Short selling is when you sell something before you buy it (you try to sell high and then buy low later, instead of buying low and then selling high later). In order to sell short, you are required to borrow the shares that you then sell. So if I own 1,000 shares of Google (I wish), I could lend them to someone to sell. Nothing happens to my position, it is just that those shares are now allocated to that short sale. If I sell them then the short seller has to go borrow them elsewhere or buy the stock to close their position. In general the borrowing is either from brokers that hold shares for individuals or from large institution (mutual funds, insurance companies…).

However from everything that I read it appears the SEC hasn’t bothered to actually enforce this law much. There was a bunch of excitement recently when the SEC announced it would bother to enforce the law to protect a few large banks, many of whom are said to practice naked short selling but didn’t like it when that was done to their stock. As you can see, this does make the SEC look pretty bad, when they chose to enforce a law, not in all circumstances, but only to protect a few of those who actually take advantage of the SEC’s failure to enforce the law to make money.

CEOs Launch Web Site To Protect Short Sellers

Some people find the whole concept of short selling bad since it is based on making money on stock price declines. I don’t feel that way and believe it can help the market. But it requires regulators that actually do their jobs and enforce laws. A favorite tacit of those who seek to keep open special ways for themselves to benefit from abusing the system is to try and make things seem complex. The recent SEC order saying they would enforce the intent of the law to protect a few powerful banks from the behavior many (or most) practice themselves for years shows that it isn’t that complicated.

Adding the decision not to enforce the requirement to borrow shares to their recent decision to eliminate the requirement that short sales take place on down ticks in price (a measure put in after the 1929 stock market crash to not have short sellers accelerate market declines and insight panic seems like a really bad combination).

Related: Shorting Using Inverse Funds – Monopolies and Oligopolies do not a Free Market Make – Fed Continues Wall Street Welfare – SEC data on “failures to deliver”

There are ways to get more vacation time

…

According to Robinson, mentioning to your boss that you are willing to go on vacation without any pay can often be a very effective way to get some time off.

…

Take what you get: It may seem obvious, but many people don’t check how much time they are entitled to take off. Many others are reluctant to take the average nine days of paid vacation to which they are entitled, often because they are afraid it will show weakness or lack of loyalty.

Joe Robinson said there may be “ongoing subtle discouragement” in the work force, but employees should remember that they are entitled to their vacation and should not be afraid to take it. In 2005, U.S. workers collectively turned down a staggering 1.6 million years of vacation time that was offered to them.

I find these discussions of how little time off we have interesting. Similar studies look further back, at hunter gathers and find similar patterns. Still they are a bit misleading. What about total hours worked during the year (for peasants). What about the conditions of work and life. What about life expectancy… Still I agree with the thought that more vacation is more important than more work to fund more spending. I would rather reduce my spending and have more free time. I have taken unpaid vacation myself, and have worked part time, at times, to buy myself more freedom to spend my time as I wished.

Related: Vacation: Systems Thinking – Workplace Experiments

In response to: Fair Use Rights by David Bradley

Copyright is a taking of a public benefit for a private entity. This was put into law in order to increase the total public benefit. The idea was that taking from the public to provide the creator a limited-term, exclusive, government-granted, right to their work would encourage individuals to invest their time in creating works that would benefit society.

So the debate is properly about how great the taking from the public should be. It seem to me the current situation is completely corrupt. Many of the actions are taking public benefit to provide to the private entity where no possible public benefit exists. Extending copyright periods of long ago created works, where obviously the public is harmed purely for private benefit. No possible argument can be made that their is a payoff to the public for this taking.

If you wanted to take such an action and made it only for new work then their could be an argument that now a creator knows they have 100 years of government provided rights and therefore investing more time and effort in their work creates new and better work. I don’t believe this argument but at least it is possible. The current actions though are mainly about large companies using government to take from the public to provide themselves private benefit with no corresponding public benefit.

