sad commentary on how failed our politicians are than a statement of how marvelous the argument on the GDP issue is between the two bloggers).

Here is a math question for you, what has a bigger impact moving from 15 to 18 mpg or 50 to 100 mpg?

Related: Government Debt as a Percentage of GDP – USA Consumers Paying Down Debt – Is Productivity Growth Bad? – Americans are Drowning in Debt

The Society for Actuaries has published a good resource: Managing post-retirement risks.

…

Many investors try to own some assets whose value may grow in times of inflation. However, this sometimes will trade inflation risk for investment risk.

• Common stocks have outperformed inflation in the long run, but are

poor short-term hedges. The historically higher returns from stocks

are not guaranteed and may vary greatly during retirement years.

…

Retirement planning should not rely heavily on income from a bridge job. Many retirees welcome the chance to change careers and move into an area with less pay but more job satisfaction, or with fewer demands on their time and energy.

Terminating employment before age 65 may make it difficult to find a source of affordable health insurance before Medicare is available.

…

Insurance for long-term care covers disabilities so severe that assistance is needed with daily activities such as bathing, dressing and eating. Some policies require a nursing home stay; others do not. The cost of long-term care insurance is much less if purchased at younger ages, well before anticipated need.

The full document is well worth reading.

Related: Many Retirees Face Prospect of Outliving Savings – How to Protect Your Financial Health – Financial Planning Made Easy – personal finance tips

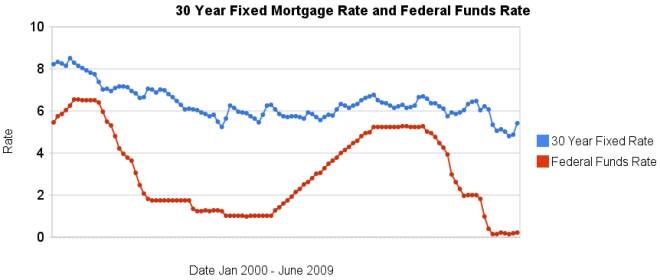

Once again the data shows that the 30 year fixed mortgage rates are not directly related to federal funds rates. In June the fed funds rate increased 3 basis points, 30 year mortgage rates increased 56 basis points. Since January the fed funds rate is up 6 basis points is up while 30 year mortgage rates are up 36 basis points. Home prices have continued to fall even with the very low mortgage rates.

Related: Mortgage Rates: 6 Month and 5 Year Charts – historical comparison of 30 year fixed mortgage rates and the federal funds rate – posts on financial literacy – GM and Citigroup Replaced by Cisco and Travelers in the Dow – Jumbo v. Regular Fixed Mortgage Rates: by Credit Score

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates

Four Lessons from Y-Combinator’s Fresh Approach to Innovation

…

Tight windows enable “good enough” design. Most Y Combinator–funded companies are expected to release a version of their idea in less than 3 months. That tight time frame forces entrepreneurs to introduce “good enough” software packages that can then iterate in market. This approach contrasts to efforts by many companies to endlessly perfect ideas in a laboratory, only to fail the real test of being exposed to real market conditions.

Business plans are nice, not necessary. Y Combinator doesn’t obsess over whether entrepreneurs have detailed business plans. Again, the focus is getting something out in the market to drive iteration and learning. After all, if you are trying to create a market, most of the material in a business plan is assumption-based anyway.

…

Y-combinator is very interesting. I have posted about them several times: Find Joy and Success in Business, Build Your Business Slowly and Without Huge Cash Requirements. Investors can learn a great deal about how to grow businesses from their model. Brains, effort, customer focus, the ability to learn and business savvy can do huge things with little cash in information technology. The opportunities are available today. Y-combinator’s support of the businesses with knowledgeable resources and education (startup school) are far more important than the money they provide.

Related: Small Business Profit and Cash Flow – Innovation Strategy – Some Good IT Business Ideas – Google and Paul Graham’s Latest Essay – MIT Launches Initiatives in Innovation and India

One factor you must understand when evaluating economic data is that the data is far from straight forward. Even theoretically it is often confusing what something like “savings rate” should represent. And even if that were completely clear the ability to get data that accurately measures what is desired is often difficult if not impossible. Therefore most often there is plenty of question about economic conditions even when examining the best available data. Learning about these realities is important if you wish to be financially literate.

Bigger U.S. Savings Than Official Stats Suggest

A closer look, however, shows that Americans have tightened their belts more sharply than the numbers report. The reason? Official figures for personal spending include a lot of categories, such as Medicare outlays, that are not under the control of households. They also include items, such as education spending, that should be treated as investment in the future rather than current consumption.

After removing these spending categories from the data, let’s call what’s left “pocketbook” spending – the money that consumers actually lay out at retailers and other businesses. By this measure, Americans have cut consumption by $200 billion, or 3.1%, over the past year. This explains why the downturn has hit Main Street hard.

…

Finally, for technical reasons the BEA throws in some “spending” categories where no money actually changes hands. The biggest is “rent on owner-occupied housing,” the money that people supposedly pay themselves for living in their own homes. Despite the housing bust, this number rose by 2.6% over the past year, to $1.1 trillion.

…

A closer look at BEA numbers shows that Americans reduced spending by 3.1% in the past year, indicating that the savings rate has risen to 6.4%

He raises good issues to consider though I am not sure I agree 100% with his reasoning.

