The delinquency rate for mortgage loans on one-to-four-unit residential properties fell to a seasonally adjusted rate of 9.5% of all loans outstanding as of the end of the fourth quarter of 2009, down 17 basis points from the third quarter of 2009, and up 159 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate increased 50 basis points from 9.9% in the third quarter of 2009 to 10.4% this quarter.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 4.6%, an increase of 11 basis points from the third quarter of 2009 and 128 basis points from one year ago. The combined percentage of loans in foreclosure or at least one payment past due was 15% on a non-seasonally adjusted basis, the highest ever recorded in the MBA delinquency survey.

The percentage of loans on which foreclosure actions were started during the fourth quarter was 1.2 percent, down 22 basis points from last quarter and up 12 basis points from one year ago.

The percentages of loans 90 days or more past due and loans in foreclosure set new record highs. The percentage of loans 30 days past due is still below the record set in the second quarter of 1985.

The data is far from good but it could well signal the situation is improving. The next few quarters seem poised to start showing better results. Granted given how bad these results are we have a long way to go before the data is actually good. “We are likely seeing the beginning of the end of the unprecedented wave of mortgage delinquencies and foreclosures that started with the subprime defaults in early 2007, continued with the meltdown of the California and Florida housing markets due to overbuilding and the weak loan underwriting that supported that overbuilding, and culminated with a recession that saw 8.5 million people lose their jobs,” said Jay Brinkmann, MBA’s chief economist.

“The continued and sizable drop in the 30-day delinquency rate is a concrete sign that the end may be in sight. We normally see a large spike in short-term mortgage delinquencies at the end of the year due to heating bills, Christmas expenditures and other seasonal factors. Not only did we not see that spike but the 30-day delinquencies actually fell by 16 basis points from 3.79% to 3.63%. Only three times before in the history of the MBA survey has the non-seasonally adjusted 30-day delinquency rate dropped between the third and fourth quarter and never by this magnitude.

“This drop is important because 30-day delinquencies have historically been a leading indicator of serious delinquencies and foreclosures. With fewer new loans going bad, the pool of seriously delinquent loans and foreclosures will eventually begin to shrink once the rate at which these problems are resolved exceeds the rate at which new problems come in. It also gives us growing confidence that the size of the problem now is about as bad as it will get.

“Despite the drop in short-term delinquencies, foreclosure rates could continue to climb, however, based on the ability of borrowers 90 days or more delinquent to solve their problems. A sizable number of the loans in the 90+ day delinquent bucket are in loan modification programs. They are carried as delinquent until borrowers demonstrate they will make the payments agreed to in the plans.

Related posts: Mortgage Delinquencies Continue to Climb (Nov 2009) – USA Housing Foreclosures Slowly Declining (Dec 2009) – Nearly 10% of Mortgages Delinquent or in Foreclosure – How Not to Convert Equity (Jan 2006)

Read more

Home Prices in 20 U.S. Cities Rose for Fifth Month

…

“The tax credit had the intended impact of drawing buyers in and lowering inventory,” Lawrence Yun, the real-estate agents group’s chief economist, said in a news conference. “An estimated 2 million buyers have taken advantage of the credit.”

…

Foreclosure filings in 2009 will reach a record for the second consecutive year with 3.9 million notices sent to homeowners in default, RealtyTrac Inc., the Irvine, California- based company said Dec. 10. This year’s filings will surpass 2008’s total of 3.2 million.

The housing market seems to have been stabilized with the tax credits, previous declines, continued low mortgage rates and a somewhat better credit environment. The market is still far from healthy. And the credit environment is still very tight. But housing may have hit a bottom nationwide, though this is not certain. I do expect mortgage rates to increase in 2010 which will put pressure on housing prices.

Related: House Prices Seem to be Stabilizing (Oct 2009) – USA Housing Foreclosures Slowly Declining – The Value of Home Ownership – Your Home as an Investment

Elizabeth Warren is the single person I most trust with understanding the problems of our current credit crisis and those who perpetuate the climate that created the crisis. Unfortunately those paying politicians are winning in their attempts to retain the current broken model. We can only hope we start implementing policies Elizabeth Warren supports – all of which seem sensible to me (except I am skeptical on her executive pay idea until I hear the specifics).