Lawrence Lessig is the person who has the best insight in this area, in my opinion: The Value of the Public Domain.

Dr. Deming published his seven deadly diseases of western management a couple decades ago. I would add 2 new diseases: Excessive executive compensation and a broken intellectual property system.

Fair use is the right to reference (and quote limited portions of) works that have been granted government copyright protection. This is integral to the whole idea of creating the greatest public benefit (even while providing some government imposed limits on public rights to the creator). The large companies now are using lawyers to greatly increase the harm to society by expanding the taking of public benefit. They threaten and scare many into paying fees (or completely avoiding works that have been granted limited government granted copyright rights) where none are are rightly due (see Lawrence Lessig for examples). This causes great harm to society for the private benefit of a few. This is an obvious failure of government. Those countries that are successful at adopting more sensible systems are going to have a great advantage over those countries that chose to continue to increasingly bad practices of harming society to benefit a few private interests.

Related: What is Wrong with Copyright Taking Public Good for Private Special Interests – Innovation and Creative Commons – Diplomacy and Science Research – More Government Waste – Crazy Watchmen – General Air Travel Taxes Subsidizing Private Plane Airports – China and the Sugar Industry Tax Consumers

I posted before on how universities seek profits instead of helping students develop good financial literacy and habits. Here are some tips on how you should use your credit card. College Credit-Card Hustle

Using state public disclosure laws, Business Week has obtained more than two dozen confidential contracts between major schools and card-issuing banks keen to sign up undergraduates with mounting expenses for tuition, books, and travel. In some instances, universities and alumni groups receive larger payments from the banks if students use their school-branded cards more frequently.

The growing financial alliance between schools and banks raises questions about whether universities are encouraging students to incur additional high-interest debt at a time when many young people graduate from college owing tens of thousands of dollars.

…

Universities rarely negotiate favorable terms for their students, according to people familiar with the practice. On the contrary, some schools and booster groups entice undergraduates to sign up for cards with low initial interest rates that are soon replaced by steep double-digit rates.

Schools (and if some try to play legal games about alumni associations being separate, I don’t accept that) should fully disclose exactly what they are doing. I know they can make all sorts of excuses about why being open and honest is not right for them. Well, I think it is easy to predict they will be selling out their students and hiding that fact (if they must be open about what they are doing they will avoid some of the most egregious behavior because they know there will be consequences if they obviously sell out students). And, now Business Week has evidence that many are.

If a school is not open and honest about the deals they are making just assume they are selling out the students for their own gain. I can’t really see why we would want to support such behavior and I would encourage us not to.

Read more

…

Even worse is the influence of the pork-barrel. Only around 20 states use cost-benefit analyses to evaluate transport projects; of these, just six do so regularly. Alaska’s “bridge to nowhere” is an infamous result of this sort of planning. But it is not exceptional. Two months after the bridge collapsed in Minneapolis, the Senate approved a transport and housing bill that included money for a stadium in Montana and a museum in Las Vegas.

…

Such plans stand in stark contrast to the federal government’s strategy today. America invests a mere 2.4% of GDP in infrastructure, compared with 5% in Europe and 9% in China, and the distribution of that money is misguided.

I think they underestimate our ability to ignore. For example we have over $500,000 in federal government debt per household and continue to raise taxes on future generations without any guilt. I think our capacity to ignore is pretty large and certainly large enough to ignore the decision to spend money on things other than infrastructure repair.

I think those that don’t somehow manage to remain ignorant all know that China has taken the lead in investing in infrastructure and that the USA has chosen to elect politicians that are gutting infrastructure investments (and still spending far beyond the resources they have available). I can’t imagine many who understand economics have any trouble seeing which country is investing in the future and which country is selling out its future. It is not the choice I wish was being made in the USA but it is obviously the choice we are making.