Related: The USA Should Reduce Personal and Government Debt – Financial Markets with Robert Shiller – Save Some of Each Raise – Over 500,000 Jobs Disappeared in November (2008)

Your Life Insurance Policy May Not Be Protected by Ben Levisohn, Business Week

…

Insurance customers need to be more vigilant. Stop focusing only on cost and service and start worrying about solvency. Check such agencies as Standard & Poor’s (MHP), Fitch Ratings, Moody’s, and A.M. Best to find the highest-rated companies, and be alert for downgrades. Then dig deeper. Find out about an insurer’s exposure to real estate and mortgages and make sure its debt holdings are investment-grade. “Everyone’s under the false assumption that it doesn’t matter what company you buy from,” says Thomas Archer, chairman of financial-services firm Archer Financial Group in New York. “It does.”

• $300,000 in life insurance death benefits

• $100,000 in cash surrender or withdrawal value for life insurance

• $100,000 in withdrawal and cash values for annuities

• $100,000 in health insurance policy benefits

• $300,000 in homeowners benefits

• $300,000 in auto insurance benefits

One option is to diversify your insurance coverage, just like you diversifying investments. Historically insurance company failures have been rare, and even it is even rarer that state funds don’t cover the insurance. But if you have large amounts of insurance you can be a bit safer by having your life insurance needs covered by multiple insurers.

Related: Personal Finance Basics: Long-term Care Insurance – Insurers Raise Fees on Variable Annuities – Personal Finance Basics: Health Insurance – How to Protect Your Financial Health

Read more

Home Ownership Shelter, or Burden?

The other area of concentrated distress is subprime mortgages, which increased their share of the American mortgage market from 7% in 2001 to over 20% in 2006. According to the Mortgage Bankers Association, the delinquency rate was 22% in the fourth quarter of 2008, compared with only 5% for prime loans.

…

“Perhaps the most compelling argument for housing as a means of wealth accumulation”, argues Richard Green of the University of Southern California, “is that it gives households a default mechanism for savings.” Because people have to pay off a mortgage, they increase their home equity and save more than they otherwise would. This is indeed a strong argument: social-science research finds that people save more if they do so automatically rather than having to choose to set something aside every month.

Yet there are other ways to create “default savings”, such as companies offering automatic deductions to retirement plans. In any case, some of the financial snake oil peddled at the height of the housing bubble was bad for saving.

The debate over whether home ownership is a wise investment or not, is contentious (more so in the last year than it was several years ago). I believe in most cases it probably is wise, but there are certainly cases where it is not. If you put yourself in too much debt that is often a big problem. I also think you should save a down payment first. If you are going to move (or have good odds you may want to) then renting is often the better option.

The “default saving” feature is one of the large benefits of home ownership. That benefit is destroyed when you take out loans against the rising value of the house. And in fact this can not just remove the benefit but turn into a negative. If you spend money you should have (increasing your debt) that can not only remove you default saving benefit but actual make your debt situation worse than if you never bought.

Related: Your Home as an Investment – Nearly 10% of Mortgages Delinquent or in Foreclosure – Housing Rents Falling in the USA – Ignorance of Many Mortgage Holders

Life Insurers Profit as Retirees Fear Outliving Cash by Alexis Leondis

…

Payouts among insurers vary significantly, said Weatherford of NAVA. Monthly payments range from $629 to $745 for a $100,000 investment by a 65-year-old male, according to a survey of six issuers by Hueler Companies, a Minneapolis-based data research firm and provider of an independent annuity platform.

An annuity is a comforting in that you cannot outlive your annuity payment. However, there are drawbacks also. Having a portion of retirement financing based on annuity payments does help planning. Social security payments are effectively an annuity (that also increases each year, to counter inflation). While living off social security payments alone is not an enticing prospect, as a portion of a retirement plan those payments can be valuable. If you have a pension that can also serve as an annuity.

It can make sense to put a portion of retirement assets into an annuity however I would limit the amount, myself. And the annuity payout is partially determined by current interest rates, which are very low, and those now the payout rates are low. If interest rates stay low, then you lose nothing but if interest rates increase substantially in the next several year (which is certainly possible) the payout for annuities would likely increase.

Choosing to purchase an annuity is something that should be done after careful study and only once you understand the investment options available to you. Also you need to have saved up substantial retirement saving to take advantage of the option to buy enough monthly income to contribute substantially to your retirement (so don’t forget to do that while you are working).

Related: Many Retirees Face Prospect of Outliving Savings – Spending Guidelines in Retirement – Retirement Tips from TIAA CREF – Social Security Trust Fund

I make a point of showing the discount rate changes by the Fed don’t translate to mortgage rate changes. I do so because many people think the discount rate does directly effect mortgage rates. But the Fed announced today, actions that actually do impact mortgage rates.

Federal Reserve to Buy $1.2T in Bonds, Mortgage-Backed Securities

If you are looking at refinancing your mortgage now (or soon) might be a good time, rates were already very low and will be declining. And if you own long term bonds you just got a nice increase in your value (bond prices move up when interest rates move down).

Related: Lowest 30 Year Fixed Mortgage Rates in 37 Years – Low Mortgage Rates Not Available to Everyone – Why do we Have a Federal Reserve Board?