She is completely right that the congress giving hundreds of billions of dollars to those that give Congressmen big donations is wrong. Something needs to be done. Unfortunately it looks like the taxpayers are again looking to re-elect politicians writing rules to help those that pay the congressmen well (one of the problems is there is little alternative – often both the Democrat and Republican candidates will both provide favors to those giving them the largest bribes/donations – but you get the government you deserve and we don’t seem to deserve a very good one). We suffer now from the result of them doing so the last 20 years. Wall Street has a winning model and betting against their ability to turn Washington into a way for them to mint money and be favored by Washington rule making is probably a losing bet. If Wall Street wins the cost will again be in the Trillions for the damage caused to the economy.

Related: If you Can’t Explain it, You Can’t Sell It – Jim Rogers on the Financial Market Mess – Misuse of Statistics – Mania in Financial Markets – Skeptics Think Big Banks Should Not be Bailed Out

Mortgage defaults hit an all-time high in July according to RealtyTrac (the data in this post is from their survey). Last month default notices nationwide were down 8% from the previous month but still up 22% from November 2008, scheduled foreclosure auctions were down 12% from the previous month but still up 32% from November 2008, and bank repossessions were flat from the previous month and down 2% from November 2008. The housing market is currently not getting worse but it is hardly improving rapidly.

“November was the fourth straight month that U.S. foreclosure activity has declined after hitting an all-time high for our report in July, and November foreclosure activity was at the lowest level we’ve seen since February,” said James J. Saccacio, chief executive officer of RealtyTrac.

Four states account for 52% of national foreclosures for the second month in a row: California, Florida, Illinois and Michigan.

Related: Mortgage Delinquencies Continue to Climb – Over Half of 2008 Foreclosures From Just 35 Counties – Nearly 10% of Mortgages Delinquent or in Foreclosure

The Federal Weatherization Assistance Program has been around for decades and funding has been increased as part of the stimulus bills. This type of spending is better than much of what government does. It actually invests in something with positive externalities. It targets spending to those that need help (instead of say those that pay politicians to give their companies huge payoffs and then pay themselves tens of millions in bonuses).

The Depart of Energy provides funding, but the states run their own programs and set rules for issues such as eligibility. They also select service providers, which are usually nonprofit agencies that serve families in their communities, and review their performance for quality. In many states the stimulus funds have increased the maximum funds have increased to $6,500 per household, from $3,000.

The weatherization program targets low-income families: those who make $44,000 per year for a family of four (except for $55,140 for Alaska and $50,720 for Hawaii).

The program provides funds for those with low-income for the like of: insulation, air sealing and at times furnace repair and replacement. Taking advantage of this program can help you reduce your energy bills and reduce the amount of energy we use and pollution created. And it employs people to carry out these activities.

The Weatherization Assistance Program invests in making homes more energy efficient, reducing heating bills by an average of 32% and overall energy bills by hundreds of dollars per year.

Weatherization is also often a very good idea without any government support. If you are eligible for some help, definitely take a look at whether it makes sense for you. And even if you are not, it is a good idea to look into saving on your energy costs.

Related: Oil Consumption by Country in 2007 – Japan to Add Personal Solar Subsidies – personal finance tips – Kodak Debuts Printers With Inexpensive Cartridges – Personal Finance Basics: Dollar Cost Averaging

Read more

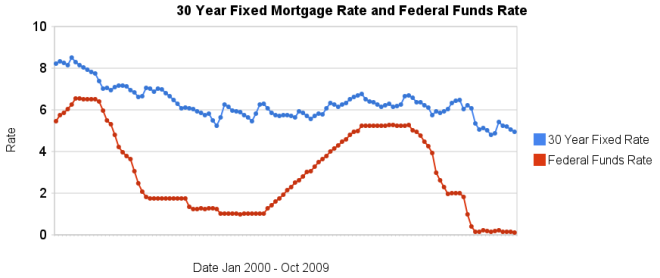

30 year fixed mortgage rates have declined a bit over the last few months and remain at very low levels.

The poor economy, Unemployment Rate Reached 10.2%, has the Fed continuing massive intervention into the economy. The Fed is keeping the fed funds rate at close to 0% (.12% in October). They also continue to hold massive amounts of long term government and mortgage debt (in order to suppress interest rates on long term bonds – by reducing the supply of such bonds in the market).

I can’t see how lending US dollars, over the long term, at 5%, makes any sense. I would much rather borrow at those rates than lend. If you have not refinanced yet, doing so now may well make sense. And if you are looking at a new real estate purchase, financing a 30 year mortgage sure is attractive at rates close to 5%.

Related: historical comparison of 30 year fixed mortgage rates and the federal funds rate – Lowest 30 Year Fixed Mortgage Rates in 37 Years – Jumbo v. Regular Fixed Mortgage Rates: by Credit Score – What are mortgage definitions – Ignorance of Many Mortgage Holders

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates

Landlords Offer Incentives to Stay Put

…

One problem for landlords is that existing tenants can easily check the Web to see what deals new tenants are being offered. And new tenants are getting incentives like a waived pet deposit or two months’ free rent.