Related: USA Infrastructure Needs Improvement – Politicians Again Raising Taxes On Your Children – Manufacturing Takes off in India – True Level of USA Federal Debt

The USA stock market has not been doing so well recently (the S&P 500 index is down over 9% so far this year). And I own S&P 500 indexes in my retirement account (in addition to other index funds). So I am losing money on those investments but I am not worried. It is possible the market will do very poorly over the next few months, year… if the economy struggles (and with the huge credit card like spending Washington much of the last 30 years and huge increases in gas prices that is certainly possible). But I am not worried.

I don’t plan on using that money for decades. Therefore the short term declines really have no impact on my life. Sure if I was able to move all that money into a money market fund for the decline and then move it back into stock funds for the increase that would be wonderful. But I can’t and no-one has proven to be able to time the market effectively over the long term. It is unlikely you or I will be the ones that do it right. I wouldn’t be surprised if the market was lower at the end of the year, but I wouldn’t be surprised if it was higher either.

Dollar cost averaging is the best long term strategy (not trying to time the market). And using that strategy, if you assume stocks reach whatever level they do say 20 years from now, I am actually better off will prices falling now – so I can buy more shares now that will reach that final price. You actually are better off with wild swings in stock prices, when you dollar cost average, than if they just went up .8% every single month (if both ended with stocks at the same price 20 years later). Really the wilder the better (the limit is essentially the limit at which the economy was harmed by the wild swings (people deciding they didn’t want to take risk, make investments…) to the point that the final value 20 years later is deflated.

Read more

I would guess a majority of people that read this blog are in the top 2% of earnings in the world. Many might not think they expect to live with more economic wealth than 98% of the world but their expectations seem to indicate that they do.

Generalizations about age groups I find to be mainly useless (providing no actual valuable information, either because it is plain wrong or the truth is so limited as to provide little value). There are often differences among age groups, but rather than the binary way it is presented it is more like those in their 20’s have x trait to say 45% and those in their 30’s have it 35% – hardly the distinct separation many claim. I do, however, think many in the USA today seem to think that it is their right to be rich. This can lead to behavior that is detrimental in the long term – since they are entitled no need to work hard, since they are entitled no need to worry about spending more than they have, since they are entitled there is no need to invest so the future will be prosperous, since they are entitle no need to worry about their own future (savings, career planning…)…

I don’t think this is very defined by age: though to some extent I feel this has grown over the decades. Those that lived through the depression, World War II, without air conditioning, without central heating, had parents that worked in factories when the parents were 14, only the richest in the USA lived in mansions (Mc or otherwise)… are not as likely to think that they just have a natural right to be rich.

Other countries are making the sacrifices today to invest in a prosperous future. It seems to me the USA is mainly counting on the huge economic wealth that has been built up to continue to provide it a prosperous future. That wealth does provide a huge advantage. But if too much is consumed today the future will not be as bright. And for the last few decades it seems to me we have been spending down the huge advantage more than building it up.

It is nice to be rich. But a society believing it is owed a life of luxury has not worked out well over the course of human history.

Related: The Ever Expanding House – Creating a World Without Poverty – Charge It to My Kids – Engineering the Future Economy – USA Federal Debt Now $516,348 Per Household – China’s Economic Science Experiment – Trying to Keep up with the Jones – It’s Not Money

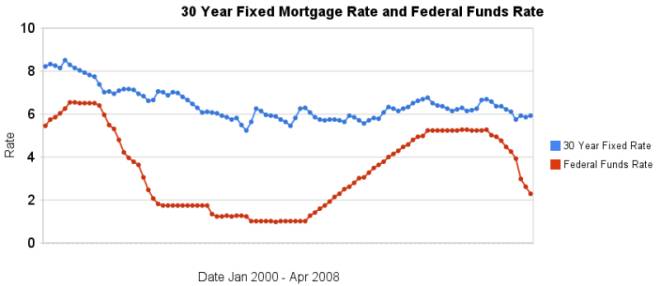

The recent drastic reductions again emphasize (once again) that changes in the federal funds rate are not correlated with changes in the 30 year fixed mortgage rate. In the last 4 months the discount rate has been reduced nearly 200 basis points, while 30 year fixed mortgage rates have fallen 18 basis points.

