Alan Greenspan made several huge errors while chairman of the Federal Reserve. Failing to deal with the massive risk taking and fraud by the member banks of the Federal Reserve was one. And supporting tax cuts for a country that was hugely in debt (while current deficits were still huge was another. Yes anyone can claim (and he did) future surpluses, but there had yet to be a single year of surplus, and obviously we would have been in deficit even before the tax cuts put us much much further in debt, history has shown .

That is either amazingly bad economic forecasting or a lie. My guess is he knew this wasn’t true. Which would make it a lie. If he really was that out of touch with economic reality, we have to question why we ever thought he had insight into the economy.

Greenspan Says Congress Should Let Tax Cuts Expire

GREENSPAN: I should say they should follow the law and let them lapse.

WOODRUFF: Meaning what happens?

GREENSPAN: Taxes go up. The problem is, unless we start to come to grips with this long-term outlook, we are going to have major problems. I think we misunderstand the momentum of this deficit going forward.

Related: Estate Tax Repeal (2006) – Charge My Government to My Kids (2007) – USA Federal Debt Now $516,348 Per Household

Accepting that, I don’t agree with those that vilify his performance. He was Fed chairman from 1987-2006. He made some very bad decisions that cost people dearly. But it isn’t very surprising someone in such power for so long would make some very bad and costly decisions. My guess is he caved to pressure from political allies that reminded him how the current President Bush’s father blamed Greenspan’s decisions for his losing the Presidency. And so Greenspan was trying to do what he could to do what the then President Bush wanted. Not a very honorable explanation but people often do not make the most honorable choices.

In 2003 he publicly disagreed with the wisdom of additional cuts:

Politicians, eager to give favors, at the expense of the future, went ahead and passed more tax cuts – weakening the country for their (and their political allies) short term benefit.

Related: Estate Tax Repeal (2006) – Charge My Government to My Kids (2007) – USA Federal Debt Now $516,348 Per Household

Greenspan’s thoughts on the economy, from his July 16th 2010 interview:

Read more

Fed Focusing on Real-Estate Recession as Bernanke Convenes FOMC

…

Commercial property is “certainly going to be a significant drag” on growth, said Dean Maki, a former Fed researcher who is now chief U.S. economist in New York at Barclays Capital Inc., the investment-banking division of London-based Barclays Plc. “The bigger risk from it would be if it causes unexpected losses to financial firms that lead to another financial crisis.”

…

Any sales of mortgage-backed bonds would be the first new issues in the $700 billion U.S. market for commercial-mortgage- backed securities since it was shut down by the credit freeze in 2008. About $3 billion are in the pipeline, and the success of these sales may foster as much as $25 billion in total deals in the next six months

…

Forty-seven percent of loans at the 7,000-plus smaller U.S. lenders are in commercial real estate, compared with 17 percent for the biggest banks…

Related: Data Shows Subprime Mortgages Were Failing Years Before the Crisis Hit – Home Values and Rental Rates – Record Home Price Declines (Sep 2008)

First Quarter GDP 2009 in the USA was down 6.1%. This is after a revised 6.3% drop in fourth quarter of 2008 (preliminary fourth quarter report showed a 6.2% decline). Real exports of goods and services decreased 30% in the first quarter, compared with a decrease of 23.6% in the fourth. Real imports of goods and services decreased 34.1%, compared with a decrease of 17.5%.

The personal saving rate — saving as a percentage of disposable personal income — was 4.2% in the first quarter, compared with 3.2% in the fourth quarter of 2008.

The news certainly is nothing to be happy about. But the stock markets around the world were buoyed by the Federal Reserves positive words:

Although the economic outlook has improved modestly since the March meeting, partly reflecting some easing of financial market conditions, economic activity is likely to remain weak for a time. Nonetheless, the Committee continues to anticipate that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a gradual resumption of sustainable economic growth in a context of price stability.

True, those words hardly sound like great news but the markets were quite happy.

Related: The Economy is in Serious Trouble (Nov 2008) – Warren Buffett Webcast on the Credit Crisis – Fed Continues Wall Street Welfare (March 2008) – Manufacturing Data – Accuracy Questions

Mortgages Falling to 4% Become Bernanke Housing Focus by Brian Louis and Kathleen M. Howley

…

Conventional mortgages averaged 4.61 percent in 1951, 4 percent when backed by the Veterans Administration, and 4.25 percent by the Federal Housing Administration, according to The Postwar Residential Mortgage Market, a 1961 book written by Saul Klaman and published by Princeton University Press. Rates during the 1930s were as high as 7 percent.