…

Apartment landlords say that one benefit of the bad market is that it has practically halted new construction. New completions are expected to be 98,000 next year and 109,000 in 2011, compared with 188,000 last year and 204,000 this year, according to Green Street Advisors Inc.

But when loss rates are taken into account—the removal of units because of obsolescence—the actual addition will be immaterial. That means that when the economy rebounds, the supply will be tight, increasing landlord profits.

Related: Apartment Vacancy at 22-Year High in USA (July 2009) – Articles on Real Estate Investing – It’s Now a Renter’s Market – Housing Rents Falling in the USA

It is a shame that it is no surprise when a bank lies to you. I got a “priority notice” from my mortgage company that my 30 year fixed load could be reduced. They show big huge figures showing current interest rate, new interest rate, potential yearly savings of over $5,000… Complete lies. They are claiming savings with a completely different mortgage, a 5/30 year adjustable rate mortgage (which you have to turn over the paper and note they list “mortgage product: 5/1 ARM” and then know what that means).

Then they go on for a page with all sorts of text seemingly designed to confuse fools. Obviously they try to claim the savings are what is important and the different mortgages, risks of rising interest rates etc. are not important [why don't they just make it a 30 year mortgage at the low rate, if they think the interest rate risk they try to stick the client with is such an unimportant detail that isn't even mentioned on the front page with the "comparison" mortgage rates]).

Anyone that trusts any company that so blatantly tries to fool you is crazy. When they are not shy about using such obviously deceitful tactics you can’t trust them to do much much worse in ways that are very difficult to protect yourself from.

As I have said before, don’t trust your bank. More than any other companies I see, financial institution, treat customers as fools to be fleeced not customers to provide value to. It really is amazing people defend banks paying obscene bonuses to those that are able to fool financial illiterates into stupid decisions. The company trying to deceive in this case, did indeed fail (and was saved by the FDIC). Financial institutions have decided that they will just focus on tricking those that are not financially literate out of as much money as they possibly can. If you don’t educate yourself you are at great risk to be taken advantage of by financial institutions focused on finding people they can take advantage of.

Related: FDIC Study of Bank Overdraft Fees – Ignorance of Many Mortgage Holders – Don’t Let the Credit Card Companies Play You for a Fool – Customer Hostility from Discover Card – Legislation to Address the Worst Credit Card Fee Abuse – Maybe

Home prices in the United States rose 0.3% on a seasonally-adjusted basis from June to July, according to the Federal Housing Finance Agency’s monthly House Price Index. The previously reported 0.5% increase in June was revised downward to a 0.1% increase. For the 12 months ending in July, U.S. prices fell 4.2%. The U.S. index is 10.5% below its April 2007 peak.

The FHFA monthly index is calculated using purchase prices of houses backing mortgages that have been sold to or guaranteed by Fannie Mae or Freddie Mac. Read the full press release. The Case-Shiller Home Price Indices also have increased (10 and 20 city indices) for June and July.

I am still not convinced we have seen the bottom of the housing price declines nationwide. The economy is still in very fragile territory. But the data does show the declining prices have been stopped in many locations, at least for a while. If job losses continue housing prices may well resume the decline. The commercial real estate market seems to be even weaker than housing.

Related: The Value of Home Ownership – Housing Prices Post Record Declines (April 2008) – posts on economic data – real estate articles

…

BECKY: All right. Let me go at this another way. Let’s pretend you’re on a desert island for a month. There’s only one set of numbers you can get. What would it be?

BUFFETT: Well, I would probably look at– perhaps freight car loadings and– perhaps– and– and truck tonnage moved and– but I’d want to look at a lot of figures.

…

BUFFETT: Well, I think that– unfortunately, I think that the — what– what– we’re really talking about reforming health insurance more than health care. So I– the incentives that produce the 16 or so percent of GDP that’s going to health care, I think unfortunately they’re getting– they’re going to get changed. But– so I think that we really– and I’m talking as much about reforming health care as we’re talking about reforming the insurance. And I think that will be an opportunity missed if we don’t do more about looking at what– what the incentives are in the present system and what they would be in an ideal system.

Related: Buffett’s Fix for the Economy (Oct 2008) – Warren Buffett Webcast on the Credit Crisis – Warren Buffett on Taxes – Many Experts Say Health-Care System Inefficient, Wasteful