Wholesale Prices Rising at Fastest Pace Since 1981

New federal government data showed that the cost of materials used by businesses increased 1.2 percent in July and have risen 9.8 percent during the past 12 months. It was the largest yearly increase since 1981, as businesses absorbed sharp increases in energy and other commodity costs.

Today’s report follows recent news that consumer prices are also rising faster than expected — and faster than the Federal Reserve’s generally accepted target rate of around 2 percent.

Inflation can cause serious damage to your personal finances. As prices increase if you don’t get a raise (or your investments don’t raise) to match the increased costs you must pay your financial situation deteriorates. One benefit, to those with 30 year fixed rate mortgages, is that you get to pay back your loan with inflated dollars. This can be a huge advantage for some, and a huge loss for whoever holds the mortgage.

Related: inflation risk for investments – Inflation is a Real Threat – Food Price Inflation is Quite High – posts on inflation

Short selling is when you sell something before you buy it (you try to sell high and then buy low later, instead of buying low and then selling high later). In order to sell short, you are required to borrow the shares that you then sell. So if I own 1,000 shares of Google (I wish), I could lend them to someone to sell. Nothing happens to my position, it is just that those shares are now allocated to that short sale. If I sell them then the short seller has to go borrow them elsewhere or buy the stock to close their position. In general the borrowing is either from brokers that hold shares for individuals or from large institution (mutual funds, insurance companies…).

However from everything that I read it appears the SEC hasn’t bothered to actually enforce this law much. There was a bunch of excitement recently when the SEC announced it would bother to enforce the law to protect a few large banks, many of whom are said to practice naked short selling but didn’t like it when that was done to their stock. As you can see, this does make the SEC look pretty bad, when they chose to enforce a law, not in all circumstances, but only to protect a few of those who actually take advantage of the SEC’s failure to enforce the law to make money.

CEOs Launch Web Site To Protect Short Sellers

Some people find the whole concept of short selling bad since it is based on making money on stock price declines. I don’t feel that way and believe it can help the market. But it requires regulators that actually do their jobs and enforce laws. A favorite tacit of those who seek to keep open special ways for themselves to benefit from abusing the system is to try and make things seem complex. The recent SEC order saying they would enforce the intent of the law to protect a few powerful banks from the behavior many (or most) practice themselves for years shows that it isn’t that complicated.

Adding the decision not to enforce the requirement to borrow shares to their recent decision to eliminate the requirement that short sales take place on down ticks in price (a measure put in after the 1929 stock market crash to not have short sellers accelerate market declines and insight panic seems like a really bad combination).

Related: Shorting Using Inverse Funds – Monopolies and Oligopolies do not a Free Market Make – Fed Continues Wall Street Welfare – SEC data on “failures to deliver”

Are You Financially Literate? Do this Simple Test to Find Out by Annamaria Lusardi.

a) More than $102

b) Exactly $102

c) Less than $102

d) Do not know

2) Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After 1 year, would you be able to buy more than, exactly the same as, or less than today with the money in this account?

a) More than today

b) Exactly the same as today

c) Less than today

d) Do not know

3) Do you think that the following statement is true or false? “Buying a single company stock usually provides a safer return than a stock mutual fund.”

a) True

b) False

c) Do not know

…

To be “financially literate” you need to answer correctly to all three questions.

And I would add, just answering those 3 simple questions does not mean you are. But if you don’t answer all 3 correctly you are not financially literate. We provide several resources to help people improve their literacy, including: our blog posts on financial literacy, Curious Cat Investing Dictionary and Curious Cat Investing Books.

Related: Questions You Should Ask About Your Investments – Annual Percentage Rate (APR) – Ignorance of Many Mortgage Holders

Read more

I posted before on how universities seek profits instead of helping students develop good financial literacy and habits. Here are some tips on how you should use your credit card. College Credit-Card Hustle

Using state public disclosure laws, Business Week has obtained more than two dozen confidential contracts between major schools and card-issuing banks keen to sign up undergraduates with mounting expenses for tuition, books, and travel. In some instances, universities and alumni groups receive larger payments from the banks if students use their school-branded cards more frequently.

The growing financial alliance between schools and banks raises questions about whether universities are encouraging students to incur additional high-interest debt at a time when many young people graduate from college owing tens of thousands of dollars.

…

Universities rarely negotiate favorable terms for their students, according to people familiar with the practice. On the contrary, some schools and booster groups entice undergraduates to sign up for cards with low initial interest rates that are soon replaced by steep double-digit rates.

Schools (and if some try to play legal games about alumni associations being separate, I don’t accept that) should fully disclose exactly what they are doing. I know they can make all sorts of excuses about why being open and honest is not right for them. Well, I think it is easy to predict they will be selling out their students and hiding that fact (if they must be open about what they are doing they will avoid some of the most egregious behavior because they know there will be consequences if they obviously sell out students). And, now Business Week has evidence that many are.

If a school is not open and honest about the deals they are making just assume they are selling out the students for their own gain. I can’t really see why we would want to support such behavior and I would encourage us not to.