…

Mortgages were cheaper through most of the 1940s, ranging from about 4 percent to 5.7 percent, depending on whether the lender was a life insurer, a commercial bank or a savings and loan. In that era, most loans were for 14 years and less.

…

The central bank has purchased more than $300 billion of mortgage-backed securities in 2009 through the week ended April 8, helping to cut home-loan rates to 4.82 percent last week from 5.1 percent at the start of the year, according to Freddie Mac data.

…

The difference between 30-year mortgage rates and 10-year Treasury yields has narrowed to about 2.2 percent from 3.1 percent in December, which was the widest since 1986. The spread remains almost 0.7 percentage point above the average of the past decade, data compiled by Bloomberg show. Rates for 15-year mortgages are about 1.8 percent above 10-year Treasury yields, compared with an average 1.4 percent since 1999.

Excellent article with interesting historical information. I don’t believe mortgage rates will fall to 4% but differences of opinion about the future is one function of markets. Those that predict correctly can make a profit. I am thinking of refinancing a mortgage and I think I am getting close to pulling the trigger. If I was confident they would keep falling I would wait. It just seems to me the huge increase in federal debt and huge outstanding consumer debt along with very low USA saving will not keep interest rates so low. However, as I have mentioned previously, it is interesting that the Fed is directly targeting mortgage rates and possible they can push them lower. The 10 year bond yield has been increasing lately so the slight fall in mortgage rates over the last month are due to the reduced spread (that I can see decreasing – the biggest question for me is how much that spread can decrease).

Related: Fed to Start Buying Treasury Bonds Today – Federal Reserve to Buy $1.2T in Bonds, Mortgage-Backed Securities – Low Mortgage Rates Not Available to Everyone – what do mortgage terms mean?

Federal Reserve Beige Book highlights for April 15th. The Beige Book documents comments received from business and other contacts outside the Federal Reserve and is not a commentary on the views of Federal Reserve officials. The book is published eight times a year.

…

Manufacturers’ assessments of future factory activity improved marginally over the survey period as well.

…

Consumer spending remained generally weak. However, several Districts said sales rose slightly or declines moderated compared with the previous survey period.

…

Home prices continued to decline in most Districts, although a few reports noted that prices were unchanged or that the pace of decline had eased. Low mortgage rates were fueling refinancing activity. Outlooks for the housing sector were generally more optimistic than in earlier surveys, with respondents hopeful that increased buyer interest would lead to better sales.

…

Commercial real estate investment activity weakened further.

…

Labor market conditions were weak and reports of layoffs, reductions in work hours, temporary factory shutdowns, branch closures and hiring freezes remained widespread across Districts.

Related: Central Bank Intervention Unprecedented in scale and Scope – Why do we Have a Federal Reserve Board? – Manufacturing Employment Data – 1979 to 2007 – Oil Consumption by Country

Fed to start buying T-bonds today, hoping to move rates

The yield on the 10-year T-note plunged to 2.53% on March 18 from 3% the previous day, the biggest one-day drop in decades. But since then, Treasury bond yields have been creeping higher. The 10-year T-note ended Tuesday at 2.65%. Conventional mortgage rates have flattened or inched up, although they remain historically low, in the range of 4.75% to 5%.

…

On Tuesday the Treasury sold $40 billion of new two-year T-notes at a yield of 0.95%, which was lower than expected, indicating healthy investor demand. The government will auction $34 billion in five-year notes today and $24 billion in seven-year notes on Thursday. Against numbers like those in just one week, the Fed’s commitment to buy $300 billion of Treasuries over six months doesn’t look like much.

…

there’s nothing to stop the Fed from suddenly announcing that its $300-billion commitment will get substantially bigger: The central bank can, in effect, print as much money as it wants to buy bonds — at least, until the day that global investors stop wanting dollars.

The original announcement caused a dramatic move but since then yields have been drifting up, every day, including today. Rates are already very low. And the huge amount of increased federal borrowing is a potential serious problem for lowering rates. And potentially an even more serious problem is foreign investors deciding the yield does not provide a good investment given the risks of inflation (I know that is how I feel). It will be interesting to see what happens with rates.

Related: Who Will Buy All the USA’s Debt? – Lowest 30 Year Fixed Mortgage Rates in 37 Years – mortgage terms

I make a point of showing the discount rate changes by the Fed don’t translate to mortgage rate changes. I do so because many people think the discount rate does directly effect mortgage rates. But the Fed announced today, actions that actually do impact mortgage rates.

Federal Reserve to Buy $1.2T in Bonds, Mortgage-Backed Securities

If you are looking at refinancing your mortgage now (or soon) might be a good time, rates were already very low and will be declining. And if you own long term bonds you just got a nice increase in your value (bond prices move up when interest rates move down).