I have update my article showing the historical comparison of 30 year fixed mortgage rates and the federal funds rate. The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through April 2008 (for more details see the article).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates that can be used for those looking to determine short term (over a few days, weeks or months) moves in the 30 year fixed mortgage rates. For example if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do. No matter how often those that should know better repeat the belief that there is such a correlation you can look at the actual data in the graph above to see that it is not the case.

Related: real estate articles – Affect of Fed Funds Rates Changes on Mortgage Rates – How Not to Convert Equity – more posts on financial literacy

Read more

The day the dream of global free- market capitalism died

The lobbies of Wall Street will, it is true, resist onerous regulation of capital requirements or liquidity, after this crisis is over. They may succeed. But, intellectually, their position is now untenable.

The intellectually depravity of such claims were obvious well before. Two problems make that truth less important. First, few actually believe in intellectual rigor any longer. Second, huge payments to politicians from those wishing to receive special favors from the government work (not very surprisingly). So given the lack of intellect and the alternative of just rewarding those that pay you huge sums of money it is no surprise politicians turned against capitalism and instead gave favors to a few that paid them well.

Maybe the latest huge bailout will change how things are done. I doubt it. New rules will be put in place. Plenty of people will pay politicians plenty of money to assure their methods of subverting the intent of those rules are allowed to continue. To change things you would need to vastly improve the intellectual rigor of decision making. That is unlikely, but if it happens it will be plenty obvious from how debate is carried out.

Read more

Ok the title is a bit of an misstatement but I am getting so tired of massive government transfers to the rich. Basically here is what has happened. People with tens and hundreds of millions of dollars didn’t want to be subject to pesky regulations just because capitalism requires it. So they paid their politicians to not regulate their investment activities. They paid their lawyers to evade the legal requirements that they couldn’t get their political friends to remove.

Largely what they did was take huge amounts for taking positions that risk the economy for personal gain. The investments have huge leverage and massive negative externalities to the economy. Any capitalist would know this is exactly what the government is suppose to protect the economy from. Unfortunately our politicians think capitalism is that whoever has the gold, therefore should make the rules. A sad state but not a surprise.

So then, the negative externalities begin taking effect and the government now seems to think that massive government intervention is a great thing. What a sad state of affairs.

What should happen now. That is hard to say.

But certainly with the amount of huge financial bailout the government has engaged in recently certainly they need to plan for this far in advance (it is obvious their preferred method of letting their friends take huge risks with the economy and pay themselves well while the risks work out requires huge bailouts very frequently).

You could, I suppose, decide everyone should pay to support a few thousand people being allowed take positions that have huge negative externalities (in risks to the economy) and pay themselves millions before those externalities become obvious and then bail them out when it doesn’t but that doesn’t seem like the best strategy to me. Though it is obviously the one we have chosen. This is one very non-partisan issue. They pretty much all support letting those that pay the politicians well, do whatever they want. And then support bailing them out if there are problems.

What should the government do in economic matters. Not at all hard to say. Politicians shouldn’t auction off the health of the economy to those that pay them the most money. Politicians should not allow companies to subvert the legal and tax system and be rewarded (just because those companies pay the politicians well and fly them to nice vacations…). The government should regulate negative externalities as capitalism requires to function properly.

But most of all the voters need to vote for those actions. As long as voters elect those that believe in corporate welfare this is the natural result.

Related: Why Pay Taxes or be Honest – Politicians Give Lobbyists Tax Breaks for Billion Dollar Private Equities Deals (not the politicians are given the deal makers cash loans) – Estate Tax Repeal (payoff to the rich) – Politicians Again Raising Taxes On Your Children

Read more