Read more

U.S. Consumer Prices Jumped in June by the Most in 26 Years

…

Prices increased 5 percent in the 12 months to June, the most since May 1991. They were forecast to climb 4.5 percent from a year earlier, according to the survey median. The core rate increased 2.4 percent from June 2007, also more than forecast.

Energy expenses jumped 6.6 percent, the biggest gain since the aftermath of Hurricane Katrina in September 2005. Gasoline prices soared 10.1 and fuel oil jumped 10.4 percent.

…

Rents which, make up almost 40 percent of the core CPI, also accelerated. A category designed to track rental prices rose 0.3 percent after a 0.1 percent gain in May. Today’s figures also showed wages decreased 0.9 percent in June after adjusting for inflation, the biggest drop since August 1984, and were down 2.4 percent over the last 12 months. The drop in buying power is one reason economists forecast consumer spending will slow.

The continued increase of inflation is a serious problem. Eventually the federal reserve needs to take serious action (raising the discount rate). And the politicians need to stop raising taxes on the future to spend more and more every year. Their continued financial irresponsibility is a large part of the reason for the declining value of the dollar – along with the voters that keep electing those proposing large increases in spending while pushing off paying for that spending to future tax increases.

Related: inflation investment risk – Food Price Inflation is Quite High – Bernanke warns of inflation – Politicians Again Raising Taxes On Your Children – USA Federal Debt Now $516,348 Per Household

Read more

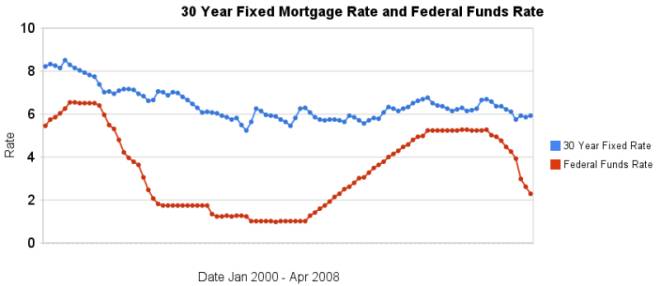

The recent drastic reductions again emphasize (once again) that changes in the federal funds rate are not correlated with changes in the 30 year fixed mortgage rate. In the last 4 months the discount rate has been reduced nearly 200 basis points, while 30 year fixed mortgage rates have fallen 18 basis points.

I have update my article showing the historical comparison of 30 year fixed mortgage rates and the federal funds rate. The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through April 2008 (for more details see the article).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates that can be used for those looking to determine short term (over a few days, weeks or months) moves in the 30 year fixed mortgage rates. For example if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do. No matter how often those that should know better repeat the belief that there is such a correlation you can look at the actual data in the graph above to see that it is not the case.

Related: real estate articles – Affect of Fed Funds Rates Changes on Mortgage Rates – How Not to Convert Equity – more posts on financial literacy

Read more

Sorry but that is a symptom of massive ignorance. Not knowing an incredible important aspect of your largest financial decision is like not know what days you are suppose to show up for work. There is a minimum amount of knowledge people should have that sign a mortgage. I think at least 34% of mortgage holders need to read this blog. Ok, I probably alienated all of them, so if that is the case then they should read some of the blogs we list in our blogroll.

There is a big problem in that logic – it could maybe make sense if you had good reason to believe rates will be lower in the future than when you took out the loan (but that is a very questionable). I don’t know why someone would think that in the last couple of years – the risks have been much better than rates would go up a few hundred basis points than down that much. Basically I can see someone that is very financially savvy using an adjustable mortgage to qualify and if they know they will move in a fairly short period…

Related: Learning About Mortgages – Mortgage Defaults: Latest Woe for Housing – How Not to Convert Equity – 30 year fixed Mortgage Rates

CNNMoney is not exactly intellectual discussion of economic and investing issues but normally it offers fairly good material for the large number of people. Especially those who really don’t want to read Warren Buffett or Brad Setser. Still the following quote in their article, Cashing in on hot real estate is just wrong:

…

San Diego-based certified financial planners Christopher Van Slyke and Terry Green recommend an unconventional plan: taking out a new $500,000 ARM.

Handel and Laport can pay off their existing mortgage before the rate rises and retire their other debts. They can put the remaining $200,000 into stock and bond funds.

To be sure, borrowing against a house to put the proceeds into the market rarely makes sense. But in Handel and Laport’s case it does because so much of their net worth is tied up in their home, and the super-hot L.A. real estate market looks primed for a fall…

They can convert equity that might melt away.

They can what? In no way does increasing their leverage convert equity that might melt away. Any amount of “melting away” will still happen after this increase in leverage – no conversion has happened. They still have a full ownership interest in the real estate. If the value of their house fell $300,000 before or after this supposed “conversion” they would “lose” (on paper) the same amount: $300,000. The investment risk for the house has not changed (for the whole portfolio you could argue it has but that gets complicated and subject to debate).

Read more