Related: Lowest 30 Year Fixed Mortgage Rates in 37 Years – Low Mortgage Rates Not Available to Everyone – Why do we Have a Federal Reserve Board?

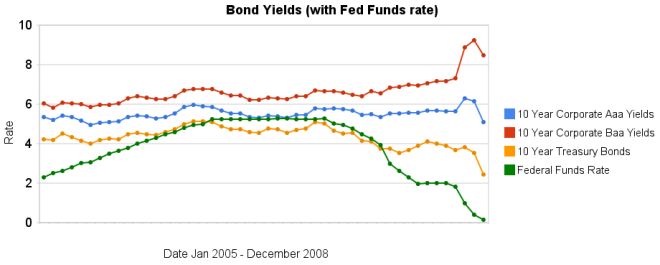

The recent reactions to the credit and financial crisis have been dramatic. The federal funds rate has been reduced to almost 0. The increase in the spread between government bonds and corporate bonds has been dramatic also. In the last 3 months the yields on Baa corporate bonds have increased significantly while treasury bond yields have decreased significantly. Aaa bond yields have decreased but not dramatically (57 basis points), well at least not compared to the other swings.

The spread between 10 year Aaa corporate bond yields and 10 year government bonds increased to 266 basis points. In January, 2008 the spread was 159 points. The larger the spread the more people demand in interest, to compensate for the increased risk. The spread between government bonds and Baa corporate bonds increased to 604 basis points, the spread was 280 basis point in January, and 362 basis points in September.

When looking for why mortgage rates have fallen so far recently look at the 10 year treasury bond rate (which has fallen 127 basis points in the last 3 months). The rate is far more closely correlated to mortgage rates than the federal funds rate is.

Data from the federal reserve – corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Corporate and Government Bond Rates Graph (Oct 2008) – Corporate and Government Bond Yields 2005-2008 (April 2008) – 30 Year Fixed Mortgage Rates versus the Fed Funds Rate – posts on interest rates – investing and economic charts

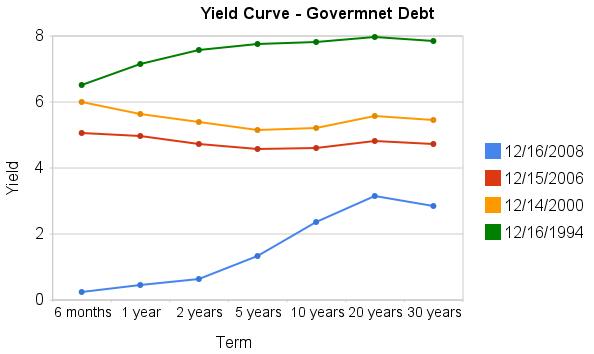

Treasury bills have been providing remarkably low yields recently. And the Fed today cut their target federal funds rate to 0-.25% (what is the fed funds rate?). With such low rates already in the market the impact of a lowered fed funds rate is really negligible. The importance is not in the rate but in the continuing message from the Fed that they will take extraordinary measures to soften the recession.

There are significant risks to this aggressive strategy (and there would be risks for acting cautiously too). But I cannot understand investing in the dollar under these conditions or in investing in long term bonds (though lower grade bonds might make some sense as a risky investment for a small portion of a portfolio as the prices have declined so much).

The current yields, truly are amazing as this graph shows. The chart shows the yield curve in Dec 2008, 2006, 2000 and 1994 based on data from the US Treasury

Related: Corporate and Government Bond Rates Graph – Discounted Corporate Bonds Failing to Find Buying Support – Municipal Bonds After Tax Return – Total Return

Fed Could Remake Credit Card Regulations

…

The proposal would also dictate how credit card companies should apply customers’ payments that exceed the minimum required each month. When different annual percentage rates apply to different balances on the same card, banks would be prohibited from applying the entire amount to the balance with the lowest rate. Many card issuers do that so that debts with the highest interest rates linger the longest, thereby costing the consumer more.

Industry officials have lobbied against the provisions, particularly the one restricting their ability to raise interest rates. They have warned that the changes would force them to withhold credit or raise interest rates because they won’t be able to manage their risk.

“If the industry cannot change the pricing for people whose credit deteriorates then they have to treat most credit-worthy customers the same as someone whose credit has deteriorated,” Yingling said. “What that means for most people is they’ll pay a higher interest rate.”

The government has been far to slow in prohibiting the abusive practices of credit card companies.

Related: How to Use Your Credit Card Responsibly – Avoid Getting Squeezed by Credit Card Companies - Legislation to Address the Worst Credit Card Fee Abuse – Maybe (Dec 2007) – Sneaky Credit Card Fees – Poor Customer Service: Discover Card